Intercontinental Exchange Inc. (ICE) has reported fresh records for Asian natural gas futures in August, with Japan-Korea Marker (JKM) volumes surpassing 100,000 lots traded during the month.

ICE said JKM futures reached 106,529 lots traded, close to double August 2020 volumes. In addition, open interest ended the month at a record 114,531 lots.

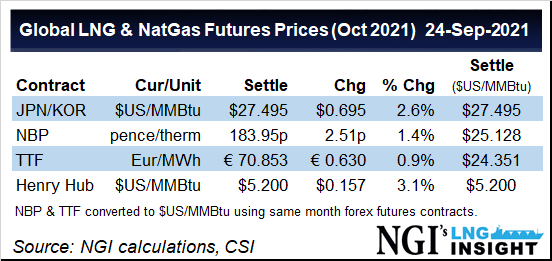

The news comes as JKM prices remain at a premium over the European Title Transfer Facility (TTF) benchmark through the winter months. Asian liquefied natural gas (LNG) buyers have continued to stockpile supplies to avoid a repeat of the shortages experienced last winter. This is pulling cargoes away from Europe on the spot market, which is smaller than LNG volumes locked up under long-term contracts.

Still, August was busy for TTF...