Infrastructure | NGI All News Access | NGI The Weekly Gas Market Report

McDermott Faces 2Q Headwinds for Cameron, Freeport LNG Delays, Pemex Issues

A record backlog of contract awards bodes well for McDermott International Inc. going forward, but the Houston-based operator faced substantial headwinds during the second quarter from delays at two major Gulf Coast natural gas export facilities, as well as issues with Mexico’s state-owned producer.

In the third straight quarter for net losses, McDermott said it lost $146 million (minus 80 cents/share) in 2Q2019, compared with year-ago profit of $47 million (33 cents). Revenue climbed to $2.14 billion from $1.74 billion.

Management now expects to report a full-year loss of $310 million versus earlier guidance of $170 million in profits, with annual revenue of around $9.5 billion from an expected $10 billion.

There was less than a thrilling performance following the combination with CB&I, a cross-town rival, but there were other issues as well, CEO David Dickson said during the quarterly conference call.

“Yes, there have been a few operating disappointments and surprises since last year’s combination,” he said. “We’re not happy with the magnitude of the loss for the quarter, which to a certain degree is expanding the overall timing of our transition period, but we fully expect the benefits of the combination to become more evident next year.”

Management is expecting a “sharp improvement in the company’s operating income by the fourth quarter of this year as we build momentum heading into 2020…Looking ahead, our revenue opportunity pipeline remains near a historic high and, more specifically, we are seeing steady upward momentum in a number of key areas.”

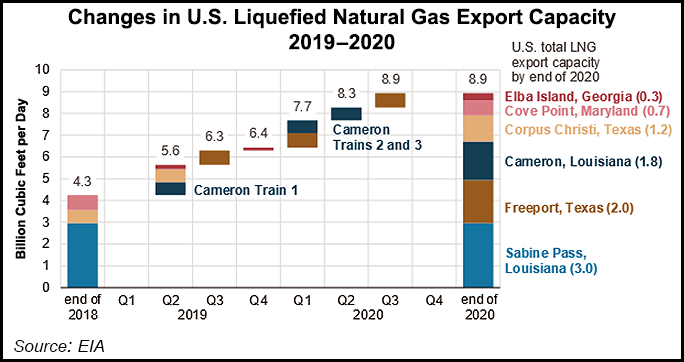

Overall, cash used by operating activities led to a quarterly loss of $205 million, primarily reflecting slippage in the work schedule for Sempra Energy’s Cameron liquefied natural gas (LNG) export project in Louisiana. The delay had been flagged during the first quarter, suggesting a roughly three-month delay.

Around $38 million in costs were booked for delays in the Freeport LNG project for increased construction and subcontractor costs. Another $33 million was recorded in one-time charges for Mexico’s state-owned Petroleos Mexicanos, aka Pemex, “related to disagreements…that have arisen coincident with changes in that company’s leadership team and the country’s political landscape,” management said.

“Disappointingly, we did have some more charges during the second quarter” for the Pemex offshore projects, CFO Stuart Spence said. Two projects “are literally days away from completion. So we’re not comfortable on the costs…This is the first time we’ve seen this type of behavior.

“We felt it was prudent at this time to take that charge until we can resolve this situation with Pemex…Working with Pemex can take a number of months or a number of quarters to finalize or reach a resolution. So we felt at this time it was prudent to take the charge…until we get an agreement with the customer.”

The charges and underwhelming second quarter performance led McDermott to revise 2019 assumptions for its the North, Central and South America, or NCSA, operating segment.

Adjusted operating income has been reset to $470 million from $800 million. Negative cash flow from operating activities is forecast to be about $495 million this year, versus previous guidance of negative $310 million.

“The good news here is that most of this negative cash flow has already occurred during the first half of the year, which suggests the cash flows from operating activities would be only modestly negative in the second half,” Spence said.

In the NCSA segment, revenues were $1.3 billion, with operating income of $15 million and a margin of 1.2%. Results for the quarter included the benefit of a settlement agreement on the Cameron LNG project, under which $110 million of progress incentives were recognized.

The NCSA, however, achieved some operational milestones in the quarter. The first cargo was shipped from Cameron LNG Train 1, and substantial completion of Phase 1 is expected in the third quarter. Trains 2 and 3 “continue to progress on schedule, with the overall project reaching 93% completion (on a cumulative basis) during the quarter.”

The Freeport export project is at 95% completion overall for all three trains. Commissioning of Train 1 has continued, with first shipments expected by the end of September.

In addition, McDermott completed the Entergy St. Charles power project in Louisiana and it was turned over to the owner.

Dickson pointed to other optimistic signs on the ledger. McDermott has booked more than $19 billion of engineering, procurement and contracting (EPC) awards since the May 2018 combination with CB&I. At the end of June, legacy CB&I projects represented about 14% of the current backlog.

“Although the company reported mixed results for the second quarter of 2019, we are encouraged by the record-setting level of backlog and new awards,” Dickson said. There is “visibility” on expected 2020 revenues, with $7.4 billion in backlog at the end of June, “well above the $4.2 billion of 2019 revenues we had in backlog this time last year…”

In the front end engineering design (FEED) business, awards through the first half of 2019 “are already more than double what we won in all of 2018 in terms of both man-hours and dollar value, and that’s especially important as FEED work positions us for EPC opportunities,” the CEO said.

“This year we have booked $1.5 billion of EPC work as a result of FEED work that’s been done since the combination. Further, in our technology business, we are forecasting the number of license sales to increase by 25% this year versus 2018.”

Among the quarterly accomplishments, first gas was achieved on the Abkatun platform offshore Mexico in the Bay of Campeche in April, with first oil in early July and substantial completion expected in the third quarter. The new platform allowed Pemex to replace one damaged by a fire in 2015. Other projects for Mexico’s offshore in the queue include the Eni Amoca EPC offshore project.

McDermott earlier in July also was awarded a “sizeable contract” by Argentina’s YPF SA to provide pre-FEED services for a 5-10 million metric ton/year LNG liquefaction facility to serve producers developing the Vaca Muerta. Its experience as the EPC contractor for the Peru LNG facility in which YPF was involved were said to be key factors in the win. In addition, the NSCA division booked the Petrobras Sepia Phase 1 field development in Brazil.

Meanwhile, in McDermott’s technology business segment, the company sees “roughly $40 billion of potential EPC pull-through opportunities in the refining and petrochemical markets over the next five years,” said Dickson.

“We believe the petrochemical market, in particular, is poised for another wave of investment in the next 12 to 24 months, with world ethylene capacity expected to increase by more than 40% between 2019 and 2028.”

In its Europe, Africa, Russia and Caspian segment, McDermott also secured an EPC contract for Mozambique LNG via a joint venture with Saipem and Chiyoda. Anadarko Petroleum Corp. and its partners sanctioned the project in June.

In other news, the technology segment in June acquired the assets and intellectual property of Siluria Technologies, giving McDermott ownership of a proprietary catalytic process to transform methane into a scalable process. The process may be integrated into existing industry infrastructure or placed as modules at locations where stranded methane gas is available, such as the Permian Basin. Included in the acquisition was a commercial demonstration-scale unit operating at a petrochemical facility in La Porte, Texas.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |