NGI Archives | NGI All News Access

Latest Abraxas Eagle Ford Well Raises the Bar

In an operations update Monday, San Antonio, TX-based Abraxas Petroleum Corp. said a recent Eagle Ford Shale well turned in solid initial performance. The company’s third well in the WyCross area has outperformed a previous top performer.

In McMullen County, TX, the Mustang 1H produced an average 1,152 boe/d [1,025 b/d of oil; 500 Mcf/d of gas; 44 b/d of natural gas liquids (NGL)] on a restricted choke over its first 30 days of production. The well continues to flow to sales at a rate of 999 boe/d (847 b/d of oil; 914 Mcf/d of gas) plus NGLs on a 22/64 choke, Abraxas said.

“We are quite pleased with the early performance of the Mustang 1H,” said CEO Bob Watson. “This is our third well in the WyCross area, and [it] materially outperformed our previous best well, the Cobra 1H [see Shale Daily, Jan. 15].”

Also in the Eagle Ford, completion crews have been rigging up on the Corvette C 1H to complete the well with a 20-stage fracture stimulation. Abraxas recently reached total depth on the Gran Torino A 1H with a fracture stimulation date anticipated in February. The company has just spudded its sixth well at WyCross, the Mustang 3H. Abraxas owns a 25% working interest in the Corvette C 1H and an 18.75% working interest in the Mustang 1H, Gran Torino A 1H and Mustang 3H.

In the Williston Basin, drilling continues on the company’s Lillibridge East PAD with intermediate casing set on the 1H and 2H. Abraxas just reached total depth on the curve of the Lillibridge 3H. After setting intermediate casing on the Lillibridge 3H, the rig will move to drill the curve of the Lillibridge 4H. Abraxas recently received final consents on the Lillibridge PAD and now holds a 34.14% working interest across the four Lillibridge wells. The Ravin 2H and 3H are now expected to be completed during mid-February. Abraxas owns a 49% working interest in both the Ravin 2H and 3H.

Proceeds of $22 million from recent asset sales (see Shale Daily, Nov. 13, 2012) have been applied to paying down Abraxas’ debt revolver. At the end of 2012, the company had $113 million drawn on its $150 million credit facility and about $575,000 in cash, providing about $38 million in liquidity.

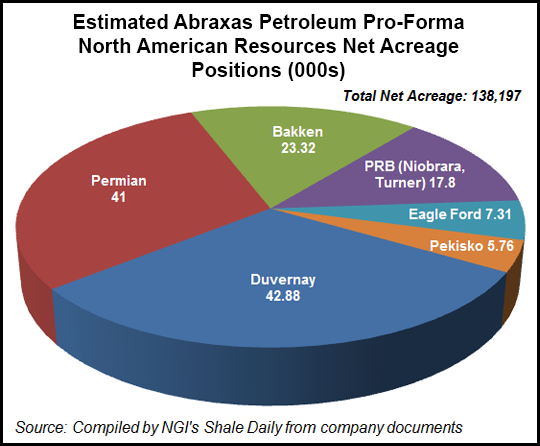

Abraxas is active in the Rockies, Midcontinent, Permian Basin and onshore in the Gulf Coast as well as in Alberta, Canada.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |