Mexico’s industrial natural gas consumers are adopting more sophisticated procurement strategies and seeking to lock in relatively cheap U.S. prices for as long as possible, according to BP plc’s Pedro Elio, head of origination for BP’s Mexico gas marketing business.

Elio spoke Wednesday at LDC Forums’ US-Mexico Natural Gas Forum in San Antonio, TX.

BP is the largest natural gas marketer in North America, and was among the first non-state marketers to enter Mexico after the country’s 2013 energy sector liberalization.

BP mainly serves industrial clients in Mexico, including producers of steel, glass, aluminum, car parts and petrochemicals, Elio said.

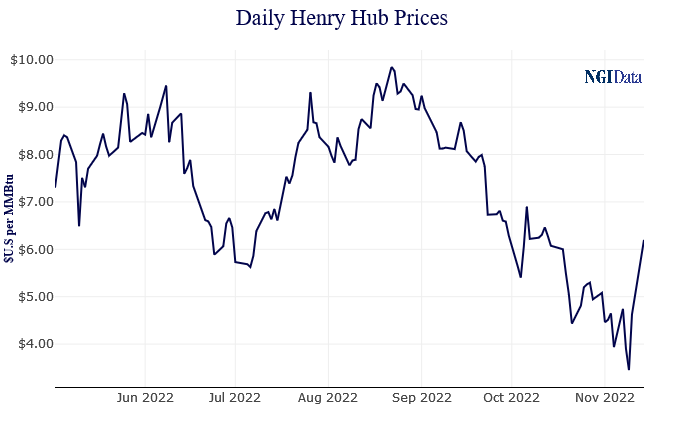

Although U.S. prices have surged over the last year, they remain far cheaper than in gas-starved Europe and...