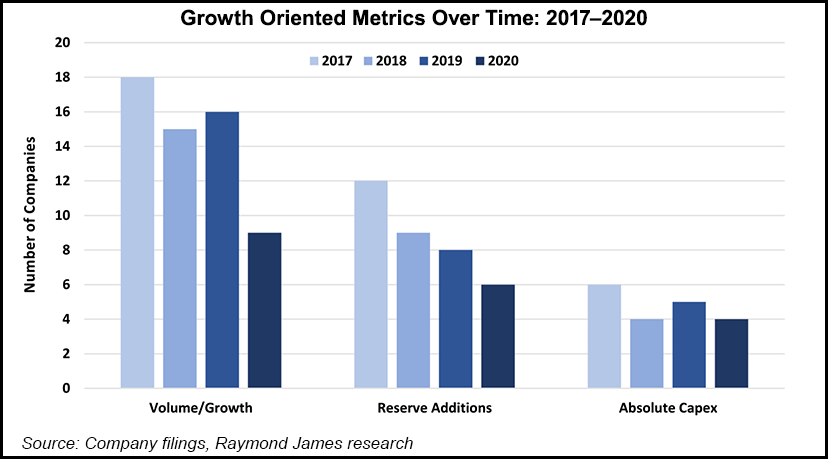

Exploration and production (E&P) companies working in the Lower 48 have witnessed an evolution in how their executive teams are compensated, with returns and free cash flow (FCF) now trumping volumes and growth, according to an analysis by Raymond James & Associates Inc.

Nearly all, or 90% of the E&Ps covered by the analyst firm also are using environmental, social and governance (ESG) performance metrics to determine annual bonuses.

“This further underscores the E&P industry’s commitment to sustainability,” said analysts John Freeman and Harry Halbach in the firm’s latest Stat of the Week.

Notably, small and mid-cap E&P CEO median pay has fallen sharply, down 59% between 2018 and 2020. General/administrative costs per boe also are down 30% for the period. In addition,...