Markets | Infrastructure | NGI All News Access | NGI The Weekly Gas Market Report

Led by U.S., 2018 Another ‘Golden Year’ for Natural Gas, Says IEA

Natural gas demand emerged as the global fuel of choice last year, particularly in the United States and China, as energy consumption worldwide increased by 2.3%, the fastest pace this decade, the International Energy Agency (IEA) said Monday.

Energy demand overall was driven by a robust global economy and stronger heating and cooling needs in some regions. Gas posted the strongest gains, accounting for 45% of the rise in consumption.

“We have seen an extraordinary increase in global energy demand in 2018, growing at its fastest pace this decade,” said IEA Executive Director Fatih Birol. “Last year can also be considered another golden year for gas, which accounted for almost half the growth in global energy demand.”

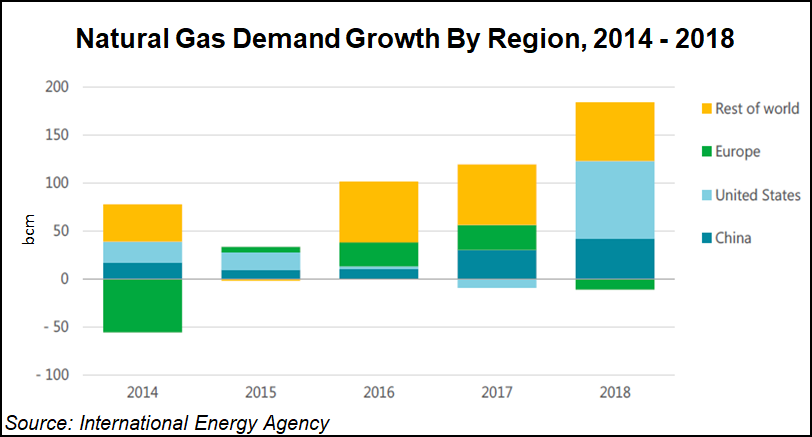

Natural gas consumption grew by an estimated 4.6%, its largest increase since 2010 when gas demand bounced back from the global financial crisis. The second consecutive year of strong growth, following a 3% rise in 2017, climbed on growing energy demand and coal substitution.

The switch from coal to gas accounted for more than 20% of the rise in gas demand. The United States led the growth followed by China.

The United States saw the largest increase overall in oil and gas demand worldwide, with natural gas consumption jumping 10% from 2017, the fastest increase since the beginning of IEA records in 1971.

The U.S. Energy Information Administration on Monday echoed IEA’s report, noting U.S. gas consumption set a new record in 2018, jumping by 10% to a record high of 82.1 Bcf/d. Domestic consumption of natural gas increased across all sectors in 2018, led by a 3.8 Bcf/d increase in the electric power sector, caused by a combination of recent gas-fired electric capacity additions and weather-related factors.

The annual increase in U.S. gas demand last year was equivalent to the UK’s current gas consumption, IEA noted.

“Global gas demand expanded at its fastest rate since 2010, with year-on-year growth of 4.6%, the second consecutive year of strong growth, driven by higher demand and substitution from coal,” IEA researchers said. “Demand growth was led by the United States. Gas demand in China increased by almost 18%.”

Oil demand was up 1.3% year/year worldwide, with the United States also leading the global increase “for the first time in 20 years, from a strong expansion in petrochemicals, rising industrial production and trucking services.”

The start-up of large U.S. petrochemical projects drove product demand, partially offset by a slowdown in growth in gasoline demand. As with natural gas, the United States and China showed the largest overall growth in oil, while demand fell in Japan and Korea and was stagnant in Europe.

“Together, China, the United States and India accounted for nearly 70% of the rise in energy demand around the world,” researchers said.

IEA’s analysis, which also reviewed carbon dioxide (CO2) emissions, said demand last year for all fuels increased, with fossil fuels meeting nearly 70% of the growth for the second year running.

Coal demand grew for a second year but by only 0.7%, significantly slower than the 4.5% annual growth rate seen from 2000-2010. While its role in the global mix continued to decline, coal last year still remained the largest source of electricity and the second-largest source of primary energy, IEA noted.

Renewables increased by 4% in 2018, accounting for almost 25% of global energy demand growth. The power sector led the gains, with renewables-based electricity generation increasing at its fastest pace this decade. Solar photovoltaic, hydropower and wind each accounted for about one-third of the growth, with bioenergy accounting for most of the rest.

“Renewables covered almost 45% of the world’s electricity generation growth,” and “now account for almost 25% of global power output,” according to the IEA analysis. China remained the leader in renewables last year, both for wind and solar, followed by Europe and the United States.

“But despite major growth in renewables, global emissions are still rising, demonstrating once again that more urgent action is needed on all fronts — developing all clean energy solutions, curbing emissions, and spurring investments and innovation, including in carbon capture, utilization and storage,” Birol said.

Electricity demand last year rose by 4%, nearly twice as fast as overall energy demand, and at its fastest pace since 2010. Renewables and nuclear power met the majority of the growth in demand.

“Still, generation from coal- and gas-fired power plants increased considerably, driving up CO2 emissions from the sector by 2.5%,” researchers said. Global energy-related CO2 emissions rose by 1.7% to 33 Gigatonnes (Gt) in 2018.

Power generation in coal use alone surpassed 10 Gt, accounting for one-third of the total increase. Most of the gains came from a young fleet of coal power plants in developing Asia, said researchers. Most of coal-fired generation capacity today is found in Asia, “with 12-year-old plants on average, decades short of average lifetimes of around 50 years.”

IEA’s Global Energy & CO2 Status Report noted that “electricity continues to position itself as the ”fuel’ of the future, with global electricity demand growing by 4% in 2018 to more than 23,000 TWh. This rapid growth is pushing electricity toward a 20% share in total final consumption of energy. Increasing power generation was responsible for half of the growth in primary energy demand.”

Nuclear grew by 3.3% in 2018, mainly as a result of new capacity in China and the restart of four reactors in Japan reaching pre-2011 Fukushima production levels, IEA noted. Worldwide, nuclear plants met 9% of the increase in electricity demand.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |