Jonah Energy Pads Gas-Rich Wyoming Portfolio in $581.5M Deal With Linn

Jonah Energy LLC, named after the company’s first acquisition in the gassy Jonah field in Sublette County, WY, is snapping up more acreage in its namesake field and in the Pinedale Anticline through a $581.5 million transaction with Linn Energy Inc.

The privately held exploration and production (E&P) company, formed in 2014, paid Encana Corp. $1.8 billion for its first Jonah properties. Now considered one of the largest privately held U.S. gas producers, the operator is backed by an investor group led by TPG Capital LLC and includes EIG Global Energy Partners and management.

The Linn sale, set to be completed by the end of June, would add 27,500 total net acres to Jonah Energy’s arsenal, including 16,000 in the Jonah and Pinedale fields. First quarter production was estimated by Linn at 129 MMcfe/d net; proved reserves are estimated at 384 Bcfe.

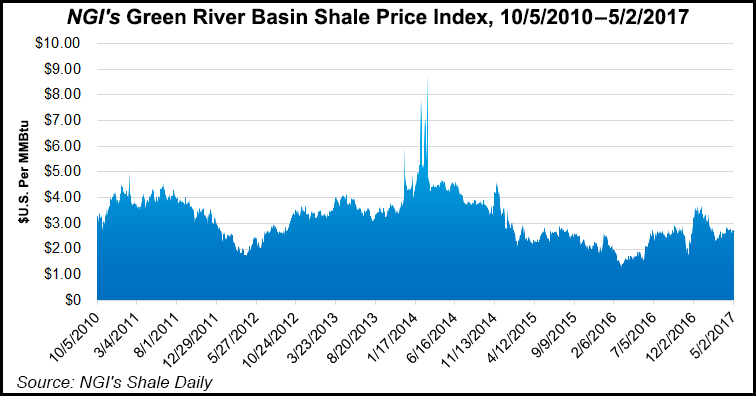

Production in the Green River Basin is dominated by natural gas and natural gas liquids from tight sands formations, primarily the Pinedale Anticline and the Jonah field in Sublette County, and the Wamsutter field in eastern Sweetwater County. In 2009, the U.S. Energy Information Administration pegged the Pinedale Anticline and Jonah field as the third and seventh largest U.S. natural gas fields as measured by proved reserves, respectively. The Wamsutter field was 39th.

Houston-based Linn, a storied gas-heavy operator that in 2006 became the first publicly traded E&P master limited partnership (MLP), fell on hard times during the downturn, emerged from voluntary bankruptcy in February as a reorganized, “traditional” E&P. It now trades on the OTCQB market.

“This sale allows us to significantly reduce leverage and improve financial flexibility,” said Linn CEO Mark E. Ellis. “We are aggressively pursuing higher return opportunities” across Oklahoma’s varied stacked reservoirs, where it is increasing rig activity and building out a midstream business.

“In addition, we are pursuing other emerging horizontal plays in the Midcontinent, Rockies, North Louisiana and East Texas,” Ellis said.

Linn had forecast full-year unleveraged cash flow from the Wyoming properties would be about $60 million. For the second half of 2017, Linn had budgeted $16 million for capital development. The funds are to be redeployed for growth projects and to further delever the balance sheet.

“This sale also marks the first step of transitioning Linn from a conventional production-based MLP to a streamlined growth-oriented enterprise,” Chairman Evan Lederman said. “The board will continue to work hand-in-hand with management to execute on a value maximizing and transformative business plan.

“This plan includes continuing the previously announced sale of noncore assets, accelerating investment in key horizontal growth plays and focusing on our overall cost structure to become a best-in-class low cost operator.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |