NGI Archives | NGI All News Access

May NatGas Bidweek Sees Most Price Points Rise for Second Straight Month

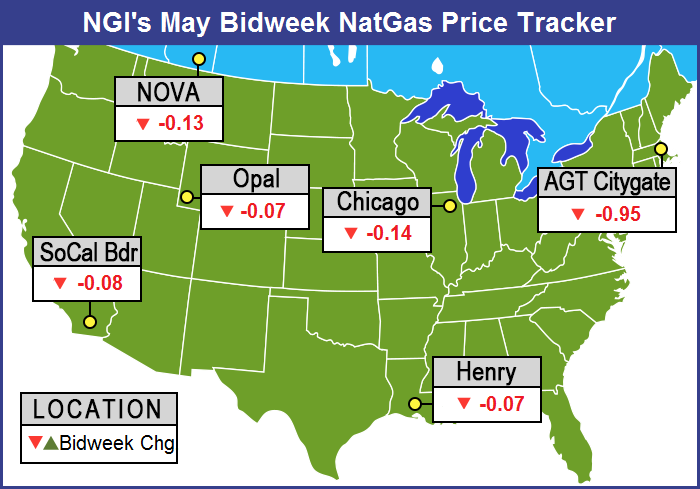

The Bidweek price landscape was able to continue the improvements seen in April Bidweek, and all but a handful of points recorded gains for May. Neither month appeared to be living up to its billing as a fall-off shoulder month. TheNGI National Bidweek Average for May rose a healthy 14 cents from April to $1.82, with Rocky Mountain and California points well into double-digit gains.

Of actively traded points, El Paso Non-Bondad recorded the largest gain at 28 cents to $1.80, while only five points scattered across the U.S. and Canada were in the red, with the largest drop coming at Northwest Sumas in the Rockies — down 8 cents to average $1.34.

While the $1.82 national average represented an increase over April, it still fell 47 cents shy of the May 2015 average of $2.29. All regions of the country found themselves in positive territory, with California in front with a 23-cent gain to $1.94 and South Louisiana at the other end with just an 8-cent advance to $1.93. Sellers into the Midwest enjoyed a 9-cent rise to $2.01, and both South Texas and East Texas saw improvements of 10 cents to $1.94 and $1.92, respectively.

Buyers in the Northeast had to endure a 12-cent advance to $1.58, and the Midcontinent rose 16 cents to $1.82. Rocky Mountain quotes added 21 cents to $1.73.

May futures settled at $1.995, 9.2 cents higher than the April settlement, but observers view the wide disparity between cash quotes and futures as bearish longer term.

Bidweek buyers in the Great Lakes found themselves reducing purchases, but for the most part they were in good shape.

“We didn’t get as much of our baseload, so it was a cutting back,” said a Michigan marketer. With the $1.995 settlement of the May futures contract, traders were looking to do basis deals at prices just above $2. “The prices are good, and on Consumers we got a 10 cent basis and on Michcon it was 6 cents. We are looking good,” he said.

As bidweek drew to a close Friday, a lack of weather developments gave traders little incentive to commit to three-day deals. Cash market values on Friday for gas to be delivered Sunday and Monday slid. That was excluding many Northeast prices, which rebounded from a couple of consecutive down days, possibly on news that part of a Texas Eastern (Tetco) mainline in Pennsylvania exploded last Friday morning.

The bump in Northeast pricing, and perhaps in futures as well, could be attributed to the force majeure on Friday on Tetco, which Spectra Energy Corp. issued following a massive explosion and fire on its Penn Jersey Line near the Delmont Compressor Station in Westmoreland County, PA, about 30 miles east of Pittsburgh. Flows through the Delmont compressor, shut off immediately after the explosion, had averaged 1.07 Bcf/d in the five days prior to the incident. With 9,096 miles of pipeline, Tetco, which can transport up to 10.46 Bcf/d, is a vital piece of infrastructure that connects the Gulf Coast with high-demand markets in the Northeast.

Tetco M-3 delivery was the single largest index gainer on the day, adding 13 cents to average $1.40. It’s unclear what caused the explosion, and the fire was extinguished by Friday afternoon. The explosion occurred in an area where four lines run parallel to one another. The rupture occurred on the 36-inch line, while the other two 30-inch lines and a 24-inch line were shut-off to assess damage.

Checking in on the futures market, natural gas bulls might have reason for optimism. June futures traded in a wide $2.042-2.195 range during Friday’s regular session before closing out at a three-month prompt-month high of $2.178, up a dime from Thursday. One school of thought had the advance as part of longer term systematic advance, but others attributed the rise to profit taking.

The June surge of 10 cents was the highest settle for a front-month contract since Jan. 29. Some market-watchers believe this could be part of a meaningful, albeit moderate rebound.

“We remain in a relatively shallow and thus sustainable rate of advance in price, which has been going on since the end of February,” Powerhouse LLC Vice President David Thompson told NGI. “Sometimes when you have near vertical price moves, either up or down, they don’t last.”

Thompson also pointed to the recent pushback and delays of pipeline projects in the East as reason for some of the recent price rebound. “If some of these pipeline issues delay or restrict Marcellus gas getting down to the Gulf Coast and the pricing points, that may be slightly bullish. In addition, with the possibility of increased exports via LNG out of the Gulf Coast, that also will help prices.”

The broker, whose firm is based in Washington, DC, said it is important to remember that the natural gas market has been in bear mode a lot longer than the oil market has been, so a lot of that economic rationalization has had the time to work its way through. He added that markets often create symmetry.

