NGI The Weekly Gas Market Report | Markets | NGI All News Access

IEnova to Make FID on Mexico LNG Project in Coming Month

Infraestructura Energética Nova (IEnova), the Mexican unit of San Diego-based Sempra Energy, plans to make a final investment decision (FID) on the Energía Costa Azul (ECA) liquefaction project in Baja California before the end of March, company officials said during a quarterly conference call Thursday.

Last year, ECA received U.S. Department of Energy authorizations allowing Sempra to export U.S.-produced natural gas to Mexico and then re-export it globally. The project still requires an export permit from the Mexican government.

“We are very close to being able to execute an EPC agreement and are making a lot of progress with our customers as well as the associated equity contract,” IEnova CEO Tania Ortiz said. “And of course, [we are] working very closely with the Mexican government to obtain the export permit.”

Ortiz said regulatory agencies since President Andres Manuel Lopez Obrador has been in office have seen budgets slashed. Regulators are undergoing a learning process, leading to delays in some areas, such as permitting approval, but projects are still going ahead.

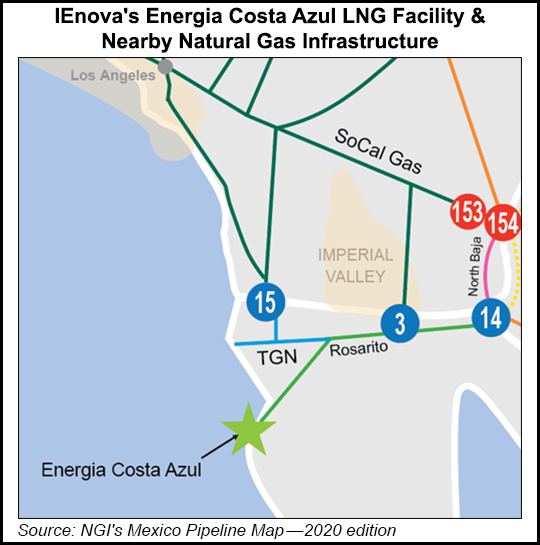

The two-phase ECA liquefaction project, a joint venture between IEnova and Sempra LNG, would be built adjacent to Sempra’s existing ECA LNG receipt terminal near the city of Ensenada.

In late 2018, ECA signed heads of agreement (HOA) with Total SA, Mitsui & Co. Ltd. and Tokyo Gas Co. Ltd. to take capacity from Phase 1 of the proposed project. The three companies each potentially could purchase 0.8 million metric tons/year (mmty) from Phase 1.

Both Ortiz and Executive Chairman Carlos Ruiz were bullish on the project despite the current global glut in LNG supply and historically low gas prices.

“We are 100% committed and we think this is going to move forward,” Ruiz said. “We are working with our three clients…The government knows the project and the benefits of it, and we are in the last stages to get the permit. It has been a lot of work. This is a fantastic sign and chance to bring gas to Asia, and we are in the last mile.”

ECA isn’t the only Mexico export project looking to use U.S. gas to feed exports to Asian markets. In January, developer Mexico Pacific Ltd. LLC brought on former Cheniere Energy Inc. executive Douglas Shanda to be CEO in an apparent attempt to expedite the planned 12 mmty Puerto Libertad project.

The Mexico projects, which are seen as advantageous because vessels can reach Asian markets without having to traverse the Panama Canal, are in line with longer term forecasts of increasing global demand for LNG.

In the fourth annual LNG outlook published Thursday, Royal Dutch Shell plc executives said that by 2040 global LNG demand is forecast to double to 700 mmt as gas plays an ever increasing role in the energy transition to lower carbon fuels and renewables. Last year consumption grew by a record 12.5% to 359 mmt, bolstering the role of gas in what Shell executives said would be a decades-long transition.

IEnova’s 510 MMcf/d Guaymas-El Oro pipeline remains in force majeure as conflicts with Yaqui indigenous communities continue, company officials said. Because of the interruption, IEnova had been receiving regular capacity payments from anchor customer Comision Federal de Electricidad (CFE) until last August, when pipeline agreements between private developers and Mexico’s government were renegotiated.

Ortiz did not provide a timeline for the pipe’s return to commercial operations, but said in the call that dialogue with the government has been constructive and ongoing. “We have extended the suspension agreement with CFE until mid-May, and while the process has taken time, we are moving in the right direction.”

IEnova reported profit of $144 million (9 cents/share) in the fourth quarter, compared with $89 million (6 cents) in the same period of 2018, driven mainly by the startup of the Sur de Texas-Tuxpan pipeline. Profit for 2019 was $468 million (31 cents), up from $430 million (28 cents) in 2018.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2577-9966 | ISSN © 1532-1266 |