NGI The Weekly Gas Market Report | Markets | NGI All News Access

Market Development, Pricing Hubs Seen Advancing in Mexico Natural Gas Market

Local pricing indexes will develop in Mexico in the coming years as infrastructure interconnectivity and increasing liquidity become features in the natural gas market, according to experts who spoke earlier this month in Monterrey.

“We still don’t have the liquidity conditions and secondary markets, but we see that evolving and we see points forming where a confluence of transportation routes and a multiplicity of gas suppliers and consumers exist,” said CEO Santiago Garcia of marketer Santa Fe Gas LLC.

Garcia shared a panel with other industry executives at the 5th Mexico Infrastructure Forum.

Ternium México’s Gerardo Rojas, energy strategy developer for the steel producer, suggested that “three or four” potential points in Mexico met the characteristics of a pricing hub, including around the Ramones pipeline in the north, the El Encino and Guadalajara areas and around the still uncompleted Villa de Reyes pipeline.

TC Energy Corp. expects the phased entrance into service of the 886 MMcf/d Tula-Villa de Reyes pipeline in Mexico to occur in the first quarter. Energy ministry Sener has said the project’s completion depends upon the conclusion of an “archaeological rescue” along the pipeline route.

“Once we can get local gas from Southeast Mexico, along with gas injected through South Texas and those new systems being developed to bring in gas from the Permian, when all this is ready and the interconnections are ready, we will start seeing different zones where local prices can be developed,” Rojas said.

Crucial to the plan is Fermaca’s Waha-to-Guadalajara pipeline system, set to enter service in the next few months, which when complete would move gas from the Waha hub in West Texas to reach Mexico’s industrial heart.

“When we have enough confidence that there are enough buyers and sellers and we are willing to trust an index to do a deal, that’s when you will see it form,” said BP Energy Co.’s Darrel Thorson, vice president for business development. “And it will be there in a year or two, but right now it’s not there.”

One issue that could facilitate liquidity is access to storage, and Mexico currently has no underground storage facilities.

Cydsa SAB de CV’s Raul Puente, head of hydrocarbons storage for the Mexican manufacturer, said the country is “light years away” from developing gas storage options similar to the United States, Europe and Japan, and the country needs to advance storage projects that were begun during the previous administration.

“We have abundant storage on the other side of the border, but political and natural disaster events can put this molecule at risk,” Puente said. “Even though the cost will be paid by the user, it will count as an insurance. This is important. Without natural gas, Mexico would go into paralysis.”

Thorson argued that storage on the U.S. side of the border for now is sufficient.

“Right now, until you get more capacity constraints, Mexico has built in storage through all the cross-border pipelines,” he said. “Hopefully we get a tremendous surge in demand and ultimately, we will start to get some constraints, whether it’s a summer peak or something else, but we are not going to be there for awhile. It could be something that Mexico needs as this market grows.”

Meanwhile, panelists at the event expressed some concern over the anti-market rhetoric of the administration of socialist President Andrés Manuel López Obrador, although the general sentiment remained that the gas market has continued to develop since he came into office in December 2018.

“In the area of commercialization of natural gas, there is a lot of noise, but we haven’t seen a lot of change in the last two years,” said Garcia. “Yes, we need to keep building infrastructure. But the changes we’ve seen maybe are more in exploration and production of gas. Will we be able to increase gas production according to the policies put in place? We hope so, but if not, Mexico can continue to depend on gas imported from Texas.”

Rojas said there was “a clear tendency toward state producing enterprises and maybe a reviewing process of a greater openness in the market,” but he is optimistic on the longer-term development of the market in Mexico. “The fundamentals of the region are in place, the competitiveness is there, and the price transparency is coming.”

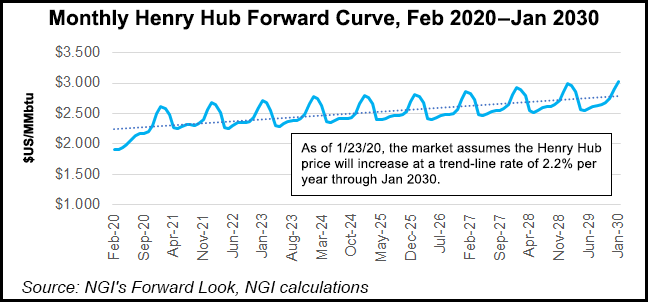

Thorson agreed. “The price of natural gas today is $2 in Texas; the two-year strip is $2.30 and the 10-year strip is $2.40. I’m optimistic about Mexican manufacturers’ willingness to continue to invest and grow. There will be some ups and downs, but that’s what we manage and this is what we do.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2577-9966 | ISSN © 1532-1266 |