LNG | LNG Insight | NGI All News Access

LNG Recap: U.S. Feed Gas Deliveries Rebound, but More Cargo Cancellations Likely

Feed gas deliveries to U.S. liquefied natural gas (LNG) export terminals finally jumped back up on Monday after sitting below 4 Bcf/d for nearly two weeks.

For the evening cycle for Monday’s gas day, Genscape Inc. estimates showed a 550 MMcf day/day jump in feed gas demand to more than 4 Bcf/d overall.

“Most notably, feed gas demand from Sabine Pass facilities has increased by 493 MMcf/d since Sunday,” the firm said. Genscape said most of the gas is being sourced from increased deliveries from the Transcontinental pipeline and the Kinder Morgan Louisiana Pipeline.

Since June 15, feed gas demand from interstate pipelines has averaged 3.61 Bcf/d, Genscape said, or roughly 600 MMcf/d less than Monday’s levels. Until Monday, NGI’s U.S. LNG Export Tracker showed feed gas volumes below 4 Bcf/d for 10 consecutive days.

Domestic LNG output has fallen significantly amid a supply glut and low prices overseas that have made it uneconomic to deliver the super-chilled fuel to key markets. The Energy Information Administration (EIA) said eight LNG vessels departed the United States during the week ending June 17 with a combined carrying capacity of 29 Bcf. That’s up from the prior week when only five vessels left carrying 18 Bcf, the lowest numbers since June 2017, EIA said.

The situation isn’t likely to change until this fall when prices firm and demand increases with colder weather. More cargoes are likely to depart the United in the weeks before the seasonal shift, but until then, more cancellations are likely.

Last month, shipbroker Poten & Partners said 130 U.S. cargoes would be canceled between May and October, including more than 30 this month. Up to 23 cargoes are expected to be canceled by Cheniere Energy Inc.’s customers alone in August, Bloomberg reported Monday. While Reuters cited market sources in reporting that up to 45 U.S. cargoes for August loading could be canceled from the nation’s export terminals.

Abundant supplies have kept a lid on prices. European natural gas storage was 77% full on Monday. The continent took in 52% of all U.S. cargoes through mid-June, according to NGI calculations.

Demand has also been lackluster because of the pandemic. The World Health Organization reported the highest daily infection increase yet over the weekend, raising the specter of a second wave and more lockdowns that further threatens energy consumption.

In another sign of the distressed market, there were 26 vessels floating with LNG aboard across the world on Monday, according to ClipperData.

However, supply continues to grow in anticipation of a tighter market in the years ahead.

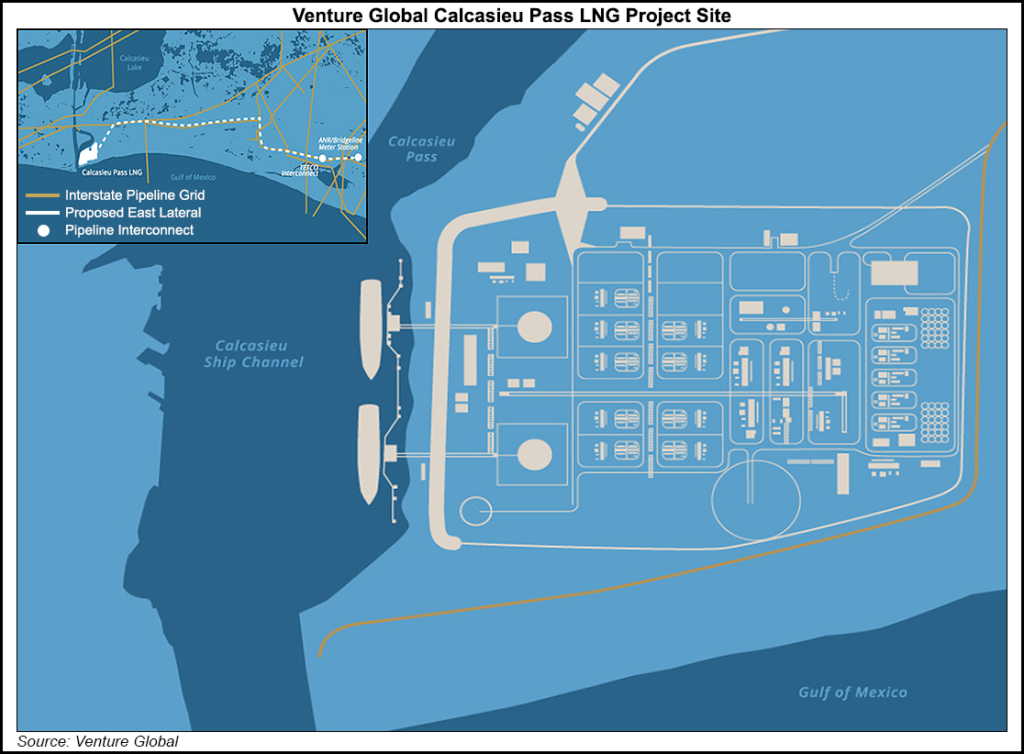

Venture Global LNG Inc. said last week it had begun installing equipment at its 10 million metric tons/year (mmty) Calcasieu Pass LNG facility in Cameron Parish, LA. The company said it has started setting in place two of 18 heat exchangers, aka cold boxes, that would be part of the facility’s liquefaction system.

Calcasieu Pass was sanctioned last August. The Federal Energy Regulatory Commission has also cleared Venture Global to start some construction at the proposed Plaquemines LNG export terminal in Plaquemines Parish, LA. Venture has not yet made a final investment decision on the 20 mmty facility.

Overseas, Total SA officials in media reports said the first phase of its Mozambique LNG plant, the first of its kind onshore in the country, would now produce 13.1 million tons (Mt), compared with an initial target of 12.9 Mt. The company also said the export terminal is on track for first production in 2024.

On the import front, LNG Croatia, which is developing the country’s first import terminal, said it has booked all available capacity for the next three years. The 2.6 billion cubic meter floating regasification and import terminal is set to enter service next year.

Myanmar also became the latest country to start importing LNG after Malaysia’s Petronas made its maiden delivery to the country in May, which was followed by another cargo this month. Last year, 42 countries imported LNG from 21 exporting countries, according to the International Group of Liquefied Natural Gas Importers.

In other news, the Indian Gas Exchange (IGX) has launched the nation’s first online gas trading platform as the country continues to invest in pipelines and LNG import terminals. IGX said the exchange is expected to boost price transparency and market participation.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |