NGI The Weekly Gas Market Report | E&P | M&A | NGI All News Access

Lucius Called ‘Linchpin’ in Anadarko’s $2B Buy of Freeport-McMoRan Deepwater Stakes

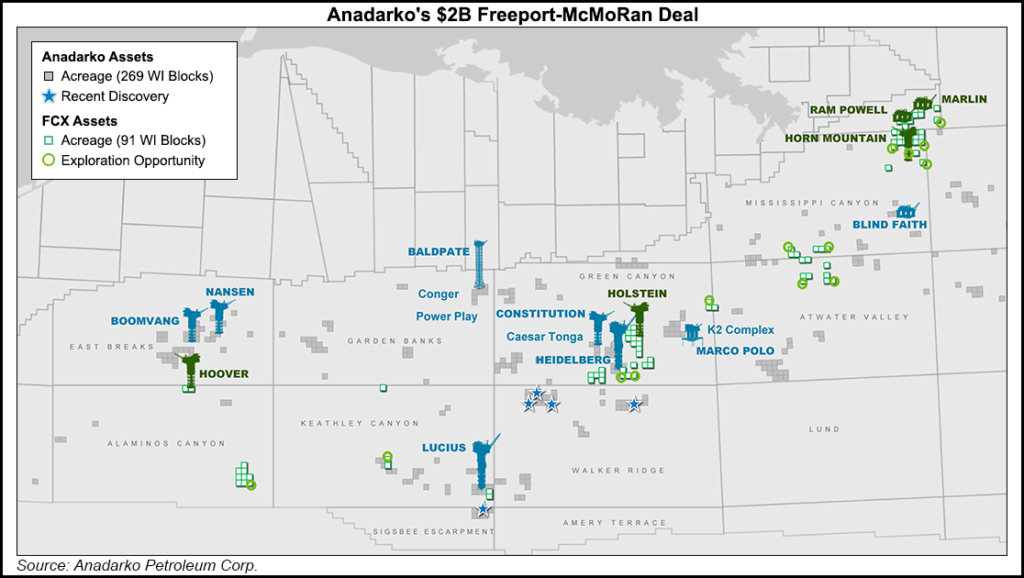

Anadarko Petroleum Corp. is betting that its offshore expertise and operational efficiencies will give it the upper hand after agreeing to pay $2 billion-plus for the ailing Gulf of Mexico deepwater portfolio of Freeport-McMoRan Inc. (FCX).

The deal, announced Monday, comes months after the global mining conglomerate put its entire U.S. portfolio on the market under pressure from shareholders and because of sustained low commodity prices for natural gas, oil and copper (see Daily GPI, April 27).

The Phoenix-based company was a “very motivated seller,” Anadarko CEO Al Walker said during a conference call Tuesday. “This immediately accretive, bolt-on transaction strengthens our industry-leading position in the Gulf of Mexico and is a catalyst for the company’s oil-growth objectives, with quality assets being acquired at an attractive price to create significant value.”

The acquired assets are expected to generate substantial free cash flow, enhancing Anadarko’s ability to increase U.S. onshore activity in the Delaware and Denver-Julesburg (DJ) basins.

All of the deepwater interests held by Freeport McMoRan Oil & Gas (FM O&G), developed and undeveloped, are being bought for $2 billion. Anadarko also agreed to make $150 million in contingent payments and assume $500 million in asset retirement obligations.

Sales volumes from FM O&G’s deepwater properties from June 2015 to June 2016 averaged 73,000 boe/d, with revenue of $1.0 billion, cash production costs of $300 million and capital spending at $1.6 billion.

Lucius the Linchpin

The biggest attraction among the long list of opportunities was Lucius, which Anadarko discovered and now operates in Keathley Canyon (KC) (see Daily GPI, Dec. 16, 2011). The project, 230 miles southeast of Houston in waters about 7,000 feet deep, includes portions of KC blocks 874, 875, 918 and 919.

“Lucius is the linchpin of the acquisition,” Executive Vice President Bob Daniels told analysts. “It largely supports spending in other assets…We are buying at just the right time to benefit from past spending, and we have the growth profile…”

Anadarko over the past several years had whittled its interest in Lucius to help finance the expensive startup (see Daily GPI,July 3, 2012). Purchasing FCX subsidiaries’ 25.1% stake would give it a 49% share in the project, which Anadarko now estimates holds around 400 million boe-plus in reserves, versus a previous estimate of 300 million boe. Gross oil sales volumes through the facility recently surpassed 100,000 b/d.

However, Anadarko is getting much more than Lucius. FM O&G also is selling 100% of the Holstein, Horn Mountain, Marlin, Dorado and King fields, as well as working interests in Ram Powell (31%), Hoover (33.3%), Heidelberg (12.5%) and Vito (18.67%). In addition, Anadarko would gain a half-interest in the Phobos discovery, as well as interests in 16 prospects identified by seismic imaging, including 154 undeveloped well locations.

There are preferential rights for some of prospects being acquired, Daniels said during the conference call. Claims by other stakeholders in some of the fields could be made before the deal is consummated, excluding Lucius and the 100% holdings being sold.

If all goes to plan, the takeover would add 80,000 boe/d net to current production, 85% weighted to oil, and almost double offshore output to around 150,000 boe/d.

More Free Cash Flow for Onshore

As important, at current strip prices the new offshore properties would generate an estimated $3 billion of incremental free cash flow over the next five years, which would be directed in the DJ and Delaware, Walker said.

“Our current plans are to add two rigs in each play later this year, and to increase activity further thereafter, with an expectation of more than doubling our production to at least 600,000 boe/d collectively from these two basins over the next five years.”

The increased activity in the U.S. onshore, he said, should drive a company-wide 10-12% compounded annual growth rate (CAGR) in oil volumes over the same time horizon in a $50-60/bbl oil-price environment. In addition, the transaction would expand Anadarko’s offshore infrastructure, offering subsea tieback opportunities and optionality with new exploration prospects.

Acquisition and development cost of the acquired FM O&G properties, excluding a total $300 million of materials inventory and seismic, is estimated at $13.50/boe for the estimated proved reserves.

The company also has increased its 2016 full-year capital guidance, not including the acquisition, by $200 million to a range of $2.8 billion to $3.0 billion, primarily reflecting the increased activity in the Delaware and DJ.

The Delaware and DJ would be the biggest drivers of CAGR, with implied 15%-plus growth through 2021. While the onshore portfolio is big, it’s going to take some oomph in pricing for other areas to compete for capital, Walker said.

“We always compete within the portfolio,” he said. If oil prices were to increase as expected in 2017, and “if there are opportunities for development that can compete for capital with the DJ and the Delaware, we’ll consider that…

“If the Delaware is not the finest oil play in the North American onshore, I’d be surprised if someone made a counter comment to that…In the DJ, we’ve talked many times about putting more rigs back to work. Those two basins are likely to compete for a lot of capital” alongside the GOM.

Plans are to monetize some assets if they are unlikely to “compete for cash” for the next five years. Walker declined to offer any suggestions for what may be on the block.

“This is a bolt-on opportunity, material enough to be meaningful to a company our size,” Daniels said. In every case, acquisitions “come down to price.”

Anadarko continues to eye other prospects, but “we’re not chasing pricey transactions, like in the Delaware,” he said. “We look at them all the time, and we’d love to find the right opportunity. But we have a footprint that gives us running room for a long time and we can leverage off the infrastructure…”

The deal came about over several months, Walker told analysts.

“In our view, certain assets made sense to us,” and “we indicated if they ever isolated the deepwater, we’d be interested,” he said. “It took a while to get to where we were” Monday, but once the offshore alone was for sale, “we were ready to go.”

Going forward, Anadarko knows it has become a buyer’s market. However, not every asset is worth the price, Daniels explained.

“We don’t want to to an acquisition where the cost of entry is too high,” he said. “We’d never make any money there. Buying at the right price, where we can drive material oil growth inside cash flow, is pretty attractive…Those opportunities are few and far between. We want to find one or two of them, then stay disciplined.”

The transaction, financed through a 35.35 million common stock offering, about 7% of shares outstanding, is set to close by year’s end.

Big Comedown for FCX

FCX does not expect to record a material gain or loss on the transaction, but for the conglomerate, the sale puts to bed — in part anyway — what many had considered to be a strategic blunder almost five years ago. Almost nothing has gone to plan since the company in late 2012 launched a $9 billion cash-and-stock deal to build its U.S. arm with the friendly buyout of Plains Exploration & Production Co. and related McMoRan Exploration Co. (see Daily GPI,Dec. 6, 2012).

Shareholders revolted; the stock price has never recovered. Shareholders began to pressure the company in 2013 to reduce the debt-laden balance sheet, and the conglomerate then was crushed by flailing commodity prices a year later.

Although it has searched high and low for joint venture partners and had assets on the market for months, nothing much has come from the efforts. The much ballyhooed FM O&G arm is being rolled into FCX after the entire exploration and production management team was ousted last spring (see Daily GPI,April 5).

The sale “brings our total 2016 asset sale transactions to over $6 billion and reflects our commitment to debt reduction and our focus on dedicating our capital and management resources to our global leading copper business, FCX CEO Richard Adkerson said. “With our announced asset sale transactions, combined with cash flows from operations and previously announced at-the-market equity transactions, we are on track to achieve our stated balance sheet objectives.”

The $150 million in contingent payments would be received by FCX “over time as Anadarko realizes future cash flows in connection with FM O&G’s recently completed third-party production handling agreement for the Marlin platform,” Adkerson said. Anadarko also is assuming “future abandonment obligations associated with the properties, which had a book value of approximately $500 million at June 30…”

Preferred shareholders in FM O&G’s consolidated subsidiary Plains Offshore Operations Inc. are entitled to receive $582 million in connection with the transaction. The remaining net proceeds would be used for debt repayment.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |