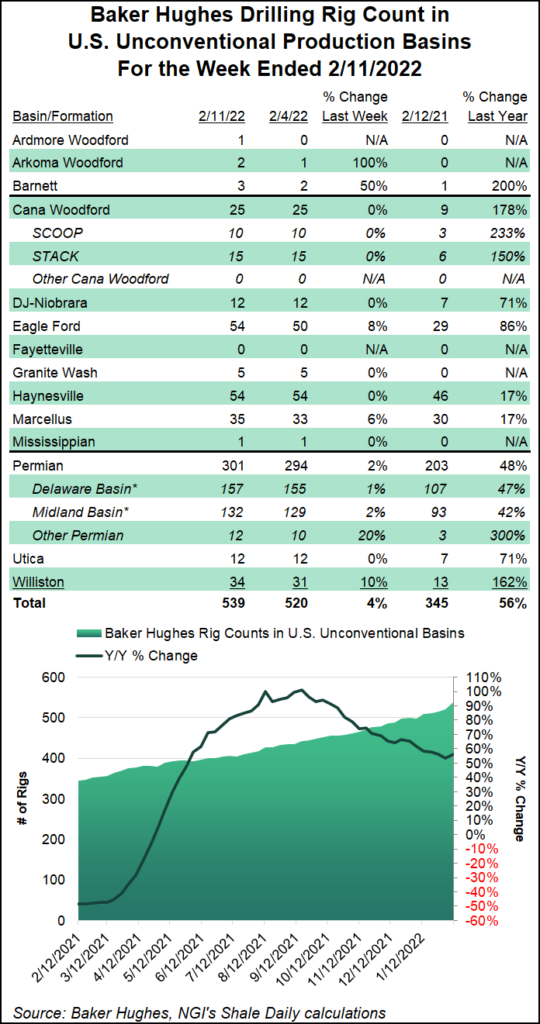

A major increase in oil-directed drilling, especially in Texas, propelled a 22-rig surge in the U.S. rig count during the week ended Friday (Feb. 11), lifting the overall domestic tally to 635, the latest numbers from Baker Hughes Co. (BKR) show.

Including gains of 19 oil-directed rigs, two natural gas-directed rigs and one miscellaneous unit, the total number of active U.S. rigs ended the week up 238 units from its year-earlier total, according to the BKR numbers, which are partly based on data from Enverus.

Land drilling accounted for the entirety of the net increase in domestic drilling activity, with the Gulf of Mexico holding steady week/week at 16 rigs. Four vertical units were added alongside 19 horizontal units, partially offset by a one-rig decline in directional...