NGI All News Access | Infrastructure | LNG

Jordan Cove LNG Export Project Still on Track, CEO Says

It is not a matter of if, but when, the now-stalled Jordan Cove liquefied natural gas (LNG) export project gets on track at FERC, the CEO in charge of the project for Calgary-based Veresen Inc. told an investor day audience in Toronto on Tuesday.

Elizabeth (Betsy) Spomer, CEO of Jordan Cove, said Veresen expected to hear from U.S. regulators by the end of this year on its request for rehearing of a denial of its LNG project application earlier this year (see Daily GPI, March 14). The motion for rehearing currently is on hold (see Daily GPI, May 10).

Spomer said there is no statutory time limit for FERC to act, but she is confident action is coming.

“We know that Jordan Cove is competitive on a delivered basis with Gulf of Mexico brownfield projects and that we are right-sized for current [global] market conditions. We have term sheets for 50% of the throughput, so I can’t say when, but I know this project will happen,” Spomer said.

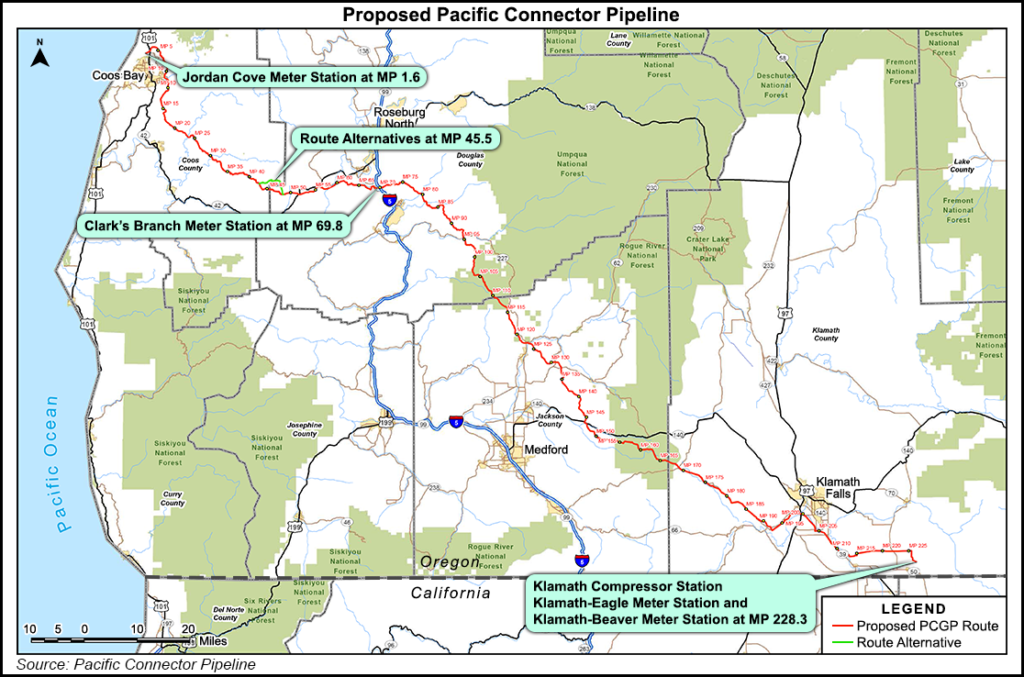

The FERC denial in March centered on the connecting 232-mile, 36-inch diameter Pacific Connector transmission pipeline for bringing gas to the proposed export facility. Veresen has since filed agreements representing 77% of the pipeline’s capacity. Prior to the denial, the Jordan Cove environmental assessment had absolutely no “show stoppers,” said Spomer, noting that added to the surprise of the denial.

At the state level, she said the project continues to make progress. “The state of Oregon has been good as gold in giving us a fair opportunity; we got our air permits last summer, and we continue to make progress on other permits,” Spomer said. All local county land-use permits are in hand, too.

Spomer said Veresen continues to emphasize its advantages over other U.S. exporters to the Far East with shipments to Tokyo taking just nine days, unlike the Gulf of Mexico projects that must negotiate the Panama Canal and face hurricanes for part of the year.

While she acknowledged that there is currently an LNG supply glut globally, Spomer said in Southeast Asia, energy demand is expected to grow at a compound annual rate of 16% between 2016 and 2030.

“Southeast Asia demand is not only GDP growth and urbanization, it also is triggered by declines in domestic gas production and pipeline supplies,” Spomer said, citing places such as Singapore, Indonesia, Pakistan, Vietnam, Thailand, Malaysia and Bangladesh as all facing domestic supply and pipeline declines. “This factor is important because in each of these markets natural gas infrastructure is already in place.”

Spomer said the barriers to market entry for LNG shipments have come down significantly in recent years. “Thailand doubled its LNG consumption last year to nearly 3 million metric tonnes per annum,* and Indonesia is expected to be a net LNG importer by 2023,” she said.

Globally, an important issue to watch is the need to reposition LNG from a “premium fuel ” ($18 MMBtu) to a fuel that can compete on a “baseload cost basis,” Spomer said. “We think that U.S. LNG exports are an important enabler to this.” She predicted that the United States will continue to push liquefaction costs lower.

“The U.S. LNG exports, if not the lowest, are clearly in the lowest priced quartile of delivered cost globally,” she said.

*Correction: In the original article NGI misquoted Jordan Cove CEO Elizabeth Spomer as saying Thailand doubled its LNG production last year. Spomer actually said Thailand doubled its LNG consumption last year to nearly 3 million metric tonnes per annum. NGI regrets the error.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |