June Bidweek Sees Natgas Quotes Muddle Lower; California Braces for Summer Heat

Following the precipitous fall in March bidweek quotes, April and May bidweek managed healthy gains, with April rising 8 cents and May up 14 cents. The third time was not a charm, however, as the June NGI National Bidweek Average fell from May, albeit slightly, by 2 cents to $1.80, which also represents a 75-cent drop from the June 2015 bidweek average.

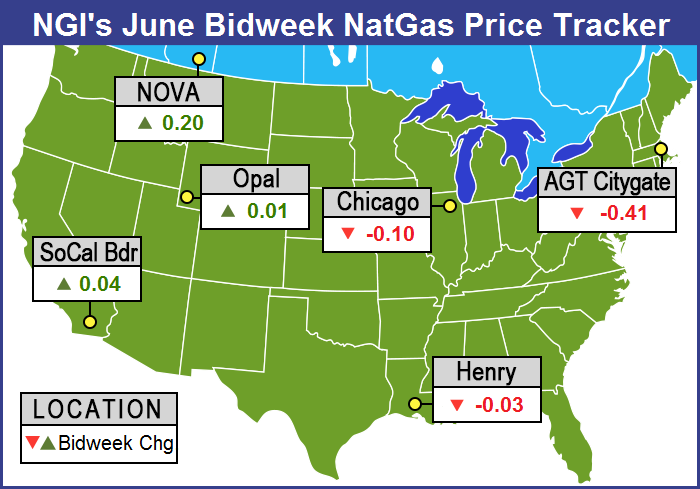

Most points came in a few pennies either side of unchanged, and the week’s biggest gainer turned out to be north of the U.S. border with NOVA/AECO C posting a C20-cent advance to C$1.31/Gj. Bidweek’s top loser was the Algonquin Citygate, down 41 cents to $2.11.

Regionally, the Midwest suffered the greatest setback dropping 8 cents to $1.93, while California increased the most, adding 2 cents to $1.96. East Texas bidweek quotes averaged a 4-cent loss to $1.88. Slightly ahead were South Texas and South Louisiana, each with a 3-cent drop to $1.91 and $1.90, respectively.

The Northeast came in a penny less at $1.57, the Midcontinent was unchanged at $1.82, and the Rocky Mountains added a penny to $1.74.

June futures went off of the board at $1.963, 3.2 cents less than the May contract settlement.

In the Midwest storage buying was in play this bidweek. “We are buying for injection right now, so we did buy a little bit, but not much,” said a Midwest municipal buyer. “We have quite a bit of RFP baseload gas and didn’t need too much.

“We have done some 30-year pre-purchases because we are a municipal buyer, and those volumes become pretty significant for us in the summer. We price it off our normal receipt point indexes,” he told NGI.

“We are shocked that spot prices are so high and haven’t seen enough electrical load to warrant that. We are assuming that electrical load in other locations is picking up.”

As bidweek drew to a close Tuesday following the extended holiday weekend, physical natural gas for Wednesday delivery bounded higher as outsized weather-driven gains in California provided sufficient lift for double-digit additions across all but a few eastern market points.

The NGI National Spot Gas Average for Wednesday delivery surged 22 cents to $1.96, but gains were directly impacted by the distance to California and the West Coast. California, on average, gained more than 40 cents, and Rocky Mountain points added a little more than 30 cents. The Northeast, by contrast, gained just over a dime.

Futures traders honed in on the first major heat episode of the season, and by the close had sent July futures up 11.9 cents to $2.288 and the August contract higher by 10.2 cents to $2.383.

The heat is expected to encompass the Pacific Northwest, as well as California. Analysts on top of the precarious Southern California power and gas market expect California demand to be higher as triple-digit temperatures are forecast.

“Prior to the long holiday weekend, the forecast was showing some heat moving into the West this week,” said EnergyGPS, a Portland, OR-based risk management and power consulting firm in a Tuesday report to clients. “As we gather ourselves for a new month, the forecast seems to be holding true as Sacramento is looking at triple digits most of the week, while Burbank will be getting warmer as we get deeper into the week.

“On the supply side, in-state wind has shifted down and will continue to stay low, while imports from other parts of the West will be hard to come by as their respective regions are warming up as well. This will push up on the overall implied heat rates and initiate more natural gas-fired generators to turn on to help balance the grid.”

Balancing the grid might not be much of a problem for now, but what happens if CAISO experiences loads similar to last year? According to CAISO, Tuesday’s peak load was a nominal 34,452 MW, but last year’s summer peak was 47,257 MW. CAISO is forecasting a peak 2016 summer load of 47,529 MW. The all-time record load of 50,270 MW was reached in July 2006.

Under normal circumstances, natural gas generation would be called upon as baseload but also in the form of peaking. What gas was needed beyond pipeline gas could be supplied by storage, but the state’s primary storage facility, Aliso Canyon, is greatly diminished (see Daily GPI, May 19).

“They still have 15 Bcf they can draw upon at Aliso,” said EnergyGPS principal Jeff Richter. “It’s not like it is off limits, they just can’t inject. You keep it for a ‘rainy’ day. You just can’t predict when you are going to need it and for how long. 15 Bcf can go a long way or not, depending on when it is, but my take is that the grid is longer this year versus last year [better supplied] and you will have more hydro and more solar capacity. I think they will manage it.

“This week is a good test. Load isn’t 49,000 MW, but I think they have had enough preparation to facilitate this thing. The one thing they don’t like is to inject gas [at Aliso Canyon]; they like to withdraw gas as long as they have it.”

Richter said on a hot day, requiring 49,000 MW gas demand will reach into the upper 4 Bcf/d range.

“On these days when demand is 4.7 Bcf/d you have to go to the well because you can only bring in 3.9 Bcf/d,” he said. “From a gas perspective, there may be some curtailments in the Los Angeles (LA) Basin, but that’s in real time [unexpected], not day ahead [forecast]. That would happen at noncore power plants where they just can’t get the gas. At the end of the day if you don’t get the gas to the power plant, you don’t get the power.

“I think there is enough scheduling capacity in the LA Basin, the question is, can you get it there as quickly as possible? A hot day would require about an extra .7 Bcf/d and with 15 Bcf at Aliso Canyon you have about 22 days.”

He suggested that there might be as big a problem if high demand is forecast but it doesn’t materialize in real time.

“Let’s say the load comes in lower than what you expected and you have all these units drawing the gas and you don’t need the gas. Where are you going to put it? You can’t put it in Aliso Canyon, and the PG&E system is mostly full. It’s the deviations from normal that cause the problems. Real time is a truth serum, and we are talking to clients every day about this.”

Weather forecasts call for triple-digit readings in Northern California well into the week. AccuWeather.com said Tuesday’s high of 100 in Sacramento is forecast to dip to 97 Wednesday and reach 98 on Thursday, well above the 84 degree seasonal norm. By the end of the week, temperatures were expected to push the mercury to 102.

Phoenix was forecast to see its normal triple-digit readings, with Tuesday’s 101 rising to 102 Wednesday and 106 Thursday, not far from the seasonal norm of 100. By Saturday, however, Phoenix is expected to see a high of 114.

Gas for delivery Wednesday at Malin gained 42 cents to $2.07, and deliveries to the PG&E Citygate vaulted 49 cents to $2.27. Gas at the SoCal Citygate changed hands 43 cents higher at $2.28, and gas priced at the SoCal Border Average was 41 cents higher at $2.10. Deliveries on El Paso S. Mainline/N. Baja gained a stout 41 cents to $2.09.

“Warmth will build and evolve into a heat wave across a significant part of the western United States this week,” AccuWeather.com meteorologists said. “The warmth will likely yield the hottest weather of the year so far into the weekend, especially interior locations. Record highs will likely be challenged across a widespread area.

“The impending heat will be a drastic change from what the Northwest has recently experienced,” meteorologist Jim Andrews said. Temperatures for “the last one to two weeks have been near- to below-normal.

“Seattle has not recorded a high above the 60s since May 13. Especially in the interior Northwest, we will be looking at record-challenging highs with 90s in the lower valleys and 80s in the higher valleys. Yakima, WA; Medford, OR; and Boise, ID, will even be near the century mark.”

Should demand increase substantially, it’s questionable as to whether producers could mobilize quickly enough to put rigs back to drilling. Rig activity is near an all time low, but shows signs of stabilizing. Last Friday Baker Hughes Inc. reported a net change of zero in the United States and the departure of one rig from Canadian activity (see Daily GPI,May 27).

DEVO Capital Management President Mike DeVooght isn’t ready to enter the market yet, but he feels it is primed for a realignment as funds and managed accounts jettison the short side.

The “nearby contracts settled lower on the week, while the deferreds were up,” DeVooght said. “We have seen this pattern over the past few months. The spot and cash market has been weak, while the deferreds have been steadily working higher, [and] part of the strength can be attributed to the buying in anticipation of a hot summer and partly by short-covering.

“The funds, that have been carrying a substantial short position for quite some time, seem to be throwing in the towel. It continues to be difficult to make a bullish fundamental case for natural gas, but we feel the gas market is ripe for a good old-fashioned short-covering rally. What will spark the rally is difficult to say. It could be a protracted heat wave or possibly the funds decide to get out of their short positions and get long. On a trading basis, we will continue to stand aside and await future developments.”

Tom Saal, vice president at FCStone Latin America LLC, in his work with Market Profile was expecting rangebound pricing for now. As Tuesday’s trading began he expected the market to test last week’s value area at $2.175 to $2.135.

Friday’s physical trading saw gas for the extended holiday weekend gain ground as traders elected to use pipeline and storage capacity for incremental purchases.

East Texas, South Louisiana and the Northeast led the gains, and the NGI National Spot Gas Average rose 7 cents to $1.74. Futures opened weak and seemed poised to trudge lower, but by mid-session, short-covering was able to lift prices into positive territory, if only temporarily. At the close July had added 1.8 cents to $2.169, after trading as low as $2.101, and August had risen 2.0 cents to $2.281.

“We saw a lot of things going on,” a Houston pipeline veteran said. “People were parking a lot of gas this weekend, and demand for that probably created a little uptick here and there. They will park it on the pipeline or in storage. You are buying for a four-day weekend and it does take a little wherewithal to figure that out.”

Traders Thursday not only had to juggle their bidweek deals, but also the weekly Energy Information Administration (EIA) storage report and the expiration of the June contract. Natural gas for Friday delivery moved little as traders, for the most part, got their deals done before the release of inventory figures.

Modest strength in the Midwest and Midcontinent was offset by weak pricing in California, and most points outside the Northeast traded within a few pennies of unchanged. The NGI National Spot gas average down a penny at $1.67. EIA reported a storage build of 71 Bcf, slightly greater than traders expectations, though well below historical averages.

Prices nonetheless slumped, and June went out like a lamb. At the close, June settled at $1.963, down 2.9 cents, and July had shed 3.0 cents to $2.151.

Hopes for ongoing advances in natural gas futures were dealt something of a setback as June couldn’t even muster a settlement better than the May contract’s $1.995.

The 71 Bcf was about 3 Bcf more than what traders were anticipating, and June futures dropped to a low of $1.914 shortly after the figures were released. By 10:45 a.m. last Thursday, June was trading at $1.935, down 5.7 cents from Wednesday’s settlement.

“I don’t think there is a strong intention to force [the market lower]. The market is just drifting with a lean towards the downside,” a New York floor trader told NGI.

“The 71 Bcf net injection for the week ended May 20 was slightly more than the consensus expectation but still supportive compared to the 97 Bcf five-year average for the date,” said Tim Evans of Citi Futures Perspective. “The data followed a bullish surprise in the prior week, suggesting that there may have been some temperature swings at the margin between the two periods. Overall, this could be a modest bearish correction to what had been signs that the background supply/demand balance was tightening.”

“We believe the storage report will be viewed as slightly negative,” said BMO Nesbitt Burns analyst Randy Ollenberger. “Storage remains at record levels, but the level of injections is below last year and points to a rebalancing over the course of the summer. We believe that U.S. working gas in storage could exit the summer season at five-year average levels, assuming normal weather.”

Inventories now stand at 2,825 Bcf and are a stout 756 Bcf higher than last year and 769 Bcf more than the five-year average. In the East Region 21 Bcf was injected, and the Midwest Region saw inventories increase by 23 Bcf. Stocks in the Mountain Region rose 5 Bcf, and the Pacific Region was higher by 5 Bcf as well. The South Central Region added 17 Bcf.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1258 | ISSN © 2577-9877 |