NGI Mexico GPI | Markets | NGI All News Access

June Natural Gas Futures Slide as Low Demand Expected to Spark Wave of Strong Storage Builds

An initial bump in natural gas futures prices failed to gain momentum Wednesday, with demand destruction weighing more heavily on the front of the curve than any declines in production. The June Nymex gas futures contract, on the first day in the prompt-month position, fell 7.9 cents to $1.869. July also dropped 7.9 cents to hit $2.091.

Spot gas prices also were lower relatively neutral weather patterns in the coming days. NGI’s Spot Gas National Avg. slipped 6.0 cents to $1.615.

With both the American and European weather models projecting light national demand through the weekend, followed by cooler air across most of the United States next week, weather was likely not a key factor in Wednesday’s futures sell-off, according to NatGasWeather. Instead, the firm said it’s possible that June is now attempting to drop into the previous trading range for the May contract, which expired Tuesday.

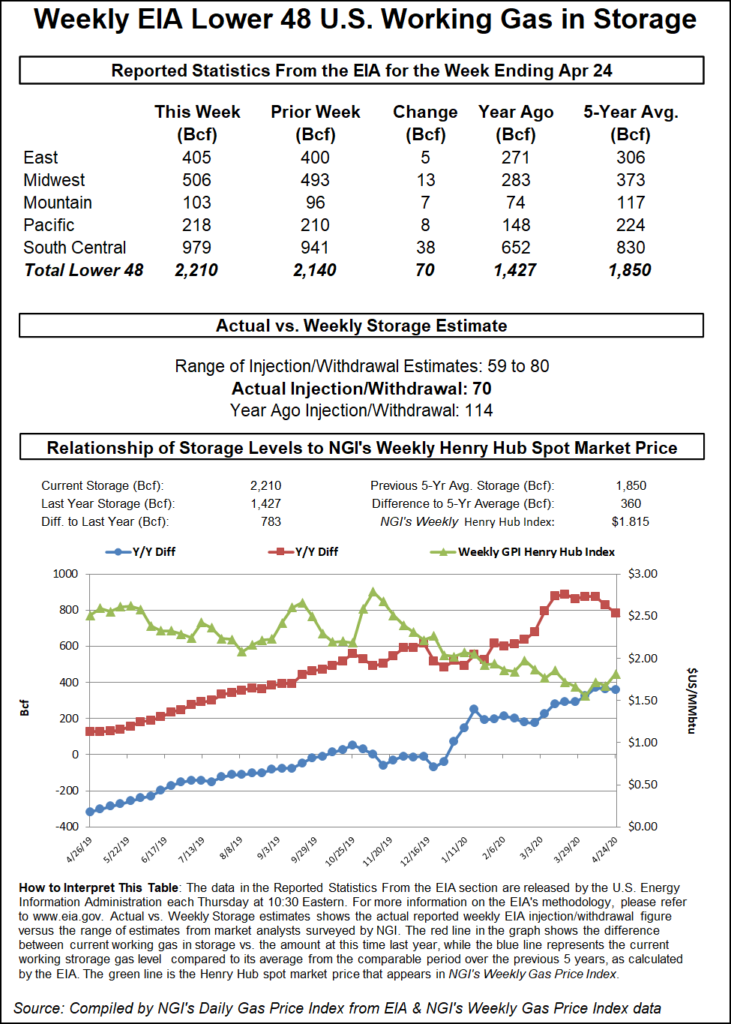

Thursday’s storage data is likely weighing heavily on the market, with market estimates pointing to an injection near the Energy Information Administration’s (EIA) five-year average of 74 Bcf. A Bloomberg survey of six analysts produced a range of 64 Bcf to 76 Bcf, with a median of 71 Bcf. A Reuters poll of 17 market participants had injections ranging from 59 Bcf to 80 Bcf. NGI also modeled an 80 Bcf build. Last year, the EIA recorded a 114 Bcf injection.

A quick glance at the natural gas storage surplus versus the five-year average highlights the extent to which demand destruction for gas may outweigh associated gas production losses, at least in the immediate term, according to EBW Analytics Group. From late April to July 4, the firm said the surplus versus the five-year average could double to more than 700 Bcf, implying a market that will be 4.6 Bcf/d looser than normal.

“If storage increases at this dramatic rate, it may match the 2018 annual peak of 3,247 Bcf by June,” EBW said. “While uncertainty remains high, any rapid storage increases of this nature are likely to put fall storage constraints in focus and potentially weigh on Nymex natural gas futures.”

Indeed, spread values for the balance (Bal) of 2020 continue to underscore bearish concerns in the market, according to Mobius Risk Group. The spread between November and December (13.4 cents as of Wednesday) and October and January (28.5 cents), the firm said, are representative of the concern that inventory constraints may arise before withdrawal season is squarely underway.

The ability for Bal 2020 prices, currently averaging $2.325, to strengthen toward the $2.50 mark or above will be highly contingent upon the crude production cuts promised by most oily public exploration and production companies and improved global liquefied natural gas (LNG) prices, according to Houston-based Mobius. The firm sees the most immediate driver to be crude production cuts, while any LNG pricing recovery could occur in mid-summer to late fall.

Indeed, Genscape Inc. said recent flow data already is pointing to a significant decline in Bakken production since mid-March. The “Flow Past Glenn Ullin Nominations,” which it says is a reliable indicator of Bakken production bound for Midwestern markets, has posted a roughly 700 MMcf/d decline in that time. The Northern border flow point includes nominations from gas plants and interconnects within the basin, according to Genscape.

“The largest drivers of the decline are from receipt points connected to Williston Basin Interstate pipeline and gas processing plants that feed directly into Northern Border,” Genscape analyst Matthew McDowell said.

These declines in receipts coincide both with stay-at-home orders issued in major demand markets as well as “frack holidays” and production cuts announced by Continental Resources Inc., Oasis Petroleum Corp. and others. Meanwhile, a sample of Chicago metro area demand is posting declines of roughly 250 MMcf/d in residential and commercial demand when compared to the prior three-year average, McDowell said.

Meanwhile, on the demand side, Genscape said its sample of U.S. industrial natural gas demand is down more than 12% year/year for the week ending April 25, continuing a decline beginning in late March due to the coronavirus. Total U.S. industrial demand last April averaged 22.4 Bcf/d, according to the EIA, implying a more than 2.5 Bcf/d reduction so far this April, according to Genscape.

“Demand is still near the five-year average; however, this is a bit misleading as U.S. industrial demand has grown considerably over the past five years,” Genscape analyst Dan Spangler said. Genscape’s sample of industrial demand has also increased to include a larger share of the total demand, as several large industrial users have come online that pull directly from interstate pipelines.

Looking at the data in more detail, the reductions in demand are not evenly spread across all sectors, according to Genscape. Big industrial demand sectors like metals and ethanol have dropped sharply as construction and automotive sectors slow — both for production and gasoline consumption.

Meanwhile, the nitrogen fertilizer industry has been relatively stable. “Nitrogen fertilizer producers use huge amounts of natural gas as a feedstock and have been one of the largest contributors to U.S. natural gas industrial demand growth over the past five years,” Spangler said.

As for LNG demand, more than 20 cargoes reportedly have been canceled for June, sending U.S. LNG export terminal utilization down by as much as 40%, according to Poten & Partners. Even worse, the firm sees cancellations extending through September and said globally, more are needed, probably to the tune of 30-40 cargoes per month through October.

Lackluster demand across the Lower 48 got the upper hand in cash trading Wednesday as even the coolest areas of the countries were expected to see only “light heating demand,” according to NatGasWeather.

The forecaster said a weather system was to continue tracking across the Midwest and East the next few days with showers, thunderstorms and highs in the 50s and 60s. Conditions were expected to remain hot across the Southwest, West Texas and the Southern Plains, with daytime highs forecast to reach the 90s and 100s for “early-season cooling.

“National demand would be more impressive this week if not for the South and Southeast being near ideal with highs of 70s to lower 80s,” NatGasWeather said.

Warmer conditions were in store this weekend from Chicago to New York City, sapping demand as highs climb into the upper 60s to 70s, according to the firm. Cooler air was to push back into the northern United States next week, however, the latest European model backed off on the amount of cooling. The crisper air is expected to push into the southern states next week to ease recent heat over Texas and the Southern Plains.

West Coast spot gas markets were a sea of red, with the exception of SoCal Citygate, which rose a half-cent to $1.860. Malin was down 10.5 cents to $1.555.

Similar losses were seen in the Rockies, while markets in Texas fell a dime or less day/day. Permian Basin pricing remained comfortably over $1.00.

Moderate losses also were seen in the Midwest, Midcontinent, Louisiana and across the Southeast. Henry Hub next-day gas fell 10.5 cents to $1.695.

On the East Coast, Transco Zone 6 NY cash lost 14.5 cents to hit $1.545.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2577-9966 |