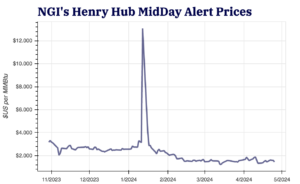

The U.S. Energy Information Administration (EIA) sees natural gas spot prices at Henry Hub averaging $2.78/MMBtu in the second quarter and $3.05 for 2021 overall, a slight upward revision from its forecast last month.

According to new research from the U.S. Department of Energy, Mexico paid $2.12/MMBtu on average for U.S. gas in 2020 and $2.57/MMBtu in 2019.

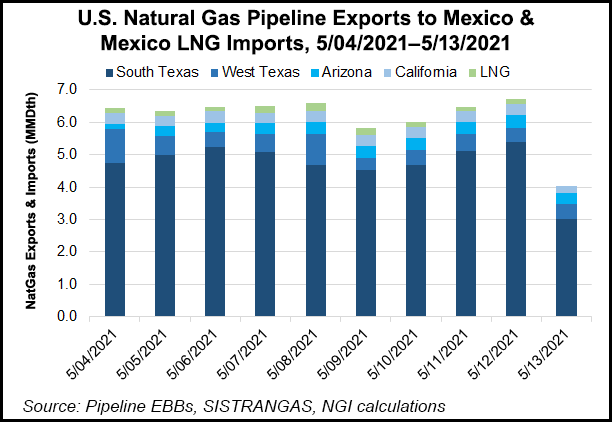

The higher prices, based on strong liquified natural gas (LNG) demand and rising U.S. consumption, will translate to higher prices for Mexico, which is importing in excess of 6 Bcf/d on cross-border pipelines from the United States.

“In 2022, we expect the Henry Hub price will fall to an average $3.02 amid slowing growth in LNG exports and rising production,” EIA researchers said.

Meanwhile Mexico’s production is...