Markets | Natural Gas Prices | NGI All News Access

March Natural Gas Expires Lower as U.S. Fundamentals Trump Russian-Ukrainian Conflict

Ignited by Russia’s invasion of Ukraine, natural gas futures climbed within striking distance of $5.000/MMBtu early in Thursday’s session. Traders struggled, however, in weighing the global implications of war with more bearish domestic factors, and volatility ensued in the last half hour of trading. The March Nymex contract ultimately expired at $4.568, down 5.5 cents from Wednesday’s close. April futures, however, moved up 4.8 cents to $4.641.

At A Glance:

- Production falls to 97 Bcf/d

- Forecasts for mixed demand

- NGI models draw of 41 Bcf

Spot gas prices continued to strengthen as cold weather lingered, with Northeast markets trading well into the $20.000 range. NGI’s Spot Gas National Avg. climbed 76.5 cents to $6.475.

The news of Russia’s attack on Ukraine had impeccable timing for futures traders, who thought February’s $2.00 rally upon expiration was unlikely to be repeated. The March contract raced out of the gate and soared to $4.940, up about 34 cents on the day, before 9 am ET. The surge followed a broader rally among global commodities, with European Title Transfer Facility (TTF) prices jumping above $40 and oil breezing past $100/bbl.

From that point, the rally started to fizzle. Prices remained firmly in positive territory, though, as traders digested the steady stream of headlines on the Russia-Ukraine conflict and what it could mean for energy markets.

U.S. ‘Still Very Much Domestic’ Gas Market

Eventually, the U.S. gas market did what it always has done – responded to its set of fundamentals. Marex North America LLC’s Steve Blair told NGI that the market has clearly shown repeatedly over the past month that even though natural gas is a global commodity, the United States is “still very much domestic” in the way it responds to weather.

“That’s not to say prices won’t spike. They will,” Blair said. “But with the March contract expiring today, it doesn’t matter what Putin does here at this point. It has no bearing on the March contract.”

Instead, March 1 is around the corner, and “winter is on the downswing, not up,” Blair said.

He added that although European storage is low, there is not much more supply that the United States could send to the continent. Most U.S. liquefied natural gas (LNG) facilities are running near their maximum capacity. While some incremental LNG production is still to come from Sabine Pass Train 6 and Calcasieu Pass, there are also transit considerations to be made.

“There’s only so many vessels that can transit waterways at any one given time. That may have an impact as well,” Blair said.

The analyst team at Tudor, Pickering, Holt & Co. (TPH) said any potential curtailments in Russian gas flows to Europe would add further stress to the supply situation on the continent. TPH analysts already had baked into their projections little movement on Nord Stream 2, even ahead of sanctions on the pipeline. Still, it expected “a healthy contribution from Russia in our winter 2022-23 balances, previously assuming a return to the roughly 17 Bcf/d range.”

However, the current geopolitical landscape suggested “limited likelihood, in our view, for flows via Ukraine to pick up the slack in Nord Stream 2’s absence,” the TPH team said.

Looking forward, TPH sees further stress on European supplies for winter 2022-23 than in 2021-22, which resulted in TTF testing “eye-watering levels.

“Despite record levels of LNG exports expected from the U.S., we continue to see limited ability for the global LNG market to support sustained elevated LNG imports into Europe beyond the 11-12 Bcf/d range,” TPH analysts said.

Spring Thaw

While the war in Ukraine could continue to cause jitters in the U.S. market in the long term, the expected warmup following several weeks of cold could send prices lower in the near term.

The latest weather models continued to show a break from the recent cold to much more mild conditions as the calendar flips to March. The midday Global Forecast System model added a hefty 16 heating degree days from Monday (Feb. 28) to March 5, which better matches the colder-trending European data set, according to NatGasWeather. However, it also was warmer for March 6-8 and still was “bearish leaning” overall for March 2-7.

With more variability in the upcoming weather pattern, the largest of this winter’s storage withdrawals have likely already occurred. After a string of 200 Bcf-plus withdrawals, there has been some loosening in recent government inventory reports.

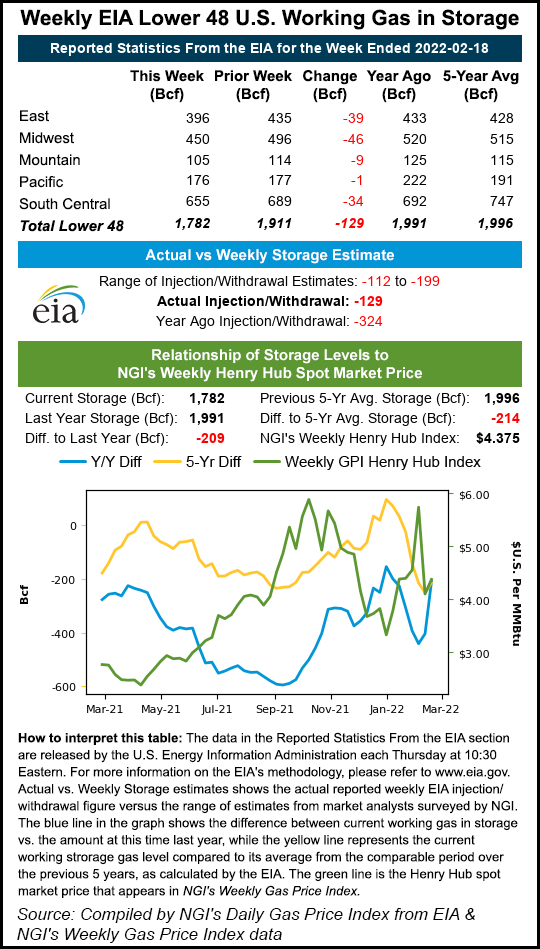

The Energy Information Administration (EIA) on Thursday reported that Lower 48 natural gas inventories dropped 129 Bcf for the week ending Feb. 18, a slightly lighter pull than expected.

Ahead of the EIA report, estimates were wide ranging and reflected the uncertainty in gauging supply disruptions amid recent cold weather. Reuters polled 16 analysts, whose estimates ranged from withdrawals of 112 Bcf to 199 Bcf, with a median estimate of 133 Bcf. Estimates submitted to a Wall Street Journal poll ranged from withdrawals of 114 Bcf to 199 Bcf, with an average draw of 140 Bcf. The median of 13 estimates submitted to Bloomberg as of Wednesday, meanwhile, was a withdrawal of 126 Bcf. NGI modeled a 121 Bcf draw for the report.

EIA recorded a 324 Bcf withdrawal for the year-earlier period, while the five-year average is a 166 Bcf draw.

Broken down by region, the Midwest recorded a 46 Bcf withdrawal from storage, and the East posted a 39 Bcf pull, according to EIA. South Central inventories slipped by 34 Bcf, including 29 Bcf from nonsalt facilities and 5 Bcf from salts. Modest decreases of less than 10 Bcf were seen in the Mountain and Pacific regions.

Total working gas in storage as of Feb. 18 stood at 1,782 Bcf, which is 209 Bcf below year-ago levels and 214 Bcf below the five-year average, EIA said.

Bespoke Weather Services said the EIA’s reported 129 Bcf withdrawal indicated that supply/demand balances have loosened compared to the very tight weeks driven by production freeze-offs. However, balances have not sufficiently loosened so that the market is “too comfortable” on refilling prospects over the next several months.

“That is more of an issue for later, however,” Bespoke said.

More Cash Increases

Spot gas prices continued to rise amid ongoing winter storms that continue to drive up heating demand across the country.

The National Weather Service (NWS) said the second major storm to impact the United States this week is expected to move toward New England on Friday. Accumulating snows were expected from the Upper Mississippi Valley into the Great Lakes, then snow may spread into the Northeast. The heaviest snows – up to one foot – were expected from along the Pennsylvania/New York State border, across much of New York and much of New England.

In the wake of the storm system moving off the New England coast Friday, below-average temperatures are forecast to stretch across much of the nation. The exception should be across portions of the Southern Mid-Atlantic and Southeast, where much above-average temperatures are possible, NWS forecasters said. Record low minimum temperatures are possible Friday morning from western Oregon through much of California and into western Arizona.

By Saturday, NWS expects more tranquil weather to dominate the Lower 48, with temperatures moderating along the West Coast and from the Northern Plains into the upper Great Lakes. Warmer-than-average temperatures expected again across the Southeast into Florida.

For now, the chilly weather continues to drive up demand. Tenn Zone 6 200L next-day gas prices shot up $10.060 to average $24.725, while Transco Zone 6 NY soared $1.735 to $6.505.

Appalachia prices also strengthened, but gains were limited to less than $1.00. Texas Eastern M-3, Delivery led the region with a 69.0-cent increase to $5.540 for Friday’s gas day.

Price increases were far more muted elsewhere across the country, coming in around 10.0-30.0 cents. Henry Hub picked up 20.0 cents to reach $4.770, and Waha in West Texas tacked on 18.5 cents to hit $4.575.

Rockies locations fell from prior day highs, with CIG recording a steep 50.0-cent decline day/day to average $4.885.

Wood Mackenzie noted that Northwest Pipeline (NWPL) withdrew nearly 1 Bcf of gas between Sunday and Tuesday from the Jackson Prairie storage facility as collective demand at citygates and power plants in the Pacific Northwest grew by nearly 740 MMcf alongside the withdrawals. As cold weather moved into the West and the Rockies, NWPL issued an operational flow order (OFO) for northbound volumes between the Plymouth South constraint and the Roosevelt compressor station. The OFO took effect Wednesday with no end date announced.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |