Infrastructure | NGI All News Access

KMI Seeking Shippers on Permian Highway Expansion After Another Quarter of Transport Growth

Kinder Morgan Inc. is seeking shipper commitments for 100 MMcf/d of incremental capacity on its planned Permian Highway Project (PHP) after fourth quarter 2018 natural gas transport volumes grew 15% year/year.

The $2 billion PHP is currently designed to transport up to 2.0 Bcf/d through 430 miles of 42-inch diameter pipeline from the Waha hub in West Texas to the Texas Coast and potentially on to Mexico markets. The pipeline is expected to be in service in late 2020.

An affiliate of an anchor shipper on PHP exercised its option earlier this month to acquire a 20% equity interest in the project, bringing Kinder Morgan Texas Pipeline’s (KMTP) and EagleClaw Midstream Service LLC’s ownership interest to 40% each.

Altus Midstream LP, a gas gathering, processing and transportation company formed by shipper Apache Corp., has an option to acquire an equity interest in the project from the initial partners by September 2019. If Altus exercises its option, KMI, EagleClaw and Altus will each hold a 26.67% ownership interest in the project. KMTP will build and operate the pipeline.

In December, Altus exercised its option to acquire a 15% equity interest in KMI’s Gulf Coast Express Project. The right of way for the 2.0 Bcf/d Gulf Coast Express project has been fully secured, and construction is underway. The first nine miles of the Midland Lateral were placed in service in August, and work on the remaining 40 miles of the lateral began in September.

The company maintains an October in-service for the $1.75 billion project, which would move gas volumes from the Permian to the Agua Dulce hub in South Texas; the project is fully subscribed under long-term, binding transportation agreements.

DCP Midstream and an affiliate of Targa Resources each hold a 25% ownership interest.

Natural gas transport volumes on KMI’s systems for the quarter were up 4.5 Bcf/d compared to 4Q2017. This increase was driven by higher throughput on El Paso Natural Gas due to additional Permian capacity sales; on Colorado Interstate Gas due to growing Denver-Julesburg Basin production, and on Tennessee Gas Pipeline due to power demand and projects placed in service.

KMI’s Texas intrastate networks (KMTP/Tejas) also contributed to a rise in transport volumes due to higher demand from shippers serving Mexico and the Texas Gulf Coast industrial markets, and on Natural Gas Pipeline Company of America due to cold weather early in the quarter, increased Permian receipts and power demand.

“This higher utilization of our system, a lot of which came without the need of capital, resulted in nice bottom-line growth for the quarter and longer term will drive expansion opportunities,” KMI President Kim Dang said.

Natural gas gathering volumes in 4Q2018 were up 21% from 4Q2017 due primarily to higher volumes on the KinderHawk system, which provides gathering, treating and dehydration services in the prolific Haynesville and Bossier Shale areas of northwest Louisiana.

On the LNG front, KMI management maintained that the first of 10 liquefaction units at its Elba Island LNG facility would be placed in service by the end of the quarter, with the remaining nine units coming online throughout the remainder of the year. As the project was originally expected to go into service in 2018, Kean attributed the delay to “contractor productivity” but said the company did “not expect the delay to have a material impact on our cost given the way our construction and commercial contracts are structured.

“We are obviously getting into the final days here. We have people on the ground watching the progress that we are making,” Kean said. “We are in commissioning activities simultaneous with the completion of the project, and so we think end of Q1 is a good and reasonable estimate for when we will be complete. There’s obviously a band of uncertainty around that date, but we think we are closing in on it here.”

Natural gas liquids volumes were down 11% in the quarter versus 3Q2017 due to unattractive pricing differentials across KMI’s Cochin system, although lower volumes have minimal financial impact given the terms of the underlying contracts, according to management.

Looming PG&E Bankruptcy Could Hit KMI’s Ruby asset

While the overall tone of KMI’s earnings call was a positive one, management indicated that the impending bankruptcy filing of California’s PG&E Corp. could impact its Ruby Pipeline, but management said there was “cause for optimism.”

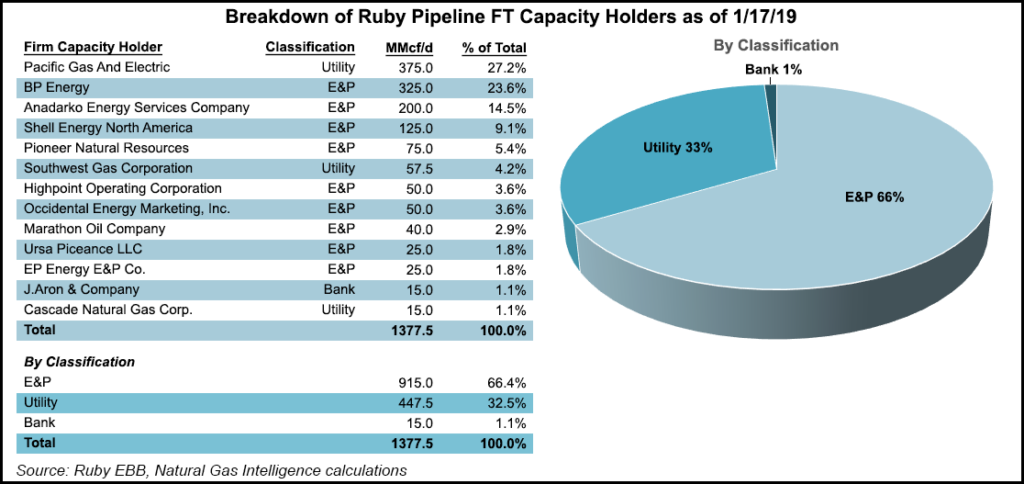

Ruby Pipeline is a 680-mile, 1.5 Bcf/d pipeline system that extends from Wyoming to Oregon, providing natural gas supplies from the Rockies to consumers in California, Nevada and the Pacific Northwest.

PG&E holds two contracts on the Ruby system, one of which serves the electric generators and service load and another that provides service to PG&E’s gas distribution business.

“We view both of those as core…or contracts that are core to PG&E’s business,” KMI CEO Steven Kean said Wednesday on a call to discuss year-end earnings.

The two PG&E contracts represent about $93 million/year of demand revenue, and while the bankruptcy process for the holding company and its utility is uncertain, “we have been told to expect continued utilization of those contracts,” KMI’s chief said.

Furthermore, the California Public Utility Commission requires PG&E to maintain upstream firm transport capacity, he said. “Those reliability aspects, we think, help improve the chances of affirmation.”

Meanwhile, a recent outage on the Gas Transmission Northwest system led to an increase in takes on the Ruby contracts, according to Kean. “So even though the current basis is lower, and below the long-term contract rate, there are reliability benefits to be considered.” He noted that in PG&E’s prior bankruptcy proceeding, firm transport contracts were not rejected.

California Gov. Gavin Newsom, who just took office last week, pledged to work with lawmakers and stakeholders on “a solution that ensures consumers have access to safe, affordable and reliable service, and fire victims are treated fairly.”

PG&E, as part of its preparation for a voluntary Chapter 11 filing, reportedly paid for natural gas supplies a month in advance. Separately, the utility posted collateral with the California Independent System Operator to cover all amounts owed and all projected future obligations.

PG&E’s planned bankruptcy is the latest fallout from Northern California wildfires over the past two years that have trapped the company and its utility in an increasingly tenuous financial situation where it faces billions of dollars of liability.

2019 Outlook

Looking ahead, KMI management noted that analyst projections for U.S. natural gas demand, which soared to about 90 Bcf/d from roughly 81 Bcf/d year/year, will increase from 2018 levels by 32% to nearly 119 Bcf/d by 2030. “Of the natural gas consumed in the U.S., about 40% moves on KMI pipelines, and roughly the same percentage holds true for U.S. natural gas exports.”

KMI expects future natural gas infrastructure opportunities through 2030 will be driven by greater demand for gas-fired power generation across the country (which is forecast to increase by 15%), net liquefied natural gas exports (forecast to increase almost five-fold), exports to Mexico (forecast to rise by 39%), and continued industrial development, particularly in the petrochemical industry.

The midstreamer has about $5.7 billion in backlog projects, the majority of which is tied to natural gas investments, including in its gathering assets in the Bakken due to constraints there. KMI expects to use internally generated cash flow to fund the vast majority of its 2019 discretionary spending, without the need to access equity markets.

As for Kinder Morgan Canada Ltd. (KML), a strategic review remained under way as the company seeks to maximize value for its shareholders, including the option to sell the unit. While nothing was announced Wednesday, management hopes to have an announcement about the direction of the company by the next earnings call, KMI chief strategy officer Dax Sanders said.

KMI reported fourth quarter net income available to common stockholders of $483 million (21 cents/share), versus a net loss available to common stockholders of $1.045 billion (minus 47 cents) in the year-ago period. Distributable cash flow (DCF) for the quarter was $1.273 billion, a 7% increase over 4Q2017.

For the full year, KMI reported net income available to common stockholders of $1.481 billion (66 cents), compared to $27 million (1 cent) for 2017, and DCF of $4.730 billion, up 6% from $4.482 billion in 2017.

“The fourth quarter capped a transformative year for KMI,” Kean said.

KML reported fourth quarter income of $40.3 million, an increase of $22.3 million from 4Q2017. DCF was $62.9 million, up 84% from $34.2 million in 4Q2017.

For 2018, KML reported income of $100 million, a gain of $64 million in 2017, while DCF was $161.5 million, up from $120.9 million in 2017.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |