NGI All News Access | LNG Insight | Markets

LNG Recap: Prices Continue to Slide as Glut Persists, Floating Cargoes Spike

The liquefied natural gas (LNG) market continues to plumb new lows as the month comes to an end, with a record number of laden vessels floating worldwide while prices and demand remain weak.

ClipperData said Monday 25 LNG-laden ships are floating with no destination, the highest its ever recorded in a “reflection of significant oversupply amid ongoing strong production and subdued demand due to the coronavirus.” ClipperData said four vessels are off the Atlantic coast of Spain, three each off the west coast of India, the Mediterranean and the UK, two each off Australia, Singapore and Japan, as well as individual cargoes offshore Panama, Brazil, the Arab Gulf, Pakistan, Thailand and Bangladesh.

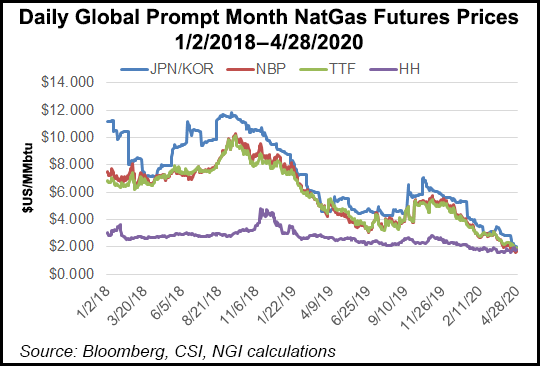

Demand has been hit hard by measures aimed at slowing the spread of Covid-19 and global gas prices have converged to historic lows, with key benchmarks in Asia, Europe and the United States for June all trading under $2.00/MMBtu. Spot prices in North Asia also hit yet another record low of $1.895 on Tuesday. Sellers continue to offer prompt cargoes at distressed rates of well below $2.00 in the region. Crude-linked LNG prices are suffering as oil prices are also extraordinarily low.

With associated gas production poised to fall in the United States as operators shut-in oil wells amid the price crash, Henry Hub, to which most U.S. LNG prices are linked, could eventually rise and make it more uneconomic to lift cargoes this summer, when the forward curve shows similarly low prices overseas. Speculation over U.S. LNG shut-ins and cargo cancellations has continued to run rampant over the last week.

Shipbroker Poten & Partners said last week it expects up to 25 cargoes for June loading to be canceled by domestic LNG buyers. Meanwhile, Bloomberg reported that it had confirmed June cargo cancellations at Cheniere Energy Inc.’s export terminals and at Freeport LNG.

“Feed gas demand has trended lower over the past week, possibly due to strategically scheduled maintenance as U.S. netbacks to Europe and Asia have held negative over the past few weeks,” said Schneider Electric analyst Christin Redmond in a note to clients on Tuesday.

U.S. LNG exports declined during the week ending April 22, according to the Energy Information Administration. Thirteen vessels departed with a combined carrying capacity of 48 Bcf, down from the 17 vessels that carried 61 Bcf in the prior week.

Export declines might prove more evident next month if other buyers don’t show up to take the canceled June cargoes. Ships typically arrive to lift cargoes weeks in advance of their scheduled delivery dates. For now, feed gas has not dropped off dramatically, loadings appear relatively normal and LNG production remains strong in the United States and across the world, said ClipperData’s Kaleem Asghar, director of LNG analytics.

LNG tankers on average carry about 3 Bcf each, Asghar told NGI, adding that if the cargo cancellations are less pronounced, or they’re spread over a month or two, they might not shock the domestic gas market all that much. Various analysts have also noted that if associated gas output falls, that could offset a decline in exports over the summer. Producers like Cheniere could also find buyers for the canceled cargoes in the spot market, Asghar said, and they would receive a fixed fee in any case under their supply agreements.

Despite a loose market, projects in the United States continue to advance. Freeport LNG in Texas has requested FERC approval to bring its third train into service. Sempra Energy’s Cameron LNG in Louisiana introduced pipeline feed gas last week to its third liquefaction train, which is the final piece of the project’s first phase. Cameron plans to add two more trains in a second phase. Train 3 remains on track to start service in 3Q2020.

Kinder Morgan Inc. was also authorized by the Federal Energy Regulatory Commission last week to start exports from its sixth unit at Elba Island LNG in Georgia.

Meanwhile, Venture Global LNG Inc. said it has raised the roof for its first storage tank at the site of its 10 million metric ton/year Calcasieu Pass export project in Louisiana eight months after sanctioning. The facility’s marine perimeter wall and levee are in place, with the arrival and installation of modular equipment the project’s next focus, Venture Global said.

Tellurian Inc., which is working toward sanctioning the massive Driftwood LNG facility in Louisiana, said it has sold unsecured notes for $50 million of much needed cash. The company also entered into an agreement to amend its 2019 term loan, including a reduction of the principal amount by $17.1 million.

The pre-revenue company had only recently extended the maturity of that loan. It also recently announced a corporate spending cut, management changes and a workforce reduction to better manage the challenges that have been created for new export projects by the pandemic.

“Tellurian is building cash reserves during this challenging time in global markets, positioning for a strong emergence from Covid-19 restrictions,” CEO Meg Gentle said Tuesday. “We remain bullish on long-term natural gas demand growth, underscoring the acute need for Driftwood LNG.”

In the international market last week, Qatar Petroleum again signaled its intent to move ahead with its North Field expansion project, which is aimed at boosting the country’s LNG output. The company announced a $3 billion deal with Hudong-Zhonghua Shipbuilding Group Co. Ltd. to reserve shipyard construction capacity in China to support its expansion plans.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |