The rates charterers pay for vessels to move LNG cargoes across the world are declining, especially in the Atlantic Basin, as global natural gas prices dip and ship availability surges after months of tightness.

Spark Commodities on Tuesday assessed spot freight rates for Feb. 8-March 10 deliveries in the Atlantic at $60,500/day, unchanged from Monday. Pacific Basin rates on Tuesday dropped $750 to $82,500/day.

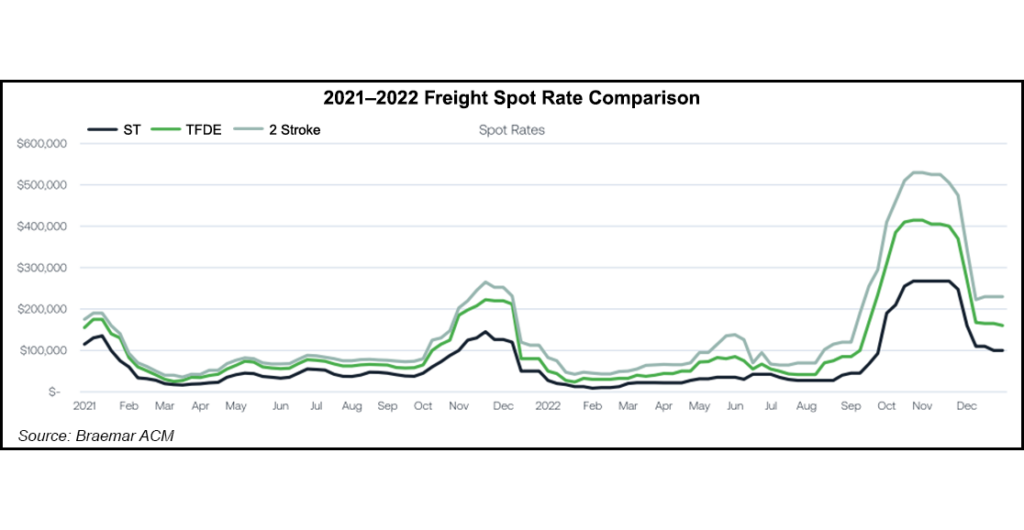

It was a $14,500/day drop for the Atlantic and a $21,000/day drop for the Pacific compared to a week prior. Both regions fell well below the average price for last year and in 2021.

Spark CEO Tim Mendelssohn told NGI that rates have fallen sharply since the beginning of the year as more vessels have become available amid a slump in demand for cargoes. Increasing...