The Lower 48’s ample supply of drilled but uncompleted wells, aka DUCs, is coming down at a quick pace and is expected to reach “normal” levels by year’s end, tightening the oil supply according to Raymond James & Associates Inc.

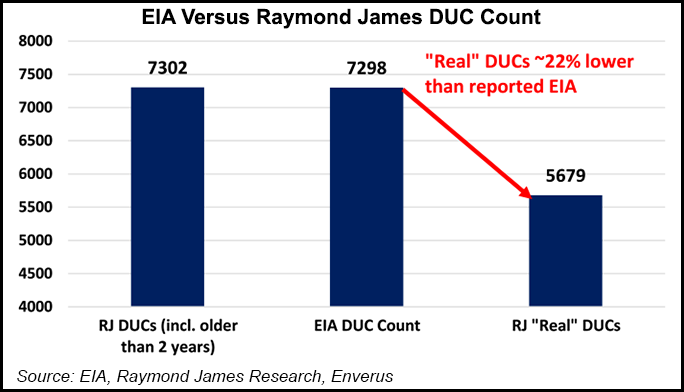

In a note to clients, Raymond James analyst John Freeman made the case that the U.S. Energy Information Administration (EIA) may be overstating the number of actual DUCS not yet completed.

The EIA in the most recent Drilling Productivity Report for December said the total DUC inventory across seven main Lower 48 regions stood at 7,298, down from 7,443 in November.

However, the EIA’s DUC count is 22% “too high and contains many older wells that are likely to never be completed,” according to Freeman.

The federal data contains a...