Long-Term Low Oil Prices Could Hurt NatGas, ICF Says

Sustained lower oil prices could slow natural gas production and market growth as the lower prices slow growth in U.S. shale oil plays, according to a first quarter 2015 Energy Outlook from consulting firm ICF International. Some long-term gas demand fundamentals are weakened by sustained low oil prices, ICF said.

The report’s findings, some of which mirror recent analyst reports, noted that many new demands for natural gas are driven in part by the recent large price spread between oil and gas, but as that spread narrows, the demand for gas may shrink, too.

“Sustained low oil prices could reduce growth in demand driven by oil-gas price arbitrage, [but] lower oil prices are unlikely to have any effect on power sector gas demand, which remains the primary force behind long-term demand growth,” ICF said.

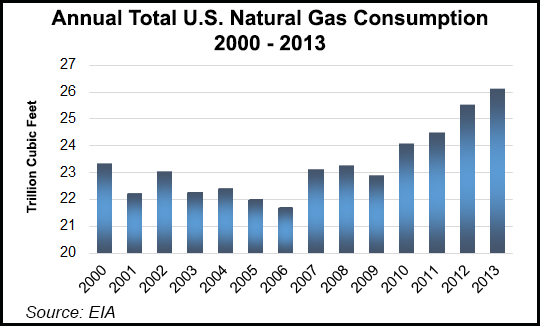

The report sees overall U.S. and Canadian gas consumption continuing to grow steadily from its current level near 30 Tcf to near 40 Tcf annually by 2035.

In the near term, ICF sees natural gas prices rising only modestly, adding that the gas market at the beginning of 2015 is characterized with “bearish price signals,” and mild December weather dampened prices at the outset of winter.

“Assuming normal temperatures for the remainder of winter, ICF projects a slight seasonable rise in gas prices, followed by lower prices in 2015,” ICF said. The report said the Marcellus and Utica shale plays in Pennsylvania and Ohio, respectively, now account for nearly a quarter of the U.S. gas production.

In the power sector, gas units “continue to dominate the build mix,” driven somewhat by the state renewable portfolio standards. “Wind and solar technologies will continue to dominate the renewable build mix, but their low capacity factors will keep their share of total generation nearly constant through 2030, and then will slowly increase to approximately 20% by 2040,” ICF said.

As more stringent federal air emissions restrictions draw closer, ultimately they will push the development of more gas infrastructure and more coal exports, according to Chris MacCracken, an ICF principal. “Despite the continued regulatory uncertainty adding decision risk, regulation and market forces will drive new investment in gas infrastructure, coal export facilities, and generation facilities over the next five years.”

In the prelude to the implementation of the federal Environmental Protection Agency’s mercury and air toxic standards rule, ICF’s report projects that 62 GW of coal-fired generation units will be retired.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |