Markets | NGI All News Access | NGI The Weekly Gas Market Report

McDermott Emerges from Chapter 11, with $4.6B Wiped from Debt

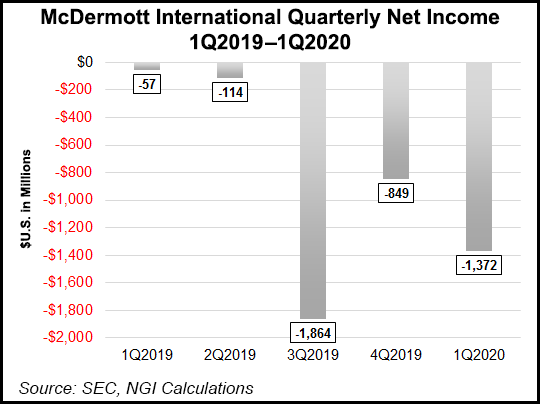

Houston-based McDermott International Ltd. has emerged from voluntary bankruptcy and cleared nearly all of its $4.6 billion debt off the books.

The engineering, procurement and contracting (EPC) giant, which launched restructuring through Chapter 11 early this year, emerged with a $2.4 billion letter of credit capacity and $544 million of funded debt.

“We will continue executing on our significant backlog, with a new capital structure to match and support the strength of our operating business, and we emerge well positioned for long-term growth and success, even amid this period of global uncertainty,” CEO David Dickson said.

“We look forward to continued delivery on customer projects.”

As part of the reorganization, McDermott sold Lummus Technology for about $2.7 billion to a joint partnership between Haldia Petrochemicals Ltd., and Rhône Capital. Proceeds are to be used to fully repay the debtor-in-possession financing, fund emergence costs and provide cash to the balance sheet for long-term liquidity.

McDermott merged with fellow global EPC operator CB&I in 2017. Activities are underway offshore and onshore, including several power plants across the United States. It also is involved in building liquefied natural gas (LNG) projects on the Gulf Coast. Included in its portfolio are Freeport LNG on Quintana Island, TX, and Cameron LNG in Hackberry, LA.

A newly constituted board has been installed, which include Dickson, who has run the company since late 2013. Lead director is Nils Larsen, who is a senior operating adviser with The Carlyle Group’s U.S. Equity Opportunities Fund.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |