E&P | NGI All News Access | NGI The Weekly Gas Market Report

Mexico Bid Round Winner Talos To Drill Five Additional Wells This Year

Talos Energy Inc. plans to drill two exploration wells, two delineation wells, and one appraisal well this year in shallow waters off the coast of southeastern Mexico, CEO Timothy Duncan said Thursday.

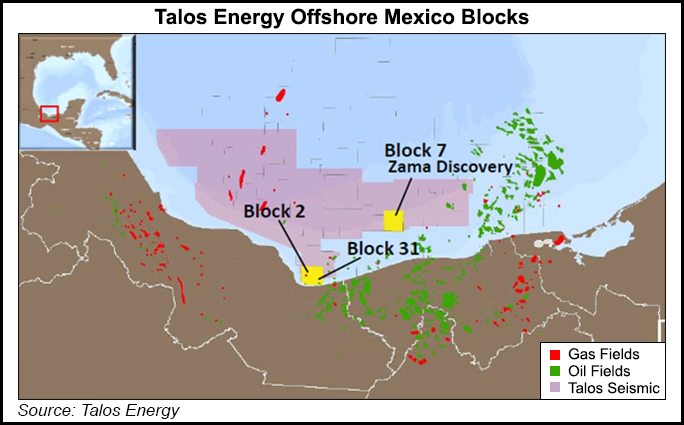

The oil and natural gas exploration wells will target the Acan prospect via offshore block 2, which Mexico’s Comisión Nacional de Hidrocarburos (CNH) awarded to a Talos-led consortium in Mexico’s inaugural round 1.1 bidding tender in 2015.

The delineation wells will target the Olmeca prospect at nearby block 31, which is operated by Hokchi Energy, S.A. de C.V., a subsidiary of Pan American Energy LLC.

Talos and Hokchi announced an agreement last October under which Talos acquired a 25% participating interest in block 31 and Hokchi obtained a 25% stake in block 2. Through the agreement, the companies aim to pool their resources and knowledge, in order to expedite the development of each project.

Hokchi won a production sharing contract for block 31, a former asset of Mexican national oil company Petróleos Mexicanos (Pemex), through CNH’s round 3.1 tender in June 2018.

“The 2019 drilling campaign [at block 31] will be to appraise the same geological structure initially tested by Pemex and, if successful, a final investment decision [FID] to develop these assets could be reached in 2020,” Talos said.

The update follows the completion in January of the Zama-2 appraisal well at Talos’ operated block 7, site of the 2017 Zama discovery.

Talos plans to complete a second appraisal well dubbed Zama-3 by mid-year, Duncan said in an earnings call, and is aiming for a 2020 FID for a Zama development plan.

If all goes according to plan, Talos and its partners could achieve first oil at Zama by 2022, Duncan said.

One variable beyond the consortium’s control, Duncan said, is the progress of appraisal drilling by Pemex at the adjacent Amoca-Yaxche-03 area, which CNH awarded to the state oil company through Mexico’s Round Zero process, which preceded the bid rounds.

The block 7 consortium and Pemex announced a pre-unitization agreement in 2018 to prepare for the event of a confirmed reservoir straddling the two areas.

“We’ll cross those bridges as we get there,” Duncan said. “We have a lot of confidence in what this discovery is … and our focus is getting it on first production.”

CNH has awarded 107 exploration and production (E&P) contracts under the framework of a 2013 energy reform that allowed foreign oil companies to bid for operating stakes in upstream acreage.

The contracts are expected to generate some $143 billion of investment, according to CNH.

However, President Andrés Manuel López Obrador, a longtime opponent of the reform, has suspended the bid rounds for three years. News outlets also quoted energy minister RocÃo Nahle saying this week that a farmout tender for operating stakes in Pemex acreage could be postponed from 2019 to 2020.

Duncan said that Talos’ projects have not suffered any delays as a result of Mexico’s government changing hands last December 1.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2577-9966 | ISSN © 1532-1266 |