Shale Daily | E&P | NGI All News Access

Jones Energy Beefs Up Midcontinent Operations With $136.5M STACK/SCOOP Acquisition

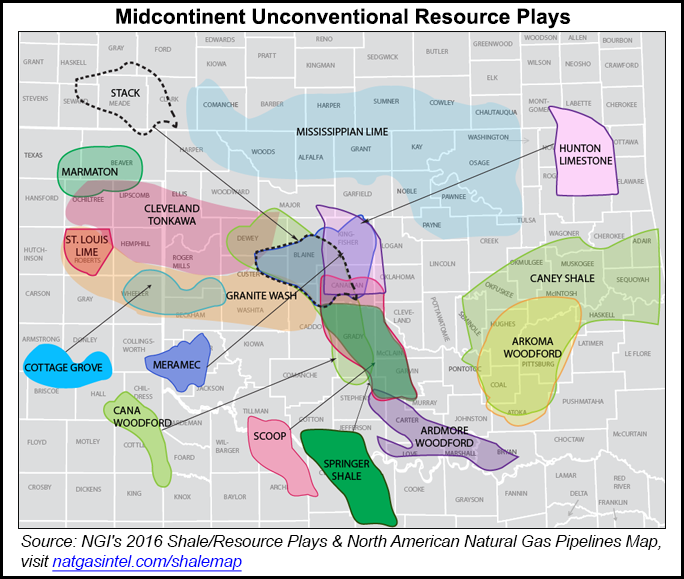

Jones Energy Inc. will pay $136.5 million to SCOOP Energy LLC for approximately 18,000 net acres primarily in southern Canadian and northern Grady counties in Oklahoma, the Austin-based independent oil and natural gas company said Thursday.

“This transformative transaction gives Jones Energy a scalable footprint in one of the most coveted resource plays in the U.S.,” said Jones Energy CEO Jonny Jones. “We identified this area as a primary target for Jones over a year ago and are thrilled to be acquiring assets in the heart of the STACK/SCOOP play. The acreage we are acquiring is highly operated, which puts us in a solid position to create value through our best-in-class Midcontinent operations.

“We truly believe that our acreage has the best attributes of both the STACK and the SCOOP plays based on our in-depth geological analysis. Recent well results on our footprint are on par with the best in the play.”

Approximately 70% of the acreage is operated with an average working interest of approximately 50%, and a majority of the acreage is in the oil window. The deal is expected to close by the end of September, the company said.

Jones Energy intends to fund the acquisition with net proceeds of 14 million shares of Class A common stock and 1 million shares of Series A Perpetual Convertible Preferred Stock for public offering announced Thursday. David Tameron, senior oil/gas exploration and production analyst at Wells Fargo Securities, said he expects total proceeds of the equity issuance to be $108 million.

“We now model Jones picking up one rig in STACK/SCOOP at the beginning of 2017, with potential to add another later toward year-end,” Tameron said in a note. “…While there hasn’t been significant drilling in the area, their acreage is sandwiched between very active areas (North: Cimarex, Newfield, Devon and South: Continental, Newfield). However, there have been a handful of recent horizontal wells and management believes this is an emerging area.”

For more on the STACK, SCOOP and other North American oil and gas plays, see NGI’s North American Shale & Resource Plays 2016 Factbook.

Earlier this month, Jones Energy said it would pay $27.1 million to an undisclosed seller for 26,000 net acres in Lipscomb and Ochiltree counties in the Texas Panhandle in the Anadarko Basin. That deal was expected to add 92 gross (68 net) Cleveland locations in the company’s core footprint. The acreage “is 98% held-by-production and will improve our overall Cleveland inventory by adding 1.5 years of drilling inventory at a three-rig pace,” Jones said at the time.

Jones Energy recently reported 2Q2016 average daily net production of 18.6 MBoe/d, with oil production of 4.4 MBbl/d, and raised its 2016 production guidance to 17.9-19.4 MBoe/d.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |