Light Storage Injection Drives August Natural Gas Futures Higher

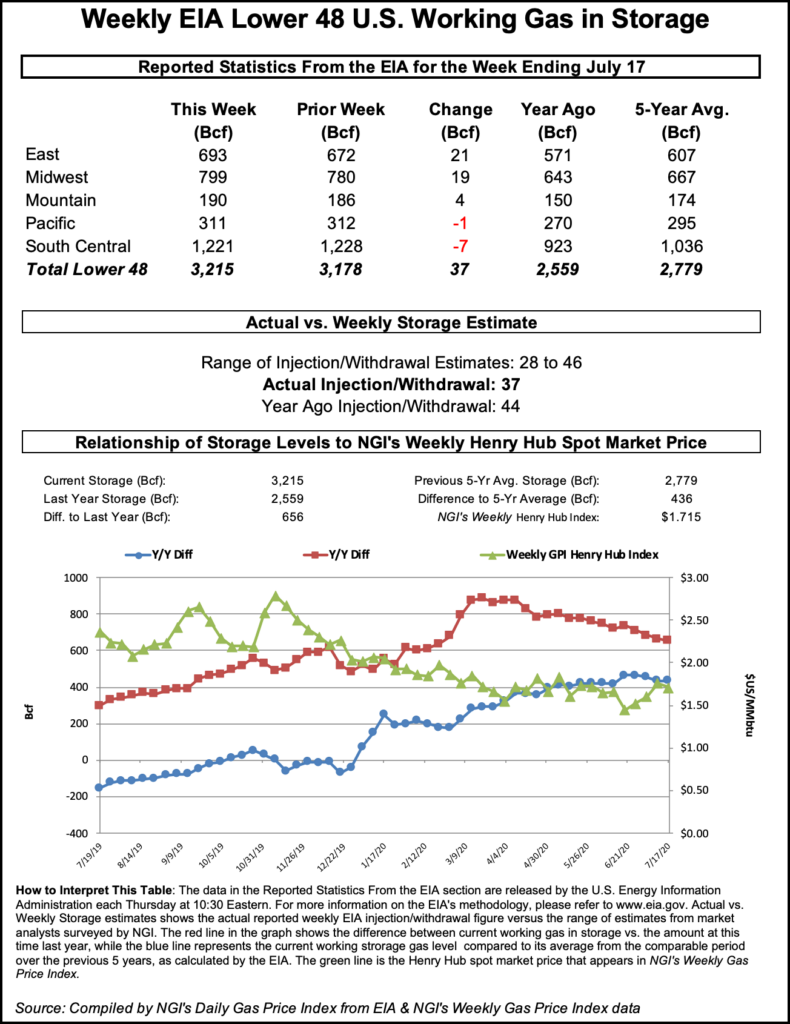

The U.S. Energy Information Administration (EIA) reported an injection of 37 Bcf into storage for the week ending July 17, marking the fourth consecutive week of double-digit builds and pushing Nymex natural gas futures higher.

Ahead of the report, the August contract was up seven-tenths of a cent at $1.688/MMBtu. The prompt month declined slightly to around $1.679 when the EIA data was released. By 11 a.m. ET, the August contract was trading at $1.743, up 6.2 cents from the prior day’s close.

Intense summer heat fueled strong cooling demand during the covered week, as it has for several weeks. “It was hotter than normal over much of the country” during the latest EIA report period, NatGasWeather said.

The EIA report pointed to continued supply/demand realignment this summer after imbalance imposed by the coronavirus pandemic and the economic recession it caused last spring.

“This is a decently tight number in terms of supply/demand balances,” Bespoke Weather Services said.

The forecaster said ongoing above-average temperatures are expected into August and should help to offset light demand for liquefied natural gas. The pandemic weakened European and Asian demand for domestic gas exports.

“Extrapolated forward,” Bespoke said of the injection report, “the balance off this number would likely be sufficient to avoid containment” in the fall, but the result was “not emphatic enough to suggest we avoid continued choppy price action in the near term.”

Prior to the report, a Bloomberg survey found injection estimates ranging from 28 Bcf to 46 Bcf, with a median of 36 Bcf. The average of a Wall Street Journal poll was 35 Bcf, with a low estimate of 28 Bcf and a high of 41 Bcf. A Reuters poll found estimates ranging from 28 Bcf to 46 Bcf and an average of 36 Bcf. NGI estimated a build of 35 Bcf.

The latest result compares with a 44 Bcf storage build in the same week last year and a five-year average increase of 37 Bcf.

The build for the July 17 week lifted inventories to 3,215 Bcf, above the year-earlier level of 2,559 Bcf and above the five-year average of 2,779 Bcf.

By region, the East and Midwest led with builds of 21 Bcf and 19 Bcf, respectively, according to EIA. Mountain region stocks rose by 4 Bcf. South Central inventories declined by 7 Bcf, which included a 3 Bcf injection into nonsalt facilities and a withdrawal of 10 Bcf from salts. Pacific inventories declined by 1 Bcf.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |