Kinder Morgan’s NGPL Joins Tennessee, Others in Switching to NGI Indexes

Kinder Morgan Inc. has requested FERC approval to switch the natural gas price indexes it uses to calculate various charges, such as cashouts on Natural Gas Pipeline Company of America (NGPL) [RP15-997] mainly to the indexes published by Natural Gas Intelligence (NGI).

The NGPL filing May 21 followed Federal Energy Regulatory Commission authorizations over the last year of similar tariff changeovers, mainly to indexes published by NGI in separate filings for six other Kinder Morgan pipelines. These include Tennessee Gas Pipeline (see Daily GPI, Dec. 3, 2014), Cheyenne Plains Gas Pipeline [RP14-630], Colorado Interstate Gas [RP14-1008], Midcontinent Express [RP15-235], Kinder Morgan Louisiana [RP15-935], and Kinder Morgan Illinois [RP15-810].

The pipeline tariff changes apply to indexes used for cashout, penalty and/or credit-related calculations. The new tariffs call for the use of price indexes published in NGI’s Daily Gas Price Index, NGI’s Weekly Gas Price Index and NGI’s Bidweek Survey, substituting for comparable quotes the pipelines had previously used in Natural Gas Week published by Energy Intelligence or Platts Gas Daily or Inside FERC’s Gas Market Report. In the case of Cheyenne Plains, some of its charges will be based on prices published by the Intercontinental Exchange, as well as by NGI.

NGI’s indexes mainly will be used by these pipelines in computing cashouts, or lost or unaccounted for gas, or for penalties for failure to comply with operational flow orders.The NGPL filing last week said the pipeline’s aim was to “streamline its business practices in a cost-effective manner.”

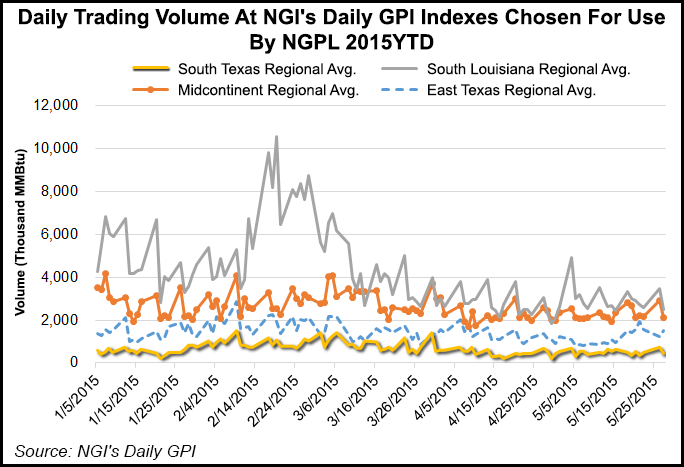

The Kinder Morgan pipelines’ filings said the companies had tracked NGI’s indices over a period of time. Their filings displayed detailed tables with volumes and number of deals that conformed to FERC’s guidelines for acceptable indexes to be used in tariffs. Comparing NGI’s indexes to the others, the pipelines found de minimis differences in NGI’s indexes compared with those that had been in use, saying they expected a seamless transition with no adverse impact on customers.

FERC authorized the changes for the six other Kinder Morgan pipelines without comment.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |