NGI The Weekly Gas Market Report | LNG | LNG Insight | Markets | NGI All News Access

LNG Cargoes Seen Shifting to Asia as European Inventory Brims Amid Demand Destruction

European natural gas storage inventories are at record highs as shoulder season nears, the Energy Information Administration (EIA) noted Tuesday, a factor that could eventually limit the continent’s ability to absorb liquefied natural gas (LNG) imports as it faces more immediate demand threats from the coronavirus.

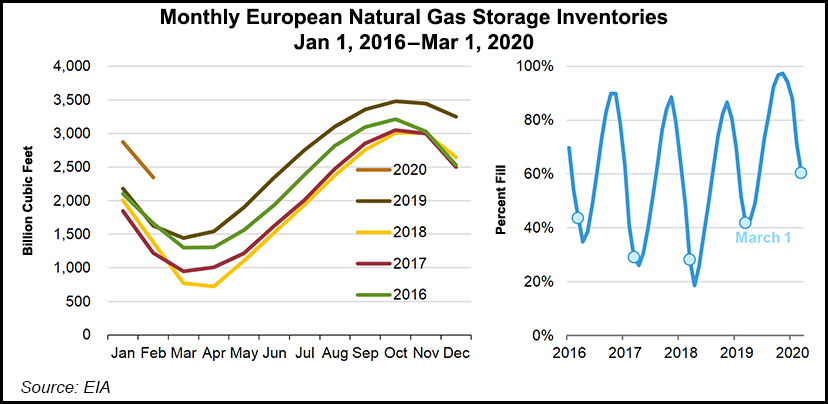

EIA said storage inventories were 60% full on March 1, the highest ever recorded for the start of March. Inventory levels were also at record highs in January and February. Storage was at 56% of capacity as of last Sunday (March 22), according to the latest estimates from Europe’s Aggregated Gas Storage Inventory. Stocks are brimming after a particularly warm winter on the continent and record high pipeline and LNG imports.

The continent is a major destination for U.S. gas exports, as 37 of this year’s 73 shipments have landed in Europe, according to NGI and Department of Energy calculations. The United States has been Europe’s largest supplier since November, EIA said, noting that European imports from the Lower 48 reached a record 5.1 Bcf/d in February, when Asian demand slumped because of the coronavirus. That’s nearly double the volume of Qatar, the continent’s second-largest supplier.

High storage inventories could threaten the continent’s ability to absorb gas later in the year and potentially force U.S. exporters to shut-in some volumes. However, increasing efforts to stop the spread of the coronavirus across the continent are also cutting into gas demand and appear poised to limit LNG imports.

“European lockdowns have become more widespread and established — shifts in power demand, market balance and price will become more marked,” Wood Mackenzie said Tuesday. “Gas remains more economic than coal despite the downward shift in carbon prices but both fuels are seeing lower margins due to depressed demand.”

Kpler also noted Tuesday that while European LNG imports are set to hit an all-time high in March of 6.59 million tons, volumes are poised to shift toward Asia, where prices have increased with recovering economic activity since the virus first broke out in China and surrounding countries earlier this year.

“A trend reversal toward Asia appears inevitable,” Kpler said in a research note. “While Europe has now become the epicenter of the pandemic, Asian spot prices are already increasing as demand picks up.”

The firm said Asian buyers are also likely to benefit from lower long-term contracted prices linked to oil, which account for roughly three-quarters of the region’s LNG trade. The gap between those term prices and the Japan Korea Marker (JKM), a pure LNG benchmark, has narrowed with the slide in crude. Assuming an average slope of 11%, Kpler said long-term contracts could soon trade around $3.00/MMBtu, or about where JKM spot and forward prices were on Tuesday.

Europe’s large wholesale market, strong demand and ample storage and regasification infrastructure have made it an attractive market and one of last resort as global gas volumes have spiked. But the virus is cutting sharply into demand. In Italy, which has been ravaged by the outbreak and which has halted all nonessential industrial activity, power consumption is currently down 20% year/year, according to Schneider Electric.

Bloomberg reported Tuesday that key LNG importers in both Spain and Italy are considering issuing force majeure notices as Chinese state-owned companies did earlier in the year when virus mitigation efforts made it difficult to take in cargoes.

Through early March, roughly 21 vessels were forced to divert from Asia, but Kpler noted that the situation has since improved as only six were floating in the region.

“China labor is returning, expected to be at 70% in March and over 90% in April,” Wood Mackenzie added. “However, shutdowns in Asia are not over, as last week countries including the Philippines, Malaysia, India and Thailand announced more lockdown measures with implications for domestic developments as well as global technology supply chains.”

ClipperData said Tuesday vessels floating with LNG aboard, an indication of worldwide flows, had spiked to 16 from five at this time last week. Eight vessels were floating near Europe on Tuesday, according to ClipperData.

The global dynamics haven’t improved the possibility of U.S. LNG shut-ins later in the year. EIA noted that storage inventories are typically at 38% of capacity at the beginning of March, based on the previous five years. If European storage is brimming as shoulder season gets underway, and it continues to fill during warmer months, the continent’s ability to take in gas later in the summer could be limited

As long as there’s a positive difference between the U.S. loading price, less variable costs such as shipping, and the foreign sale price of LNG, offtakers may move cargoes from the United States, even at a few cents per MMBtu. Still, global prices are low across the board.

The maximum Gulf Coast LNG netback price for May between key markets in Asia and Europe on Monday was $2.090/MMBtu, or just $0.417 above where Henry Hub futures settled, according to NGI data.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |