LNG | LNG Insight | NGI All News Access

LNG Recap: U.S. Export Outlook Improving as Winter Months Near

The outlook for U.S. liquefied natural gas (LNG) exports is slowly improving as fewer cargo cancellations and increasing feed gas deliveries are likely in the months ahead.

Analysts at Goldman Sachs said Monday that they’re comfortable keeping their forecast for feed gas deliveries to U.S. export terminals from August to October at 4.3, 6 and 8.5 Bcf/d, respectively, as the arbitrage window in Asia reopens for U.S. deliveries. NGI calculations show the same, along with the window opening in Europe in October. Feed gas deliveries have hovered around 4 Bcf/d or lower this month.

Up to 30 U.S. cargoes could still be canceled in September, Bloomberg found in a recent survey of traders. That’s versus over 50 that were canceled in July and up to 45 that are expected to be cancelled in August, according to Bloomberg’s survey.

For now, the market continues to feel the squeeze on an abundance of supply and lower demand. The EIA said seven LNG vessels departed the U.S. from July 16-22 with a combined-carrying capacity of just 25 Bcf. That’s still up from only four vessels that left with 15 Bcf in the prior week, or what EIA said was the lowest reported export volume since 2016, when only Sabine Pass was in operation with two trains.

Meanwhile, the European Union reached a deal last week on an $859 billion economic recovery package to aid with the response to Covid-19, which briefly lifted commodity prices.

But ample supplies continue to pressure European gas prices, while those in North Asia remain steady as LNG inventory levels are close to capacity and floating storage remains elevated in the region, according to Schneider Electric.

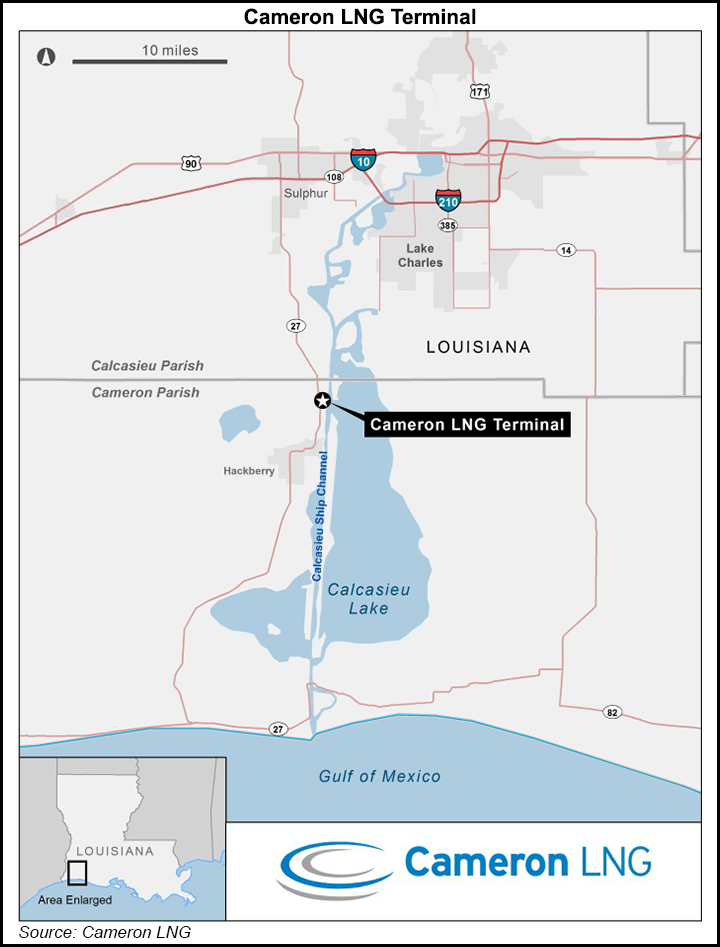

In other developments, FERC has granted Sempra Energy’s request to start service on the third liquefaction train at Cameron LNG in Louisiana, which would boost the facility’s output to 12 million metric tons per year. The first train entered commercial service in 2019, followed by the second train earlier this year. Cameron also has plans to further expand the facility, but has said it needs more time.

Kinder Morgan Inc. has also asked the Federal Energy Regulatory Commission to bring its eighth liquefaction unit online at the Elba Island LNG terminal in Georgia. The seventh of ten units was recently bought online too, KMI said Monday. The other units are expected to enter service by the end of the summer.

Overseas, Tokyo Gas’ Ohgishima LNG terminal received Japan’s first cargo from Novatek’s Yamal LNG in the Arctic. The cargo was delivered on an ice-class vessel via the northern sea route, according to ClipperData. The route takes up to 22 days, compared to the Yamal transshipment route via the Zeebrugge LNG terminal in Brussels, which takes twice as long.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |