Late-Session Rally Trims Losses for Natural Gas Futures; Cash Markets Mixed

Weather models are playing mind games with natural gas traders. After stalling the return of colder weather overnight, the latest weather model run put it back on track and increased its intensity. With another drop in production, the March Nymex gas futures contract went on to settle Wednesday at $1.861/MMBtu, down just 1.1 cents. April slipped 1.5 cents to $1.887.

Spot gas prices were mixed, with small gains in the country’s midsection easily outmatched by losses on the East and West coasts. NGI’s Spot Gas National Avg. ultimately fell 1.5 cent to $1.800.

After closing more than 5 cents higher on Tuesday, March Nymex futures threw the gear into reverse early Wednesday amid yet another flip in weather models. On Tuesday, the American and European weather data moved in better alignment, showing a significant blast of frigid air arriving by around Feb. 16-18. However, the European dataset trended notably milder overnight and sent the prompt month tumbling to an intraday low of $1.825 early in the session.

The Global Forecast System model also trended milder in its midday run, especially for the important Feb. 14-18 period, by seeing cold air slower to arrive across the Great Lakes and East, and then not pushing as far across the Canadian border, according to NatGasWeather.

“This has to again be disappointing to the natural gas markets as cold days on the back end of the forecast keep trending milder as they roll forward into days six to 11,” the firm said at midday.

However, just as Wednesday’s session was drawing to a close, the afternoon run of the European model flipped back colder, gaining back 16 of the 18 heating degree days it had lost overnight, according to NatGasWeather. The latest run also was more aggressive with the frigid Canadian air mass pushing across the border and wasn’t quite as warm for the Feb. 7-12 period. “It was still warm and bearish Feb. 5-12, just a little less so.”

Meanwhile, supply/demand balances appear to be growing tighter by the day, with production on Wednesday showing yet another decline and now sitting more than 5.5 Bcf off the highs set in late November at around 90.5 Bcf, according to Bespoke Weather Services.

Genscape Inc. reported that freeze-offs have reappeared in the Rockies and ongoing field maintenance has constrained East output. The firm pegged production slightly higher than Bespoke at 91 Bcf/d, though it continues to see notable revisions to top-day nominations in later cycles.

If Wednesday’s number holds, though, “it would represent a four-and-a-half-month low,” according to Genscape senior natural gas analyst Rick Margolin.

Earlier in the week, Rockies pipelines had issued notices warning of a strong cold front moving into the area, and Genscape believes that system is causing freeze-offs in the Green River, Piceance and Denver-Julesburg areas.

“Our estimate of East region production is down to 31.85 Bcf/d,” Margolin said. “If the number holds, it will be the lowest daily volume for the region since mid-August.”

East volumes have been capped by widespread maintenance and the lagging price environment. So far this February, East production is averaging just a tick over 32 Bcf/d, according to Genscape. At the moment, this lags January’s output by more than 0.44 Bcf/d.

Meanwhile, liquefied natural gas (LNG) intake and power burns remain stable versus the last few days, although Bespoke reiterated that the lack of weather demand globally is also stoking fears of LNG shut-ins later this year, “which explains the bearish curve structure even at these multi-year lows in prompt-month pricing.”

Nevertheless, it sees any further price deterioration likely being “a slow grind as balances and cash prices try to offer support.”

To be sure, not even storage reports have much sway in the market these days. That’s because inventories are currently sitting at 2,746 Bcf, some 524 Bcf above year-ago levels and 193 Bcf above the five-year average, according to the Energy Information Administration (EIA).

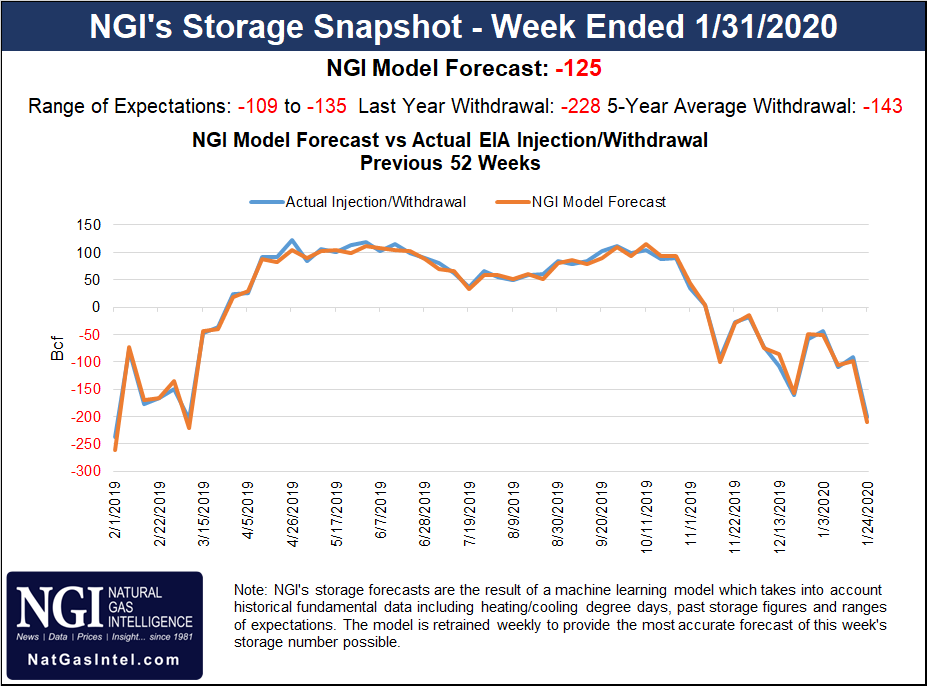

The EIA is scheduled to release the latest storage data on Thursday, with estimates pointing to a withdrawal in the upper 120s Bcf to lower 130s Bcf. A Bloomberg survey of nine analysts showed estimates ranging from 122 Bcf to 134 Bcf, with a median pull of 129 Bcf. A Reuters poll reflected a median draw of 131 Bcf. A Wall Street Journal poll of 11 analysts included a draw as low as 109 Bcf, but averaged 127 Bcf. NGI projected a 125 Bcf withdrawal.

Last year, the EIA recorded a 228 Bcf withdrawal for the similar period, while the five-year average withdrawal is 143 Bcf.

With storage inventories set to swell significantly ahead of injection season and the oil and gas industry entering 4Q2019 earnings season chanting the mantra of capital discipline, analysts at Tudor, Pickering, Holt & Co. (TPH) said Wednesday they’re lowering their 2020 price decks.

TPH revised its 2020 natural gas price projection 19 cents lower to $2.06/Mcf.

The downshift is not unexpected. With prices well below the $2 mark during the height of winter, other analysts have lowered their price projections for 2020. The long-term outlook doesn’t appear much rosier. The EIA’s updated Annual Energy Outlook 2020 shows natural gas prices stuck below the $4 mark out to 2050.

There haven’t been many days of truly cold weather in the southern United States, but this week’s blast continued to provide some modest uplift for prices in the region on Wednesday.

Spot gas across most of Texas picked up a few cents at best, while Permian Basin markets posted more notable gains. Waha jumped 20.5 cents to $1.540 as temperatures in Amarillo, TX, were set to dip to the upper teens overnight before climbing to a high of 50 on Thursday.

In the Midcontinent, ANR SW next-day gas rose 3.5 cents to $1.650, while even smaller gains, and some minor losses, were seen in the Midwest.

Day/day increases throughout Louisiana and the Southeast were minimal, as were losses in Appalachia.

More substantial declines were seen in the Northeast, where Tenn Zone 6 200L tumbled 31.5 cents to $2.180. Transco Zone 6 non-NY was down 7.5 cents to $1.680.

Declines were also seen on the West Coast, where most pricing hubs posted losses of less than 10 cents. SoCal Citygate, however, plunged 22.5 cents to $2.735.

In Western Canada, NOVA/AECO C spot gas fell C4.5 cents to C$1.785/GJ as production hitting TC Energy Corp.’s Nova/Alberta system is on the rise this week.

Nova production topped 12 Bcf/d for the first time this week since the end of December, according to Genscape. During January, brutally cold temperatures (even by Alberta standards) triggered freeze-offs that wiped out roughly 0.8 Bcf/d of production over a 15-day period.

“On gas day Jan. 13, freeze-offs cut more than 1.5 Bcf/d of production to push the day’s total down to a four-month low of 10.3 Bcf/d,” Margolin said. “Since Jan. 22, however, production has been slowly recovering with warming temperatures in the province.”

Production then took a notable step increase on Jan. 31, the same day TC Energy announced it had placed its new North Montney Mainline (NMML) into service, according to Margolin. NMML extends the TC Nova pipeline system into northeastern British Columbia to tap production out of the Montney Shale.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |