NGI The Weekly Gas Market Report | Infrastructure | NGI All News Access

IEnova’s Marine NatGas Pipeline Startup Near but Guaymas-El Oro Still Stalled

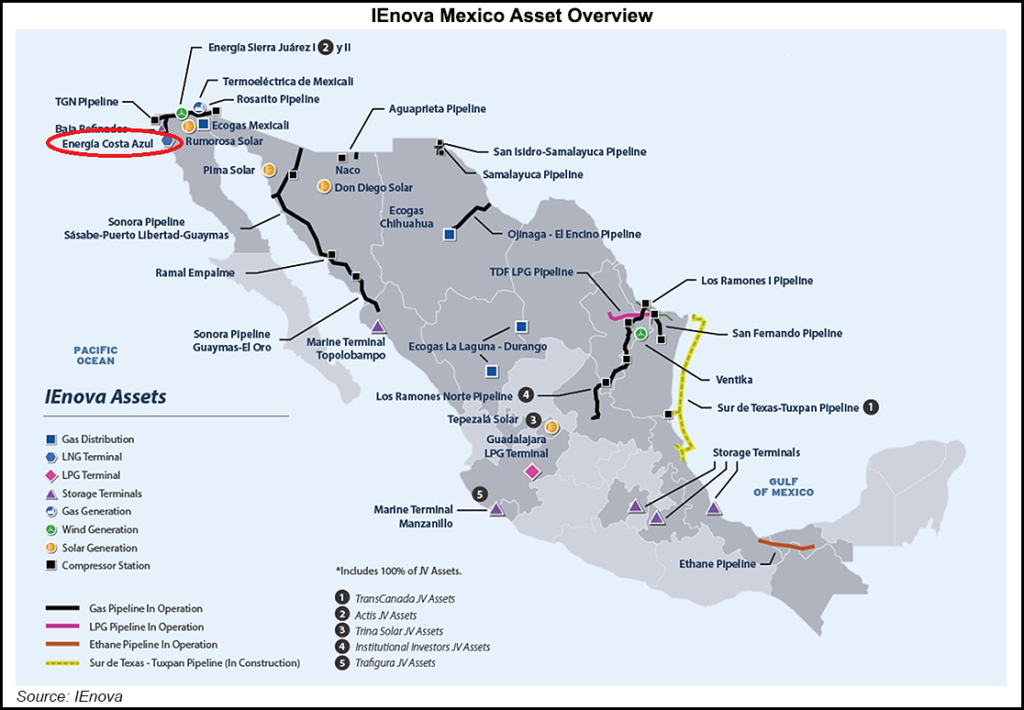

Infraestructura Energética Nova (IEnova), Sempra Energy’s Mexico subsidiary, said Tuesday the 2.6 Bcf/d Sur de Texas-Tuxpan marine pipeline should be online “in a few weeks,” in time for the Mexican summer when natural gas demand traditionally peaks.

“We’re in preconditioning and commissioning,” CEO Tania Ortiz said during a call to discuss quarterly results. “We should be calling for gas in the next couple of weeks to do our testing and line-packing. So, we are in the final few weeks of finishing the project.”

The $2.1 billion underwater pipe, a joint venture with TransCanada Corp., stretches nearly 500 miles through the Gulf of Mexico from the tip of Texas in Brownsville to the Tuxpan port in Veracruz state. It has been delayed for several months by bad weather, with offshore tie-ins still pending, IEnova said.

When the delayed pipe is running it can count on a 500 MMcf/d interconnection to the main Sistrangas network, meaning immediate market access to receive imported U.S. gas. The Cempoala compressor station has also completed the initial phase of its reconfiguration, allowing for U.S. gas to reach gas-deprived Southeast Mexico.

The 510 MMcf/d Guaymas-El Oro pipeline, the downstream segment of IEnova’s Sonora pipeline in western Mexico, however remains in force majeure as conflicts with Yaqui indigenous communities continue.

“We have always had a good relationship with the Mexican government,” Chairman Carlos Ruiz Sacristan said during the call. “We remain fully committed to being a responsible partner. We are engaged in an ongoing discussion with the government in relation to solving the force majeure of the second segment of the Sonora pipeline. Resolving the issue continues to be a high priority for both IEnova and the government.”

The Sonora pipeline receives gas imports from Sierrita Pipeline at Sasabe in Arizona. This segment of the pipeline has been shut since August 2017.

“There are a lot of meetings in Sonora to try to find a solution,” Ruiz added. “We hope to obtain results in the short term.”

The company also announced that it expects to make a final investment decision this year on its EnergÃa Costa Azul (ECA) liquefaction project on Mexico’s Pacific coast after securing two approvals from the U.S. Department of Energy. The authorizations allow Sempra to export U.S. produced natural gas to Mexico, and to then re-export liquified natural gas (LNG) from Mexico globally.

The two-phase ECA liquefaction project, a joint venture between Sempra LNG and IEnova, would be built adjacent to Sempra’s existing ECA LNG receipt terminal near the city of Ensenada.

“This is an important step in the development of the project,” Ortiz said. “We are working toward receiving all the major permits…and executing the ECP contract and finalizing commercial agreements to make a final investment decision by year-end.”

In the first quarter, IEonva posted profit of $101 million (7 cents/share), down from $128 million (8 cents) in the same period of 2018, mainly because of noncash exchange rate effects.

In other news, Mexico’s government released its National Development Plan 2019-2024 on Tuesday in which it outlines major goals for the administration of Andrés Manuel López Obrador. Read it here, in Spanish.

The document criticizes the energy reform of the previous government, saying it “caused grave damage” to state companies Petróleos Mexicanos (Pemex) and the Comisión Federal de Electricidad (CFE). An important strategic goal of the current administration is to “rescue” the two companies. The government plans to provide “extraordinary” resources to both state firms and revise their tax burdens.

The government also wants to focus efforts on upgrading existing refineries, constructing another refinery, and modernizing power plants, in particular hydroelectric facilities.

The document said the government would respect all existing contracts with private sector companies, provided they were not obtained by corrupt practices.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2577-9966 | ISSN © 1532-1266 |