Shale Daily | Coronavirus | Daily GPI | E&P | LNG Insight | Markets | NGI All News Access | NGI The Weekly Gas Market Report | Permian Basin

IEA Sees Record Decline in Global Oil Demand, but OPEC More Optimistic; U.S. Shale Patch in Crosshairs

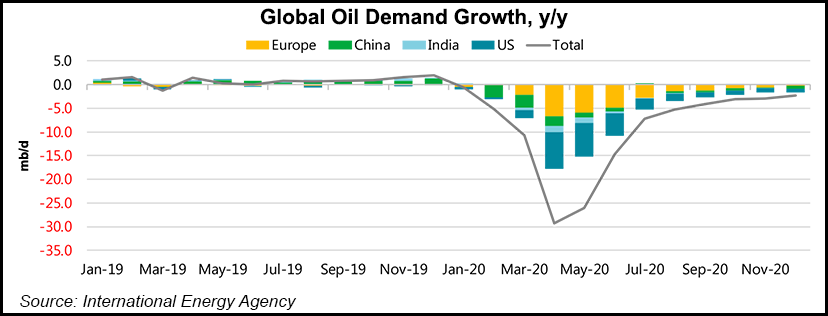

Citing global Covid-19 containment measures that have brought mobility “almost to a halt,” the International Energy Agency (IEA) said Wednesday it expects year/year (y/y) global crude demand to fall by a record 9.3 million b/d in 2020 to 90.5 million b/d after nearly a decade of growth.

In its April Oil Market Report (OMR), the intergovernmental organization projected April oil demand would fall by 29 million b/d y/y, to a level not seen since 1995.

For the second quarter of 2020, IEA sees demand falling by 23.1 million b/d from the year-ago period. Amid a gradual second half 2020 recovery, the global energy watchdog expects December demand to be 2.7 million b/d lower than in December 2019.

Following a historic pact reached Sunday by the Organization of the Petroleum Exporting Countries (OPEC) and its allies to cut supply by 9.7 million b/d during May and June from an agreed baseline level, IEA expects global supply to fall by a record 12 million b/d in May versus April.

“Additional reductions are set to come from other countries with the U.S. and Canada seeing the largest declines,” researchers said, forecasting that full-year output for countries that are not part of OPEC, including the United States, could fall overall by 2.3 million b/d in comparison to 2019.

“That is not only a sharp reversal of the recent growth trend, but also of our earlier forecast that envisaged gains of more than 2 million b/d this year,” the report’s authors said. “Those taking part in the OPEC-plus deal account for 1.3 million b/d of the 2020 reduction, but declines from the U.S. and others accelerate through the year so that by 4Q20 total non-OPEC output could be 5.2 million b/d below the 4Q19 level.”

Global upstream investment is now expected to fall 32% y/y to $335 billion, researchers said, with savings “set to come from reduced activity levels, delays to the sanctioning of new projects and an even greater focus on cost control. However, the scope for the latter may be limited given that upstream costs are estimated to already be 25% below 2014 levels.”

U.S. independents as a group have already slashed 2020 spending guidance by an estimated 30-40%, IEA said, citing that while some firms such as EOG Resources Inc. and Pioneer Natural Resources Co. have significantly trimmed production guidance, others such as Occidental Petroleum Corp. “are hoping to maintain their earlier output guidance and make savings by cutting upstream costs, wages and personnel.”

The majors are slashing Lower 48 onshore spending as well, researchers said, with more cuts likely on the way. IEA analysts noted that ExxonMobil plans to cut its Permian Basin rig count by 20%, while Chevron Corp. will slash Permian spending by nearly $2 billion, equal to half of its global spending cut.

“While in the past, it has taken four to five months for a decline in prices to impact new drilling and a further five to six months for output to start declining, the speed at which the industry adjusts this time has been much faster,” researchers said, citing that U.S. producers have idled 26% of active oil rigs over the past four weeks.

The fracture spread, said IEA, “has fallen even more sharply, by 38% over the same period, suggesting new well completions are coming to an abrupt halt.”

In Canada, where oilsands production costs are among the world’s highest, capital cuts for 2020 have been even more aggressive than in the United States, IEA said, in some cases exceeding 60%.

With storage and pipeline capacity filling up from the plunge in demand, some operators may be forced to shut in producing wells, a situation that has led some companies to ask the Railroad Commission of Texas to curtail oil output for the first time in 50 years, researchers noted.

IEA said its analysis suggests that more than 2.2 million b/d of U.S. production does not cover its operating costs with West Texas Intermediate crude priced at $20/bbl, “including 1.2 million b/d of conventional output and around 1 million b/d of tight oil,” but that “it is not automatic” that all uneconomic production will be shut in.

“For now, we expect U.S. crude oil production in December to be 2 million b/d lower than at the end of 2019.”

In a Wednesday note to clients, analysts at Clearview Energy Partners said they believe a key element of IEA’s latest forecast is an expectation for y/y demand declines to continue through December, as opposed to the March OMR, which saw demand gains returning in 3Q2020.

Also on Wednesday, Rystad Energy analysts said U.S. oil stock builds hit a record in the week ending April 10 as about 17.2 million bbl of crude was sent into storage, and that they expect the record to be beaten twice over the next two weeks due to the demand destruction brought by the Covid-19 pandemic.

OPEC offered a less pessimistic view of demand in its April Monthly Oil Market Report Thursday, forecasting a y/y contraction of about 6.8 million b/d for 2020.

For 2Q2020, OPEC sees a decline of around 12 million b/d, with April seeing the most severe plunge at 20 million b/d.

For Organization for Economic Cooperation and Development (OECD) countries, OPEC is now expecting demand to fall by 4 million b/d while non-OECD demand is projected to shrink by 2.9 million b/d.

“Considering latest developments, and the large uncertainties going forward,” the cartel cautioned, “downward risks remain significant, suggesting possibility of further adjustments, especially in the second quarter, should new data and further developments warrant revisions.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |