LNG | LNG Insight | NGI All News Access

LNG Recap: Global Natural Gas Prices Remain Strong Amid Headwinds

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |

Natural Gas Prices

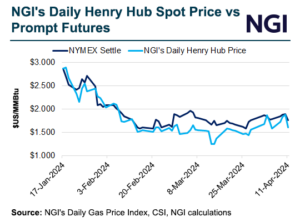

Prompt-month natural gas futures on the New York Mercantile Exchange (Nymex) neared $2.00/MMBtu last week but failed to push beyond a $1.943 Wednesday intraday high. With technical and fundamental support lacking, the front month headed lower on Monday, slipping 7.9 cents to settle at $1.691, and was trading marginally flat Tuesday morning. “The May Nymex…

April 16, 2024Natural Gas Prices

By submitting my information, I agree to the Privacy Policy, Terms of Service and to receive offers and promotions from NGI.