Markets | Natural Gas Prices | NGI All News Access

May Natural Gas Prices Rally as EIA’s 38 Bcf Storage Build Points to ‘Tight’ Balances

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |

E&P

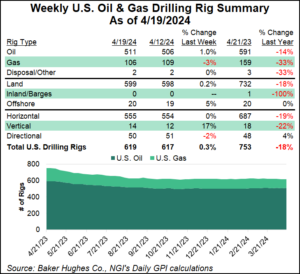

The U.S. natural gas rig count slid to 106 for the week ending Friday (April 19), down three rigs from the week prior and down 53 rigs year/year, according to the latest tally from oilfield services provider Baker Hughes Co. (BKR). The addition of five rigs in the oil patch lifted the combined U.S. rig…

April 19, 2024Natural Gas Prices

Mexico

By submitting my information, I agree to the Privacy Policy, Terms of Service and to receive offers and promotions from NGI.