NGI The Weekly Gas Market Report | E&P | NGI All News Access

Latin American E&Ps Finding Unconventional Success Using U.S. Techniques

From Mexico to Argentina, producers are eyeing ways to unearth shale and tight natural gas resources, with some leaning on the exploration success in the Lower 48 states.

During a panel discussion last Wednesday at the 5th Mexico Gas Summit in San Antonio, TX, top executives shared strategies about how their companies plan to exploit Mexico resources and those farther south in Argentina’s Vaca Muerta.

Mexico’s Jaguar Exploracion y Produccionis the largest private exploration and production (E&P) company in the country in terms of acreage, estimated at around 1 million acres, and licenses, CFO David M. Rodriguez said. Last year Jaguar sold half-stakes in three onshore prospects to Vista Oil & Gas SAB de CV, and the partners now are preparing development plans to unearth oil and gas resources in mature basins and exploration prospects.

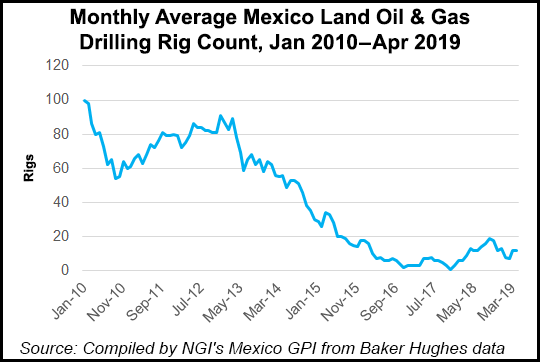

The onshore fields, many explored initially by state-owned Petroleos Mexicanos, i.e. Pemex, are “attracting a lot of private companies,” Rodriguez told the audience. Pemex, he said, stopped producing from many onshore fields between 2008 and 2011.

Although mature, new explorers can come in with fresh eyes and updated technology to exploit still-bountiful oil and gas resources in the onshore fields. Jaguar acquired 26 blocks in two of Mexico’s initial bid rounds, and it is now developing 11.

With partner Sun God Resources, Jaguar had secured 11 of the 24gas-rich blocks on offer through the Round 2.2 and Round 2.3 bidding process conducted in 2017. Last year Jaguar partnered with Vista Oil & Gas SAB de CV to develop Mexico fields, the first such alliance between two Mexican-based companies under the 2013-14 energy reform. Vista in 2017 became Mexico’s first independentproducer since the energy reforms were instituted.

Upstream regulator Comisión Nacional de Hidrocarburos (CNH) earlier in May approved a multi-well exploration planby Jaguar to drill four wells targeting four onshore gas prospects. The combined prospective resources are in the Sureste Basin near Villahermosa, Tabasco state.

Jaguar plans to invest more than $20 million in the drilling program between now and 2020.

Overall, Jaguar has secured onshore acreage that is “diversified across all of Mexico,” Rodriguez said. Five blocks now in development are in the northern part of the country, two producing and another set to turn to sales in the “next couple of months.” Three blocks are in the Burgos Basin and one is close to the city of Poza Rica, Veracruz state, which is also home to a Pemex natural gas processing center.

The blocks “were marginal for Pemex but they are very material” for a private operator like Jaguar.

Pemex had drilled an estimated 153 wells from the 1950s into the 1990s. The fields “clearly are classified as mature, but we are going back with fresh capital” and updated exploration techniques, Rodriguez said.

Jaguar needs to build and update gathering lines, facilities and conduct maintenance to return some of the fields to production, many of which were shut in by Pemex from 2008 to 2011.

“We are bringing in international expertise,” adding improved seismic to identify more production, the CFO said.

For example, in one Burgos block, six discovered fields by Pemex date back to 1953. Production peaked in the ”70s and ”80s at around 30 MMcf/d, then they naturally declined into the ”90s. In 2008, Pemex shuttered the field.

However, the Burgos block has substantial production history, with 50 wells drilled, and “we still have 10 wells with the potential to get back into production.” Once gathering lines and facilities are installed or updated, the wells should ramp up.

Under the regulatory framework plans required, Jaguar has committed to develop 35 wells, including appraising 10 in mature fields to determine the reserves in place, as well as 25 exploration wells. It will take about two years to fulfill the commitment.

“We’re working to start drilling by the end of the year,” Rodriguez said. Of the 35 development wells, commercial production could begin within four to seven years on “several” wells already identified.

“Additionally, we’re also working on five development plans” to develop other areas, which would allow more production to come onstream.

There are “still a lot of hydrocarbons in place in onshore basins in Mexico,” Rodriguez said. “Operators are willing to come in and invest in fields that the government is not investing in…”

Jaguar has gotten “a lot of positive response” from investors to develop Mexico’s energy resources. “There are a lot of stranded hydrocarbons in the ground.”

Farther south in Latin America, Tecpetrol is concentrating some of its broad exploration efforts in the promising Vaca Muerta formation in Argentina. Tecpetrol’s Ricardo Ferrerio, who is the North Region director, shared insight with conference attendees.

The company, which has an E&P unit and a gas transportation/distribution arm, provides Pemex with services, while in Argentina it invests in mature fields in Comodoro Rivadavia, with a new focus on developing resources in the Vaca Muerta.

The Vaca Muerta formation in the Neuquén Basin has drawn prospectors from around the world, and Tecpetrol has learned from the best, Ferrerio told the audience.

“The intention is to show how in the very south of Latin America, in the Vaca Muerta, we can take advantage of the vast experience in North American about shale,” he said. Using U.S. learnings, Tecpetrol has been “ able to develop rapidly an effective project in shale.”

The company has a “very good, very deep study of what was happening in the U.S.” to successfully exploit unconventional resources. What Tecpetrol’s experts came away with was the decision to use an industrial approach, i.e. “factory” or manufacturing hubs at drilling sites.

The manufacturing mode is employed across Lower 48 basins to produce from more than one well at a time, pulling oil and gas from the ground more efficiently.

Tecpetrol announced its initial investment in the Vaca Muerta in March 2017. Twenty-two months later, gas production had increased to around 600 MMcf/d from 17 MMcf/d. Facilities were installed in less than one year.

The unconventional “challenge” in Argentina is sharply different from the United States, as Lower 48 midstream infrastructure is far and wide, and the markets operate efficiently.

“In Latin America, we have to build that up,” which is why Tecpetrol’s approach basically was to use the manufacturing approach, Ferrerio said. It began deploying a significant amount of people to the region to handle processes and focus on development.

Apart from the basic drilling knowledge Tecpetrol gained, the manufacturing approach has helped reduce drilling time and improve overall pad management. For example, he said, over 22 months, Tecpetrol was able to reduce the fracture cycle time in the Vaca Muerta by 43%.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2577-9966 | ISSN © 1532-1266 |