Marcellus | E&P | NGI All News Access | NGI The Weekly Gas Market Report | Utica Shale

Magnum Hunter’s Newest Investor Relational Now Biggest Shareholder

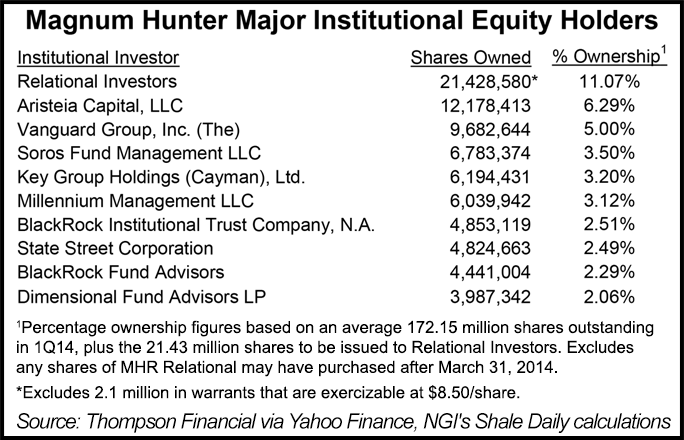

Activist fund Relational Investors LLC, helmed by former T. Boone Pickens lieutenants, is becoming the biggest shareholder in Magnum Hunter Resources Inc. (MHR) with a 15% stake after investing $150 million.

Relational, which typically works with companies to build value instead of calling for all-out changes, agreed to buy 21.4 million shares for $7.00 each. It also is receiving 2.1 million warrants with an exercise price of $8.50. MHR has a market value of $1.3 billion. The news sent the share price higher by almost 5% to around $7.38 in early trading Wednesday.

Relational co-founders Ralph V. Whitworth and David Batchelder formerly were top executives with Pickens. The fund’s oil and gas targets in recent years have included Occidental Petroleum Corp. and Hess Corp.

“Our interest in increasing our investment in Magnum Hunter coincided with some very attractive opportunities for the company to extend its growth and long-term strategic plans,” Whitworth said. “This investment reflects our confidence in Magnum’s outstanding management team and their strategic plan.”

The investment is designed to help support the operator as it expands in Appalachia’s Marcellus and Utica shales. The investment would be used to add another drilling rig, buy more leases and repay debt.

MHR CEO Gary C. Evans said he welcomed Relational’s “continued involvement and support, as both a preeminent oil and gas investor and proponent of long-term value creation for all shareholders.”

Topeka Capital Markets’ Gabriele Sorbara said the new funds would reduce MHR’s liquidity concerns. “Within our coverage universe, we believe MHR is the best way to play the dry gas Utica Shale in Ohio/West Virginia…While liquidity is still on the tight side heading into 2015, we believe the company’s asset base provides numerous opportunities to improve its balance sheet/capitalization.”

Analyst Irene Haas of Wunderlich Securities Inc. said the investment was a positive move for MHR and buys it “time and wiggle room.” The placement helps bridge a funding gap of $140 million for the second half of this year, assuming the same capital expenditures. However, “realistically, we expect the company to dial up spending,” she wrote. “For this reason, the company might still raise money after August. Proforma for the deal, MHR is expecting total liquidity of $208.5 million.”

Wunderlich’s net asset value (NAV) and price target on MHR of $13.00/share will be revised once there’s more information on the 2014 spending plan.

“Our $13.00 NAV can be broken down into $5.00 for proved reserves, $9.00 for probable reserves, $3.00 for possible assets, $3.00 for midstream assets, and netting out roughly $2.00 for assets sale and $5.00 for debt at year-end 2015,” Haas said. “Our price target for MHR is $13.00, which is equivalent to 14.0 times our 2015 estimated cash flow per share of 89 cents. We plan to revise our NAV when we have more clarity on the new spending plan. MHR is trading at 5.9 times 2015 cash flow while the Marcellus-Utica peer average is 7.2 times.”

Last year MHR sold about $500 million of assets, including its interests in the Eagle Ford Shale (see Shale Daily, April 4, 2013). Another $200-400 million of assets are to be divested this year (see Shale Daily, Dec. 12, 2013).

MHR is drilling a pilot well in Tyler County, WV that could determine the Utica potential in the state (see Shale Daily, March 26; Feb. 14). Production in 1Q2014 totaled 14,796 boe/d, with 12,700 boe/d from the Utica and Marcellus.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |