NGI Mexico GPI | Markets | NGI All News Access

IEA Forecasts Flat Mexico Oil Output Through 2021; Global Production Set to Fall 7.2 Million b/d in 2020

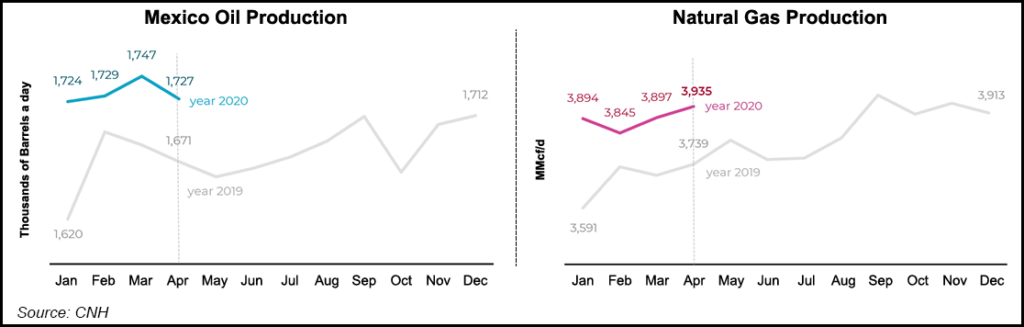

Mexico oil production is likely to stay near April levels through 2021, with the natural decline of legacy fields operated by national oil company Petróleos Mexicanos (Pemex) offsetting any production gains at the firm’s so-called priority fields, the International Energy Agency (IEA) said Tuesday.

Pemex pledged to reverse years of output declines by accelerating investment in the fields, and although production levels have stabilized, growth has been lower than promised.

“While output from the priority fields [is] expected to see continued gains in 2020 and 2021, steep declines at mature fields and lower spending by Pemex is expected to keep total production relatively steady at around 1.9 million b/d through 2020 and 2021,” IEA researchers said in the global energy watchdog’s June Oil Market Report (OMR).

Pemex reported liquid hydrocarbons production, including crude, condensates and natural gas liquids, of 1.96 million b/d in April, up from 1.92 million b/d in the year-ago period. The figure includes Pemex’s 100% working interest fields, as well as joint-venture projects.

Under a curtailment agreement between the Organization of the Petroleum Exporting Countries and its allies, aka OPEC-plus, to balance an oversupplied oil market in the wake of Covid-19, Mexico agreed to slash May and June output by 100,000 b/d from a baseline of 1.753 b/d. However, it was the only member of the alliance to reject a one-month extension of the cuts through July.

May crude oil production by Pemex “reportedly fell 8.6% month/month to 1.527 million b/d, from 1.67 million million b/d in April,” researchers said, citing the April figure published by upstream regulator Comisión Nacional de Hidrocarburos (CNH), which has yet to publish its May data.

Pemex is scheduled to release its May production figures on June 24.

Mexico was one of the few major oil producers to add drilling rigs in May, despite the collapse in oil demand and prices driven by Covid-19, as President Andrés Manuel López Obrador has largely staked his energy policy on increasing production of oil, natural gas and refined products.

Global oil demand is expected to fall by a record 8.1 million b/d in 2020 as a result of the pandemic, IEA researchers said.

Production, meanwhile, is forecast to decrease by 7.2 million b/d in 2020, before recovering by 1.8 million b/d in 2021, assuming full compliance by OPEC-plus members regarding production cuts.

However, this modest recovery “comes nowhere close to meeting the forecast recovery in oil demand of 5.7 million b/d, even considering the need to draw down surplus stocks that built up in 2020,” researchers said.

“That suggests that the market may present producers with an opportunity to ramp up more quickly than dictated by current OPEC-plus policy or U.S. and other non-OPEC production could recover more strongly than forecast.”

In May global production fell by nearly 12 million b/d versus April, researchers said, driven by the record OPEC-plus cuts, as well as “extensive shut-ins by U.S. producers.”

IEA raised its forecast for 2020 oil demand by 500,000 b/d versus the forecast in May to 91.7 million b/d because of stronger than expected deliveries during the Covid-19 lockdown. Oil demand in China recovered sharply in March-April, and in India during May.

Researchers warned, however, that “world economic growth remains highly uncertain as countries emerge from lockdowns at different paces and in some countries the number of Covid-19 cases remains high.”

In a Tuesday note to clients, Tudor, Pickering, Holt & Co. (TPH) analysts said seven-day average flights rose to 103,000 as of Sunday, up 6% week/week, citing data from FlightRadar24. TPH analysts said Transportation Security Administration data showed a 25% w/w surge in the seven-day average of passengers moving through checkpoints, to 451,000.

IEA is optimistic about the final half of 2020 as far as the global economy.

“For the second half of 2020, we expect a strong rebound in world economic activity as lockdowns are eased,” researchers said. “A total of 46 countries eased Covid-19 lockdown measures between the middle of May and the middle of June, freeing an additional 900 million people.”

Strict lockdown measures remain in place in certain countries in Latin America, the Middle East and South Asia, researchers said.

Oil traders have already priced in the prospect of a second wave of Covid cases, according to Rystad Energy’s Bjornar Tonhaugen, head of oil markets.

“The question is what happens next,” Tonhaugen said Tuesday. “Now that a return of the pandemic is a closer possibility, traders wonder if we are likely to see the same global lockdowns, if travel restrictions will be reinstated and industrial activity reduced.

“If the world treats a second Covid-19 wave like in the first half of the year, then we are in for a demand reduction that was not in the initial planning.”

Another important signpost will be an OPEC-plus production cut compliance meeting scheduled for Thursday (June 18), Tonhaugen said. Even if no decision is made on cuts, “it will be very indicative of the mood within OPEC-plus” and of the cartel’s patience for partial compliance by members of the group.

The IEA team said OPEC-plus achieved production cuts of 9.4 million b/d in May versus April, meaning a compliance rate of 89% to its pledged cuts of 9.7 million b/d.

The July WTI futures contract was trading at $38.11/bbl around 2:30 p.m. ET Wednesday, off 27 cents from Tuesday’s settle.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2577-9966 |