LNG | International | LNG Insight | NGI All News Access

LNG Demand in Latin America Continues Pulling Spot Cargoes Off the Market

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |

Markets

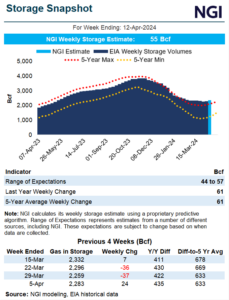

Natural gas futures gave back some of Tuesday’s gains Wednesday after TC Energy Corp. said it was able to isolate the impacts of a rupture of its Nova Gas Transmission Ltd. (NGTL) pipeline in Western Canada. At A Glance: NGTL incident is contained Analysts expect moderate injection Production at 98.4 Bcf/d Futures jumped more than…

April 17, 2024Natural Gas Prices

By submitting my information, I agree to the Privacy Policy, Terms of Service and to receive offers and promotions from NGI.