“Back in April of 2012 we hit a significant low on the weekly chart around the $1.90ish range. Then we had a solid 97-week rally up north of $6 in March 2014, which sparked another sell-off. It looks like a very symmetrical mountain with roughly 97 weeks on either side,” he said. “I would suggest we’ve been in this basing phase since the end of 2015, and that the market has rationalized demand and supply given the new shale economics.

“I think we’re moving up in a moderately bullish pattern due to the impacts of supply from constrained Marcellus Shale supplies, as well as the normal seasonal push higher as we come into summer.”

Others aren’t convinced the futures will be able to sustain any significant uptrend. “Although Friday’s unexpectedly large price up spike failed to alter our bearish opinion, it did underscore the market’s sensitivity to supportive production news as well as even minor shifts in the short term temperature forecasts,” said Jim Ritterbusch of Ritterbusch and Associates in a weekly report to clients.

“We also feel that some of the Friday advance related to month-end positioning that took the form of some speculative profit taking. In any event, we still feel that the spot market will have difficulty following the futures higher on occasional price rallies and that this weak cash basis will eventually drive some sub $2 pricing.

“Given some adjustments to the short-term temperature views that are favoring a return to mild temps into mid-month, we anticipate additional selling as this week proceeds even though deviations from normal don’t appear sufficient to significantly impact the balances. We will be looking for negligible change in the supply surplus against 5 year average levels on Thursday that is apt to be followed by more sizable injections going forward.

Directionally, Ritterbusch is looking for the June contract to follow in May’s footsteps. “Although production has been slipping as the plunge in rig counts is becoming impactful, we feel that this decline will be a much slower mover than seen in the liquids and that additional decreases in output will be required if a test of storage capacity is to be precluded next fall. On the temperature front, some shifts toward milder than previously expected patterns into mid-month is contributing to [Monday’s] selling.

“Although we are not seeing enough temperature deviation from normal to significantly impact the gas balances, we still attach a high probability to a price decline to about the $1.95 area, the pre-expiration lows in the May contract and approximately the area where the physical market finished last week. But, at the same time, it is apparent that the large non-commercial entities have begun to shy away from the short side of this market and will be looking for even minor reasons to cover shorts as was vividly displayed on Friday.”

Last Thursday the Energy Information Administration (EIA) reported an inventory build of 73 Bcf, slightly above expectations, and prices eased. Prior to the 10:30 a.m. EDT report, June futures were already at a discount to the contract’s $2.153 Wednesday close. In the minutes before the report, the contract was hovering at $2.095, and immediately after the release, June sunk to a session low of $2.075. After some back-and-forth, the prompt-month contract was trading at $2.088 at 11 a.m., which was down 6.5 cents from the contract’s regular session close on Wednesday.

Before the report, many were expecting an inventory build to fall between last year’s 84 Bcf addition for the week and the five-year average of a 52 Bcf injection. Citi Futures Perspective analyst Tim Evans was on the record with an 81 Bcf injection expectation, while a Reuters survey of 22 industry experts produced a 62 Bcf to 84 Bcf build range with a consensus estimate of a 70 Bcf injection.

As of April 22, working gas in storage stood at 2,557 Bcf, according to EIA estimates. Stocks are now 870 Bcf higher than last year at this time and 832 Bcf above the five-year average of 1,725 Bcf. For the week, the South Central Region injected 25 Bcf, the East Region injected 23 Bcf, while the Midwest deposited 16 Bcf. The Pacific and Mountain regions each chipped in 6 Bcf and 3 Bcf, respectively.

Analysts at Tudor, Pickering, Holt & Co. (TPH) called the 73 Bcf build for the week ending April 22 a “bearish tilt” and “well high of historic norms.”

The significant build also brought into question whether the fundamentals are currently in place to erase the current storage surplus. A combo of very mild weather and a miss versus expectations indicates a market no better than balanced on a weather-adjusted basis,” TPH analysts said Friday. “It’s not good enough when we need to see both normal weather and a 3 Bcf/d undersupply to erase excess storage levels.” They added that weather for the week was warmer than normal with just 48 heating degree days (HDD) versus the 79 HDD five-year average.

“Declining production and decent weather-adjusted demand have the market increasingly confident that a much higher gas price will be needed this coming winter to balance the market,” TPH analysts said. “However, in the meantime, the market needs to be tighter than it has been recently to work down excess storage, so in the near-term price needs to adjust accordingly.”

In the heart of 1Q2016 earnings reporting season, low oil and gas commodity prices are a constant and familiar gripe, but some industry executives see signs of hope. During a 1Q2016 conference call last week, Enterprise Products Partners LP’s Jim Teague, CEO of the general partner, told analysts his outlook on prices “is probably worth what you’re paying for it,” and then he made his case for optimism. “Almost all the experts have been saying that we’ve seen the bottom for oil prices and that prices in general should be on an upward move. We believe the fundamentals point in that direction.”

From now until 2020, new U.S. LNG export capacity will be steadily entering service, he said. Meanwhile, demand for gas among power generators continues to increase, and industrial load continues to grow, “…all in the face of gas rig counts that are less than 90 in the U.S., considerably past any historic lows.

“For liquids, NGL prices are influenced by oil, and with ample export capacity, ample shipping and a wave of new ethylene plants coming online, we don’t see that changing. Said simply, if you’re bullish oil, you have to be at least as bullish on natural gas liquids. Thus, the fundamentals for oil, natural gas and all the NGL products look constructive. Hydrocarbon demand continues to grow; production continues to fall, which points to improved pricing.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1258 | ISSN © 2577-9877 |