July NatGas Bidweek Bulls Relishing Near $1 Gains

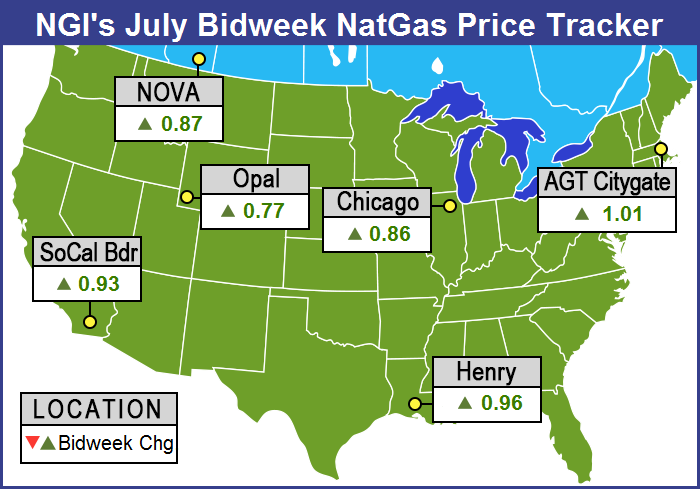

It may be too early to pop the champagne corks, but happier days look to be here again, at least for producers, as July bidweek indexes were up nearly $1 at many locations.

The NGI National Bidweek Average for July soared 86 cents from June bidweek to $2.66, and the range of increases ran from “only” a 55-cent bidweek advance at Tennessee Zone 4 Marcellus to $1.87, to a hefty $1.09 gain at PG&E Citygate to $3.14.

Major market centers put in solid advances of their own. Bidweek moves at Algonquin Citygate tallied $1.01 on light volume to $3.12 and Tetco M-3 Delivery rose 63 cents to $2.11.

Not to be outdone Gulf Coast trading points racked up some near $1 gains of their own. Gas on Transco Zone 4 rose 98 cents to $2.90, and gas at the Henry Hub jumped 96 cents to $2.92.

Bidweek gas in the Midwest changed hands sharply higher as well. Gas at the Chicago Citygate rose 86 cents to $2.80, and deliveries to Northern Natural Ventura added 83 cents to $2.71.

In order to better reflect ever-changing physical market dynamics NGI, as previously announced in a June 1 Price Notice, has added two new regions to the gas price index tables in its newsletters, along with two new price points. As of July 1, NGI has:

The surge in bidweek prices caught some traders by surprise. “Prices are a little high, but our basis isn’t too bad,” said a Michigan trader. “On Consumers it was a negative 0.0125, and Michcon was a negative 4 cents. We didn’t see that coming and it was a little bit of a surprise.”

The July futures surged 20.1 cents Tuesday to settle at a stout $2.917, largely on reports of an explosion and fire at a large gas plant bringing gas in from the Gulf of Mexico. Many Tuesday saw the loss of production from the Enterprise Partners Pascagoula, MS 400 MMcf/d gas processing plant as the day’s market driver. The plant sits astride the two major pipelines bringing gas from the Gulf of Mexico. “The loss of Destin and Discovery [pipeline] production will combine to leave the grid 0.846 Bcf shorter on the day compared to the 27th and 0.997 Bcf shorter compared to the 26th,” said EnergyGPS in a note to clients.

“The return date for both pipelines remains unknown. Destin has indicated they will attempt to moved offshore production onto the Viosca Knoll Gathering System as a means of circumventing the Pascagoula processing plant. The magnitude and uncertainty surrounding the decreased Gulf production drove the markets into a frenzy [Tuesday] with the July contract trading up 20 cents before expiration. It is unlikely that we will see much if any downward pressure on the natural gas price until this 1 Bcf of Gulf production returns.”

The near $1 surge in the July futures contract compared to the relatively mild expiration of the June contract ($1.963) also threw a number of basis relationships for July bidweek into new territory. Big jumps were noted at Marcellus points. Transco Leidy saw the basis widen from $-0.6225 June bidweek to $-0.9800, and Dominion South basis blew out to $-0.9450 from June’s $-0.5775. Basis on gas bound for New York City on Transco Zone 6 widened to $-0.5300 from $-0.4325 a month ago.

Analysts see a market ready to push through $3. “Although this market was unable to post fresh highs overnight, its ability to push above [Thursday’s] peak suggests a bull market that is very much alive and apt to realize a $3 price handle next week,” said Jim Ritterbusch of Ritterbusch and Associates in Friday morning comments to clients. “The short-term temperature views remain tilted bullish with above normal temperatures extended out toward end of month according to most forecasts. However, deviations from normal don’t appear appreciable across the northern half of the US and this is precluding strong upside follow through at the present time.

“Nonetheless, the cash market at Henry Hub appears well supported despite the fact that industrial demand will be downsized in conjunction with the upcoming three-day holiday period. This comparatively strong cash basis is likely to keep the front August-September switch inverted in providing a significant bullish portent in our opinion. Furthermore, this market may still need to price in another sharply downsized 40-50 injection in next week’s EIA [Energy Information Administration] report as a result of this week’s warm temperatures and disrupted supply out of a major gas processing plant.”

Other traders aren’t so sure that a $3 print is so easily attainable. “I thought the market held up pretty well,” said a New York floor trader Thursday. “It has a shot at $3, but that is a tough, tough area. Did you see what happened in the crude oil? As soon as it hit $50 it came off 18 cents; $50 was such a benchmark for crude oil and that is the way traders are going to look at $3 natural gas.”

In the physical market, gas for delivery Friday slumped in Thursday’s trading as a strong performance by Northeast points was unable to offset declines in the Gulf Coast, Texas, California and the Rockies.

The NGI National Spot Gas Average shed 9 cents to $2.61, but many traders elected to get their deals done prior to the release of storage data by EIA.

EIA reported a storage build of 37 Bcf, lower by about 9 Bcf from market expectations. The figure, however, included a 5 Bcf downward inventory revision, thus making the implied flow 42 Bcf. That was good enough for market bulls, and at the end of trading the August contract had marched higher by 6.1 cents to $2.924 and September was higher by $0.060 to $2.918. August crude oil tumbled $1.55 to $48.33/bbl.

“The storage number was low, but I think it will take a lot more of these low builds to push the market through $3. Look for the market to slow down as we are heading into a long weekend.”

Traders didn’t blink at the 5 Bcf adjustment in the Pacific Region, which was likely due to an adjustment posted by SoCalGas on its website Monday (June 20) and picked up in the storage report for the week ended June 24.

“SoCal announced on May 26 they would be adjusting system inventory down by 4.62 Bcf due to adjustments applicable to Aliso Canyon storage. However, the change was not actually reported on the SoCal website until this Monday,” industry consultant Genscape said in a report (see Daily GPI.

“The number came out 37 Bcf, and we were looking for 46 Bcf,” said a New York floor trader. “We were trading $2.89 to $2.90 before the number came out so we retraced back to where we were.”

Even with the adjustment traders saw the report as supportive. “The DOE reported a 37 Bcf net increase in US natural gas storage for the week ended June 24, but the data did include a 5 Bcf reclassification of working gas as base gase,” Tim Evans of Citi Futures Perspective said. ” The implied flow was therefore a somewhat less bullish 42 Bcf. Even so, this was less than the 46 Bcf consensus expectation and implied a tighter supply-demand balance, a bullish outcome.”

Inventories now stand at 3,140 Bcf and are 582 Bcf greater than last year and 637 Bcf more than the five-year average. In the East Region 20 Bcf was injected, and the Midwest Region saw inventories increase by 18 Bcf . Stocks in the Mountain Region rose 4 Bcf, and the Pacific Region was lower by 3 Bcf. The South Central Region shed 2 Bcf.

In physical market trading California points were the hardest hit as power loads were forecast to take a big dive, and temperatures were expected to trend lower. CAISO forecast that peak power load Thursday would drop from 40,081 MW to 38,686 MW Friday.

Gas atMalin skidded 14 cents to $2.68, and deliveries toPG&E Citygate were unchanged at $3.26. Gas at theSoCal Citygate changed hands 36 cents lower at $2.92, and packages priced at theSoCal Border Avg. Average were quoted 28 cents lower at $2.82.Kern Delivery gas came in down 27 cents at $2.84.

AccuWeather.com predicted that the Thursday high in Los Angeles of 82 would slide to 79 Friday and 77 Saturday, 4 degrees below normal. San Francisco’s 71 high Thursday was expected to ease to 69 Friday and 67 by Saturday, right at the seasonal average.

Major market hubs fell into the red. Gas onDominion South fell 20 cents to $1.59, and deliveries to theHenry Hub were quoted 3 cents lower at $2.90. Gas at theChicago Citygate fell 6 cents to $2.80, and gas onEl Paso Permian gave up 13 cents to $2.68.

Weather forecasts overnight changed little with expectations of a broad ridge of high pressure and anticipated warm temperatures expected to persist with minor incursions of weather systems forecast to temporarily drop temperatures and knock natural gas demand back to normal. It’s the coming week when things are expected to heat up, literally.

In a noon Wednesday update, Natgasweather.com said that “as the strong ridge of hot high pressure over the West strengthens and expands over the northern and eastern U.S. next week, above-normal temperatures of upper 80s to 100s are expected to become widespread over a majority of the country. This will result in stronger than normal natgas demand and should keep warm/red/bullish colors over vast stretches of the country in eight-15 day outlook maps, although with subtle daily changes that could switch some areas briefly to neutral/normal.

“Going forward, the next weather focus for the natgas markets will be on just how long hotter than normal conditions can last over the northern and eastern U.S. We expect the strong upper ridge to hold over a majority of the country going into mid-July. However, there could be a couple days of minor cooling over the northeastern U.S. around July 10th that will need monitoring.”

After the close of trading Wednesday traders saw the market poised to break through $3, possibly on the release of presumably bullish storage figures in the 10:30 a.m. EDT storage report. “The base the market has built has held and traders were able to lift it higher. I think they will pop it over $3,” a New York floor trader told NGI.

Last year 73 Bcf was injected and the five-year pace stands at 78 Bcf. Houston-based IAF Advisors calculates a lean 37 Bcf injection, and industry consultant Bentek Energy’s flow model sees a 44 Bcf increase. A Reuters poll of 21 traders and analysts revealed an average 46 Bcf with a range of 37 to 54 Bcf.

Traders Monday were surprised to learn of Britain’s vote to exit the European Union and were uncertain as to its impact on the domestic natural gas landscape. July natural gas fell 3.6 cents to $2.662 and August skidded 4.3 cents to $2.694. August crude,however, oil tumbled $2.47 to $47.64/bbl, as a rising dollar instigated by “Brexit” crushed crude oil and refined products prices.

Longer-term impacts of Brexit relative to the natural gas market are unclear, but short-term crude oil and products are expected to bear most of the market blows as a rising dollar is a big negative for commodities priced in dollars (seerelated story). Evans anticipates “price battles” ahead, and thinks “Brent will have difficulty regaining the $50 level now.” U.S. natural gas, however, “will trade in its own world, with little if any connection with the Brexit drama,” he added.

Future prices of U.S. liquefied natural gas will likely be more costly and less competitive. The Dollar Index surged 2.28% to 95.66.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1258 | ISSN © 2577-9877 |