Colder than normal temperatures could trigger extreme upside volatility for natural gas prices this winter, according to industry experts.

In a webinar Tuesday hosted by Refinitiv and NGI, a panel of experts said numerous factors have converged to create a far tighter market than what is normally seen at this time of year.

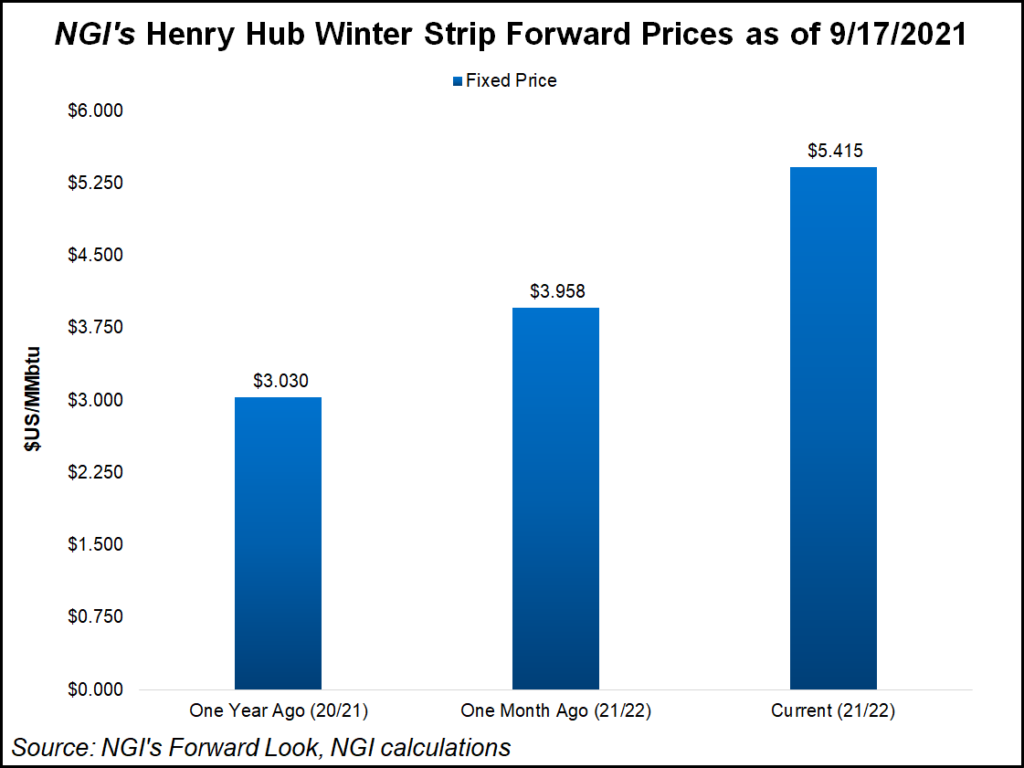

“I traded 25 years…and we are coming into a winter that has the most upside bullish tail risk for prices that I’ve seen in all my years in the space,” said NGI’s David Dutch, vice president of business development, when discussing the current state of the gas markets.

Dutch shared the virtual stage with NGI’s price and markets editor Leticia Gonzales, who agreed that “this is not looking like it’s going to be a normal winter.”

Gonzales...