Markets | Mexico | Natural Gas Prices | NGI All News Access | NGI The Weekly Gas Market Report

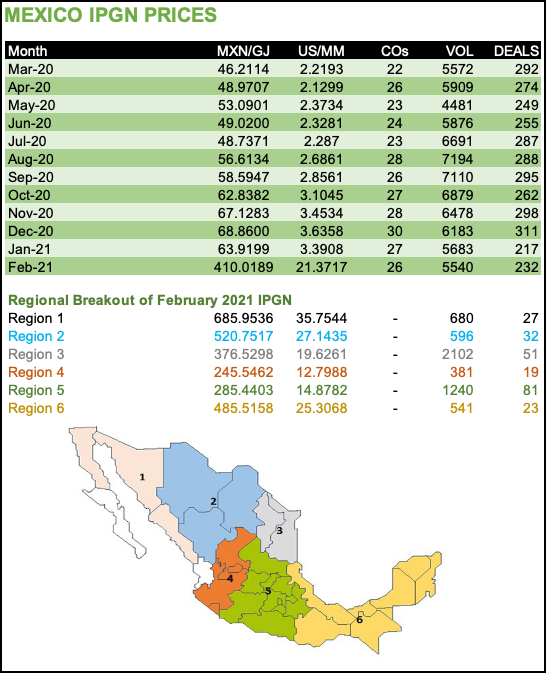

Mexico IPGN Natural Gas Prices Soar Tenfold in February to Historic High

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2577-9966 | ISSN © 1532-1266 |