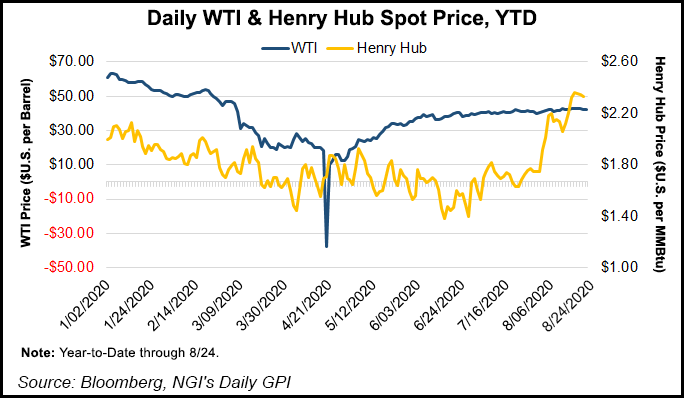

The market disruption from Covid-19 is forecast to unsettle long-term energy consumption patterns and heighten price volatility, with better financed operators ready to pounce on distressed Lower 48 assets, according to Moody’s Investors Service.

An extended oil price slump partly sparked by the pandemic, “will amplify disparities between stronger and weaker” exploration and production (E&P) companies. The well capitalized operators, along with the global majors, “will consolidate U.S. shale assets,” credit ratings analysts said.

The “universe of leveraged E&P companies will shrink substantially amid waning bank and investor support as a prolonged downturn further discourages debt investors from the E&P sector.”

Disparities between the E&P “haves and...