E&P | Eagle Ford Shale | NGI All News Access | Permian Basin

Matador Eyes Multi-Well Pads, Longer Laterals in Permian Delaware in 2019

Dallas-based Matador Resources Co. reaffirmed plans to reduce activity and consider selling assets in the Eagle Ford and Haynesville shales while hunkering down in the Permian Basin’s Delaware sub-basin, where it plans to drill more wells from multi-well pads and with longer laterals.

The producer also announced several production records, including for production overall and in the Delaware in 4Q2018, while proved reserves have more than doubled in two years.

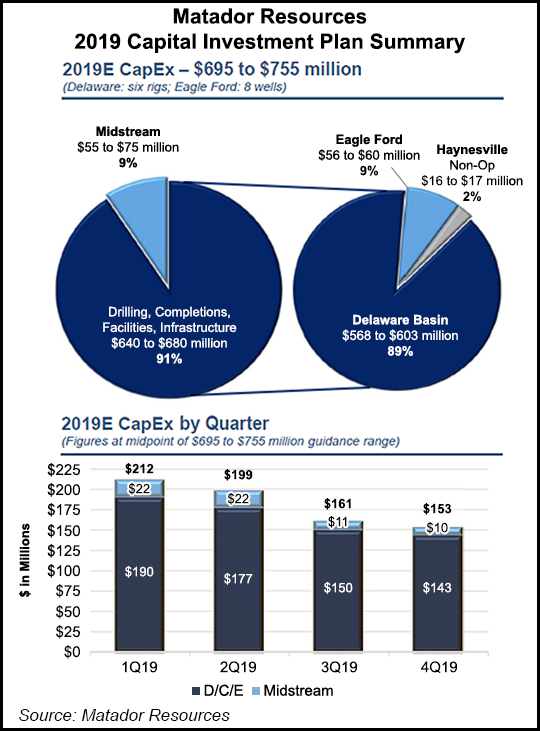

Matador unveiled a total capital expenditure (capex) budget of $725 million at the midpoint, down 6% from the $771 million spent in 2018. The latest budget includes $660 million for drilling and completions (D&C) and $65 million for midstream capex, which represents a 4% decline year/year (y/y) for D&C and 25% for midstream. Matador spent $686 million on D&C capex in 2018, which was above guidance of $645-680 million.

Also unveiled were plans to boost total production by 18% to 22.4 million boe at the midpoint. The company produced 19.0 million boe in 2018.

During a quarterly earnings call, CEO Joseph Foran said he “understands and appreciates” concerns over last year’s D&C outspend, “but our shareholders have gotten plenty of bang for their buck…

“We’re all proponents of being very careful with the money. We treat it like it’s our own because our management group has a lot of skin in the game. All of our net worth is largely in the form of stock, and recently I bought another 200,000 shares. We’ve put our money where our mouth is, and we think this is the best thing at this stage of our growth. But we’re moving cautiously in all areas.”

After dropping one rig in South Texas last month because of volatile oil prices, Matador plans to run a six-rig program in the Delaware, with four rigs deployed in the Rustler Breaks and Antelope Ridge operating areas, and one rig working the Wolf/Jackson Trust area. A sixth rig would be directed for the Arrowhead, Ranger and Twin Lakes operating areas.

Matador expects to complete about 69 net wells in 2019, including 55 in the Delaware and eight in the Eagle Ford. Numerous intervals in the Delaware are to be targeted during the year, including the First, Second and Third Bone Spring and Wolfcamp A, B and D formations.

Matador reported record quarterly production of 55,536 boe/d (60% oil) in 4Q2018, up 27% from the year-ago quarter and 1.7% sequentially. Delaware production also hit a quarterly high in 4Q2018 at 49,309 boe/d (64% oil), up 41.5% from the year-ago quarter and 3.1% sequentially. Full-year production was 52,128 boe/d (59% oil), up 34% from 2017. In the Delaware, production averaged 45,197 boe/d (62% oil) in 2018, up 54% from 2017.

The company completed and turned to sales almost 23 net wells in 4Q2018, of which 20 were operated. Of the operated wells, 19 were in the Delaware and one was in the Eagle Ford. Matador initially expected to enter three net wells in the Eagle Ford into production in 4Q2018, but it had five additional wells and one well in the Austin Chalk formation drilled and waiting on completion at the end of the quarter.

Essentially all of the operated wells completed and turned to sales in 2018 were in the Delaware. The exceptions included one operated well in the Eagle Ford.

Matador also took note of its proved reserves, which have more than doubled over the last two years to 215.3 million boe. The total includes 123.4 million bbl of oil and 551 Bcf of natural gas. Broken down by play, 89% (191.4 million boe) of proved reserves were in the Delaware, followed by the Eagle Ford at 6% (12.2 million boe) and the Haynesville at 5% (11.7 million boe).

The company announced last month that it would partner with private equity Five Point Energy LLC for a second time to expand midstream operations in the Delaware. The joint venture, San Mateo Midstream II, is designed to nearly double processing capacity with a cryogenic natural gas processing plant in New Mexico.

Matador reported net income of $136.7 million ($1.17/share) in 4Q2018, compared with $38.3 million (35 cents) in the year-ago quarter. Net income was $274.2 million ($2.41/share) in 2018, compared with $125.9 million ($1.23) in 2017. Revenues totaled $899.6 million in 2018, versus $544.3 million in 2017.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |