Marcellus | NGI All News Access | Utica Shale

Magnum Hunter 1Q Output Comes Up Short

While Magnum Hunter Resources Corp. increased its year-over-year production by 66% to 163.6 MMcfe/d in the first quarter, the company failed to meet Wall Street’s broader expectations after a bumpy finish to 2014 that found it pulling back in the face of falling commodity prices.

The company has spent more than a year selling off noncore assets in Texas, North Dakota and Canada as it’s transitioned to an Appalachian pure-play focused on the Marcellus and Utica shales, which now account for 90% of proved reserves (see Shale Daily, Oct. 2, 2014; Aug. 11, 2014). But permitting issues, liquidity concerns, falling commodity prices and mechanical issues with some of its wells forced the company to realign its strategy (see Shale Daily, Dec. 5, 2014; Oct. 8, 2014).

Management has laid out a plan to drill only five wells this year, compared to 53 in 2014, and lean more heavily on wells already in various stages stages of development to help it maintain production growth.

In January, CEO Gary Evans said wells shut-in for pad drilling would come online throughout the year and help push production up nearly 100% each quarter compared to 2014 levels (seeShale Daily, Jan. 23). But in February the company cut its capital budget by 75% and by March said it would suspend its upstream activities until service costs fall more and the market improves (seeShale Daily, March 2; Feb. 18).

Last month, Magnum said its full-year production would be 180-204 MMcfe/d. Topeka Capital Markets analyst Gabriele Sorbara said the company was expected to produce about 181 MMcfe/d last quarter.

First quarter production was up 59% sequentially, but Sorbara said a gassier mix could cut into the period’s earnings. Overall, production in the latest quarter was 74% weighted to gas, 13% to oil and 13% to natural gas liquids.

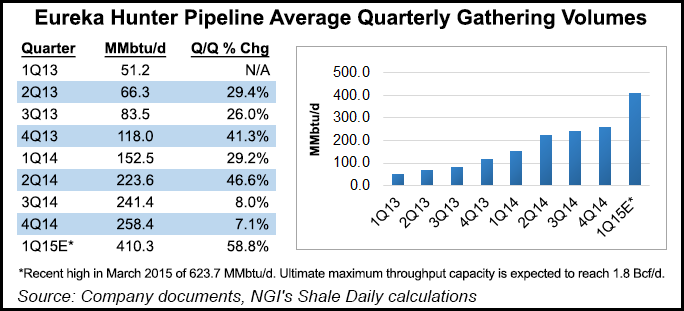

Midstream affiliate Eureka Hunter Pipeline LLC added four pipeline interconnects and realized increases in throughput during the quarter, peaking in March at 171.3 MMBtu/d. Management has said it plans to take Eureka public with a master limited partnership sometime this year depending on market conditions (see Shale Daily, Nov. 7, 2014).

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |