Regulatory | Infrastructure | Markets | NGI All News Access | NGI The Weekly Gas Market Report

Inside Cenagas: The Creation of Mexico’s Natural Gas Network

Two years since the formation of Cenagas, Mexico’s natural gas pipeline system operator, Cenagas Director General David Madero sat down with political scientist and NGI correspondent Dwight Dyer to talk about what’s ahead for infrastructure as the country’s natural gas market evolution unfolds.

Part one of a three-part series

Pipelines are integral to the evolution of Mexico’s natural gas market — those that are already in the ground and those yet to be constructed. Two-year-old pipeline operator Centro Nacional de Control del Gas Natural (Cenagas) is the overseer of the emerging interconnected grid.

State-run Petróleos Mexicanos’ (Pemex) former Gas and Basic Petrochemicals subsidiary’s natural gas pipeline assets have been transferred to Cenagas, and Cenagas is weaning itself from reliance on Pemex for expertise in their oversight. As this evolves, there will likely be opportunities for outside contractors to provide services to Cenagas. And the agency will be developing rules to ensure pipeline safety and open access — on its own pipelines and those of others.

“…[T]he [pipeline] infrastructure brought with it diverse rights and obligations and signed contracts…” Cenagas Director General David Madero told NGI recently. “We signed eight service contracts with Pemex, one very large one for operations and maintenance, and seven others for administrative services, ranging from finances and treasury matters to regulatory compliance…”

Over the last eight months, Cenagas has gradually ended the administrative services contracts with Pemex as it has developed its own capabilities and staff in those areas. The termination of other services contracts between Cenagas and Pemex is expected in the coming months, Madero said, as Cenagas becomes increasingly involved with operations and maintenance of existing pipelines.

“I can tell you that, today, termination dates for all service contracts, except for operations and maintenance and physical security, have been announced, ahead of schedule,” Madero said. “We have increasingly become involved with operations and maintenance, supervising the contract with Pemex’s field services.”

When fully up and running, Cenagas will play a different role in Mexico’s natural gas market than the one historically played by Pemex in its operation of the country’s natural gas pipelines.

To see NGI’s full exclusive interview with Madero, download the Inside Cenagas Special Report.

“We are both a transportation company like any other, and technical operator, with duties defined by legislation, for both our own pipelines, but also for third-party ducts that are incorporated into the national system,” Madero said. “Thus, we have to develop capabilities alongside regulators to define the rules, so that Cenagas as technical operator can add value to the Mexican natural gas sector.”

However, the ongoing separation from Pemex will be a gradual one, with completion expected in 2018, Madero said. Still active are contracts with Pemex for field services, which includes routine pipeline maintenance as well as corrective work on pipelines and compressor stations. Severing ties with Pemex in this area will take some analysis beforehand.

“We want Cenagas to be a company with a broad range of service suppliers, so for field operations and maintenance, we need to evaluate how many Cenagas employees [are needed] and how many from third parties [are needed] to service the infrastructure,” Madero said.

“…[T]he [Cenagas] executive board is currently studying our options, to decide how fast and when we will proceed. The rest will still be serviced by Pemex, though the plan is for a complete separation, unless Pemex can and is interested in providing these services.”

The business opportunities of Mexico’s developing pipeline grid have drawn a number of companies to the country, from the United States, Canada and elsewhere. Sempra Energy’s Mexico division, IENova, has been particularly active in bidding on and winning contracts for pipeline construction. TransCanada Corp. is another that has been active and successful in Mexico (see Daily GPI, June 13). European operators have a presence, too, and there are Mexican companies as well.

“We have strong relationships with all of them,” Madero said. “And with some of the U.S. operators, we have certain obligations as the technical administrator to make sure we can be the supplier of last resort of natural gas in Mexico. Therefore, we are engaged with U.S. transporters that are interconnected with Mexico, in case we need to sign contracts with them.”

STARTING FROM SCRATCH

When Cenagas was created in 2014, the operator did not have a budget. The federal government allocated a budget the following year, but still there was no income.

“We spent about half our budget to begin setting up operations,” Madero said. “Since Jan. 1, 2016, we started collecting fees from the national natural gas network and the Naco-Hermosillo network, and we have started paying all the transporters that are working within our system. We are also paying for the LNG [liquefied natural gas] balancing imports.

“We have been able to record income, a positive financial balance, starting in the first quarter of 2016. For the second quarter, we have profits, and we are certain that we will have profits by the end of the year. Our profits are a bit tricky because we have not yet done investments in physical assets, so, when we do, we will record outlays, but we are certain Cenagas will be able to pay dividends to its shareholder, which is the federal government.”

While Cenagas runs the pipeline network, it is Mexico’s Energy Secretariat (Sener) that is responsible for system planning. Sener works from a proposal by Cenagas, which must also have the blessing of the Comision Reguladora de Energia (CRE).

“Therefore, we work very closely with CRE to determine the needs to expand the infrastructure,” Madero said. “The first five-year plan was completed, taking into account the pipelines included in the federal government’s National Infrastructure Plan, issued at the beginning of the [Peña Nieto] administration.

“Cenagas’ technical role focuses, together with CRE, on evaluating how demand for natural gas will grow in the next five years and where, geographically, that demand will be located. With that assessment of natural gas demand growth, we can compare the pipelines that are operating now with the ones that are under construction, assuming these last are completed and start operating within a rational timeframe. Thus, we have a finite transportation capacity and a growing demand for gas across the country. So as demand starts to reach the installed transportation capacity, a ”yellow light’ turns on. Eventually, if demand is greater than supply, ”red lights’ will go on.”

Managing pipeline capacity is largely a physics and hydraulics problem, Madero said. On the demand side it is necessary to rely upon projections for the needs of industrial concerns, power generators, natural gas distributors as well as the country’s oil sector.

“Our role is determining aggregate demand, checking with CRE whether our assumptions are rational, whether our flow simulations are correct. So the only way to turn a yellow light green is to add infrastructure,” Madero said.

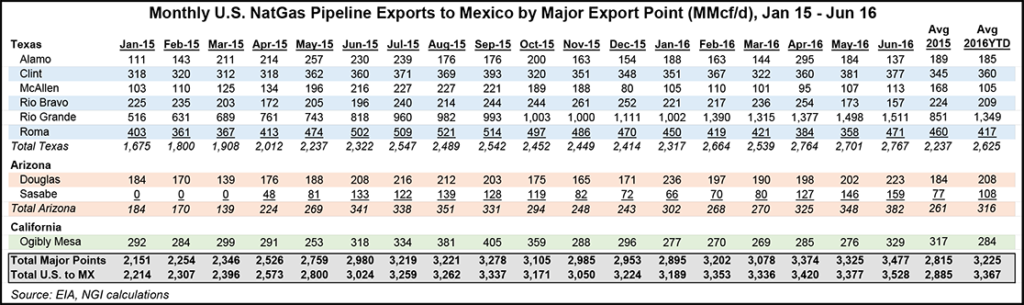

“If you compare the original five-year plan and the first revision [see Daily GPI,July 27], you can see we have identified a need to import more gas because domestic production is going through a difficult period. Then we need to have capacity to transport gas from the north to the center of the country. Also from the east to the west, since our traditional production zones are in the Gulf of Mexico and we need to supply areas like Guadalajara (Jalisco state), Aguascalientes (Aguascalientes state) and the BajÃo region (Guanajuato and Querétaro states).

“So what we have done in the first five-year plan is to create new north-south transportation corridors, create many new importation points, and many new east-west corridors. Lastly, some projects to deliver gas to areas with new demand, the so-called ”social projects’ along the Chiapas and Guerrero coastlines, for example.

“This is what we are contributing to the plan, but in the end, Sener is responsible for making the decisions. We work closely with CRE and Sener so that when our executive board approves a plan, it is something that Sener will agree to.”

“For instance, it is Sener’s responsibility to determine whether a pipeline previously proposed by the government is no longer strategic. Sometimes a privately developed project might supplant the need for the original project. Sometimes a project can be privately developed instead.”

For an update on Mexico’s rapidly evolving natural gas market, check out NGI‘s Special Report titled Mexico: A Whole New Natural Gas Market Opening Close to Home.

Madero graduated from the Instituto Tecnológico Autónomo de México with a master’s degree in economics and holds a doctorate in economics from the University of California, Los Angeles. He has more than 20 years of federal government experience and was appointed to his post at Cenagas in August 2014. While working at the Ministry of Energy, he oversaw oil/natural gas activities in the upstream, midstream and downstream sectors.

Dyer holds a doctorate in political science from UC, Berkeley. He has worked for the Mexican government and currently is an independent consultant on political and security risks related to Mexico’s energy sector reform.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |