U.S. natural gas producers hedged most of their 2022 output before prices began to soar, setting the sector up for a slew of one-time losses on the wrong-way bets, according to Rystad Energy.

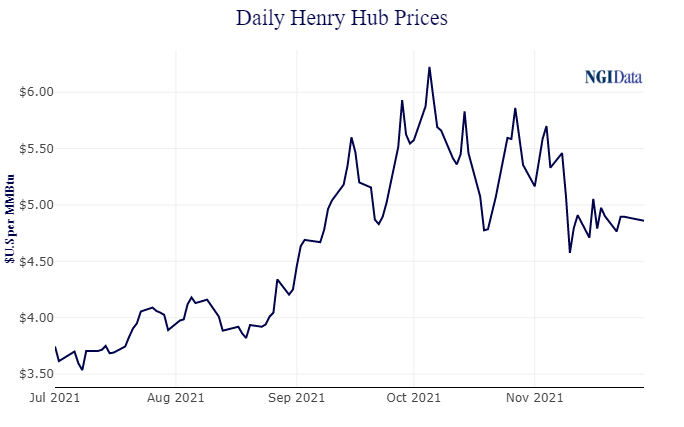

When exploration and production (E&P) companies hedge their gas production, they typically take an opposite position in the forecast price. However, increasing demand, particularly overseas, has sent gas prices sharply higher, and the outlook continues to look better than expected heading into 2022.

Rystad analyzed a peer group of Lower 48 gas-focused E&Ps, which together account for about 35% of unconventional gas production and about 53% of the overall shale gas output.

The E&Ps already had hedged “more than half of their 2022 production by the...