E&P | Mexico | NGI All News Access | NGI The Weekly Gas Market Report

June Milestone for Mexico Offshore Rigs Only Tip of Iceberg, Says Consultant

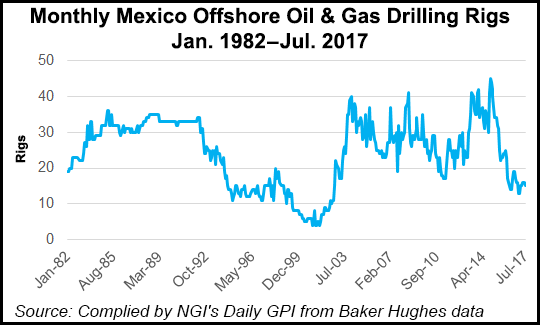

The number of active offshore exploration rigs in Mexico reached a 10-year high in June, but the upstream sector may be only just beginning to see the effects of the energy reforms.

There were 15.5 offshore exploration rigs, slightly under half of all active rigs in Mexico, operational during June, according to data from national hydrocarbons regulator CNH, which treats drillers that are active for the entire month as one full rig.

Among the offshore exploration rigs, 7.4 were run by exploration and production (E&P) companies, while the rest were held by Mexico’s state-run Petroleos Mexicanos (Pemex). Nearly all exploration activity in June was concentrated in the basins of southeastern Mexico, where many private operators signed E&P contracts in the country’s first licensing round.

“Right now we’re seeing a small increase, of which there is still more to come,” GMEC’s Gonzalo Monroy, managing director of the Mexico City-based consultancy, told NGI.

“Various companies that signed contracts last year in Round 1 are just starting their exploration plans,” he said. “Some have already submitted these plans for review and approval by CNH…I imagine they’re also negotiating the rates for the drilling rigs that they need. And based on all of that, we will start to see a gradual and sustained increase of exploration activity in Mexico.”

At the end of June, E&Ps in Mexico had drilled 36 wells and completed 42, according to CNH. The number of active rigs over the first six months averaged 27.2, a slight uptick from the full-year 2016 average of 26.5.

“Likely in the next year, year-and-a-half or possibly two years, we will see more projects — most of all those in deepwater areas — that are starting to drill,” Monroy said.

Activity in the Mexican upstream sector remains feeble compared to its most recent peak in 2009, when on average 179.2 rigs were running and 1,490 wells were drilled. At that time, international oil prices were pushing $100/bbl, and Pemex still retained its monopoly over the country’s hydrocarbons industry.

Since implementing energy reforms in 2013, the Mexican government has held seven auctions, awarding blocks for onshore, shallow water and deepwater areas. By government estimates, the contracts signed so far should raise $60 billion in investments.

The first licensing round, which involved four separate auctions, concluded in December 2016. Round 2 is still underway. The two most recent tenders held in mid-July, Rounds 2.2 and 2.3, awarded 21 of the 24 onshore areas on offer, dominated for the first time by natural gas-rich blocks. Mexican firm Jaguar E&P won six areas in partnership with Calgary-based Sun God and an additional five blocks on its own. The fourth and final auction of the second round, 2.4, is scheduled for January and is to offer 30 deepwater blocks.

Among the private operators currently drilling in Mexico, several have already made significant discoveries.

In July, a consortium led by Houston-based Talos Energy LLC announced a potential world-class find at its shallow water Zama-1 well, awarded in Mexico’s first auction. The discovery is estimated to contain 1.5-2 billion boe. Also in July, Italy’s Eni SpA, another early participant in the auctions, raised the resource estimate for its Amoca offshore field to 1 billion boe.

“There you see another real effect of the reforms,” Monroy said. “The way Pemex normally did things prior to the reforms, it would take approximately 12-18 months to get from the sanctioning of a project to its execution.”

By contrast, after the contracts were signed, it took Eni only six months and Talos seven months to drill their first wells, he said.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |