Marcellus | E&P | NGI All News Access | NGI The Weekly Gas Market Report | Regulatory | Utica Shale

Low NatGas Prices Reduce Pennsylvania Impact Fees for Third Consecutive Year

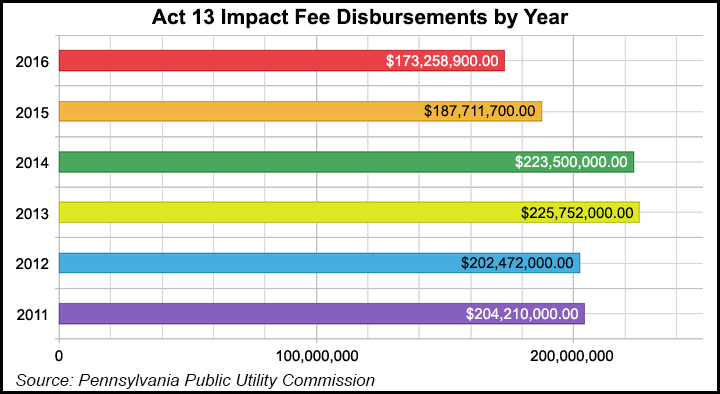

The Pennsylvania Public Utility Commission (PUC) said it collected more than $173 million in impact fees from the state’s natural gas producers in 2016, but fees declined on low commodity prices to the lowest level since enacted in 2012 and were down for the third year in a row.

The PUC said Thursday it collected nearly $173.259 million in impact fees in 2016, down 7.7% ($14.453 million) from almost $187.712 collected in 2015. The commission said that since Act 13, the omnibus Marcellus Shale law establishing the program became law, it has collected more than $1.2 billion total. Checks are to be distributed in early July.

The amount of impact fee revenue collected for 2016 is close to the $174.6 million estimate forecast by the state’s Independent Fiscal Office (IFO) last January, which based its estimate on continuing low gas prices. The PUC said lower gas prices led to a $5,000 reduction in fee revenue per well, and that the increasing age of many wells also resulted in less revenue. Impact fee revenue is down 23.3%, about $52.5 million, from a high of $225.752 million collected in 2013.

Pennsylvania’s impact fee is levied on all unconventional wells in the state during their first 15 years of operation, regardless of how much they produce. It is calculated with a multi-year schedule that is based on the average annual price of natural gas.

County and municipal governments directly affected by drilling are to receive more than $93.128 million total in 2016 disbursements, while an additional $62.086 million would be placed into the Marcellus Legacy Fund, which supports environmental, highway, water, sewer and other projects throughout the state. Another $18 million is to be distributed to state agencies.

According to the PUC’s website detailing Act 13 disbursements, Washington County will be the top county recipient for 2016 at $5.38 million, followed by these counties: Susquehanna ($4.86 million), Bradford ($4.32 million), Greene ($3.79 million), Lycoming ($3.18 million), Tioga ($2.43 million) and Butler ($1.67 million).

The municipality set to receive the most impact fee revenue for 2016 is Cummings Township, which is to receive about $922,266. The other top township recipients are Morris ($774,941), Auburn ($770,738), Center ($730,773), Cogan House ($687,273), New Milford ($672,691) and Cumberland ($646,603). Cummings and Cogan House are in Lycoming County, while Morris, Center and Cumberland are in Greene, and Auburn and New Milford are in Susquehanna..

Range Resources Appalachia LLC paid the highest impact fee bill for 2016, at about $22.8 million, compared with $23.9 million in the prior year. EQT Production Co. was the second-highest payer at about $18.3 million, followed by Chesapeake Appalachia LLC ($14 million), SWN Production Co. LLC ($12.8 million), Cabot Oil & Gas Corp. ($12.6 million), Repsol Oil & Gas USA LLC ($9.54 million) and Seneca Resources Corp. ($9.47 million).

Producers reported that there were 1,452 wells eligible for the impact fee in Washington County in 2016. Other counties with eligible wells included Susquehanna (1,304), Bradford (1,210), Greene (1,084), Tioga (883), Lycoming (875) and Butler (482). On the municipality side, Cummings topped the list with 248 eligible wells, followed by Center (191), Cogan House (179), Morris (171), New Milford (157), Springville (142) and Auburn (137). Springville is in Susquehanna County.

The PUC reported that a total of 8,035 horizontal wells were eligible for the impact fee in 2016, while 86 vertical wells were eligible. An additional 648 horizontal and 674 vertical wells were deemed ineligible, while 110 horizontal and 49 vertical wells had a disputed status.

Pennsylvania lawmakers have debated the merits of a severance tax on natural gas production for years, over the objections of the industry and the Marcellus Shale Coalition (MSC). Earlier this year, Democratic Gov. Tom Wolf proposed enacting a severance tax for the third time since taking office in 2015. Last April, the IFO said Wolf’s proposal for a 6.5% severance tax would make Pennsylvania’s the highest effective rate in the country.

“Pennsylvania’s unique tax on natural gas…continues to be a policy solution that’s working as designed, directly benefitting communities in all 67 counties throughout the commonwealth,” MSC President David Spigelmyer said Wednesday. “We understand the budget challenges that Pennsylvania faces, but proposals to enact even higher energy taxes, along with even more costly and unnecessary regulations, hurt the commonwealth’s competitiveness and our state’s ability to attract job-creating investment.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |