LNG | LNG Insight | NGI All News Access

IEnova ‘Confident’ in ECA LNG Project Progress Despite Coronavirus Challenges

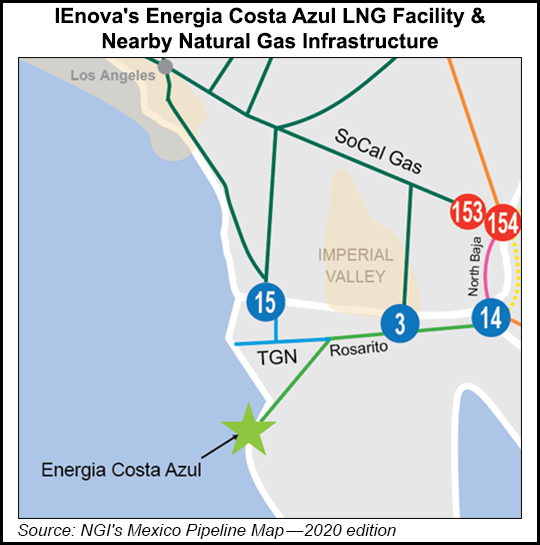

The Energía Costa Azul (ECA) natural gas export project in Mexico’s Baja California is still waiting on an export approval, Infraestructura Energética Nova (IEnova) executives said Thursday.

During a second quarter earnings call, the commitment to the project was reiterated, but there was no fixed date set for when the company expected the export permit from the Mexican government, the only missing piece from a final investment decision.

“I would say I feel fairly confident in the progress we are making,” CEO Tania Ortiz said, adding that the “permitting situation is difficult” with the coronavirus, noting Mexico is behind the United States and Europe on the contagion curve.

An engineering, procurement and construction agreement with TechnipFMC plc is in place, and executives continue to be bullish on the project.

“We are working very closely with the government to obtain the permit we are still missing, and we are quite confident we are going to get it,” Executive Chairman Carlos Ruiz said. “We are really optimistic on it.”

The liquefied natural gas (LNG) project, the first of its kind in the country, would import U.S. gas as feedstock before shipping it out from Mexico as LNG. It includes a $400 million pipeline on the Mexico side of the border. Last year, ECA received U.S. Department of Energy authorizations to export U.S.-produced natural gas to Mexico and then re-export it globally.

The proposed two-phase ECA liquefaction project, a joint venture between San Diego-based Sempra Energy subsidiaries IEnova and Sempra LNG, would be built adjacent to the company’s existing ECA LNG receipt terminal near the city of Ensenada. The target market for exports would be East Asia. Planned investment is $1.9 billion.

The project made a bit of noise recently when a Sempra executive mentioned the project during the gala dinner of Mexican President Andres Manuel Lopez Obrador’s visit to Washington, DC.

More quarterly earnings coverage by NGI may be found here

Ienova has also been impacted by new power sector rules that have stalled the entry into operation of renewable energy projects in the country. While not directly related to natural gas, the problem is a larger issue facing the energy sector in Mexico.

“It is a difficult environment,” Ortiz said. The company has an effective legal strategy to move its 125 megawatt, $130 million Don Diego plant in Sonora into testing and online.

“Today our projects are operating normally, and we continue to make progress on our projects under development,” she said.

Meanwhile, IEnova’s 510 MMcf/d Guaymas-El Oro pipeline remains in force majeure as conflicts with Yaqui indigenous communities continue.

Ortiz said the company had received an additional four months extension with anchor client Comision Federal de Electricidad (CFE). With the local communities in isolation because of the coronavirus, weekly discussions with the government have been put on hold.

“CFE has a lot of interest in getting that pipeline up and running,” Ortiz said. “Honestly, I’m glad to say we have seen a lot of help in getting that problem resolved.”

IEnova reported net profit of $126 million (8 cents/share) in the second quarter, compared with $113 million (7 cents) in the same period of 2019.

The company said it is deferring $200 million of its planned $815 million capital expenditure plan for the year into 2021.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |